Intraday market analysis: AUD in correction territory

AUD/USD drops along moving average

The Australian dollar remains underwater as the RBA minutes say no to a rate hike before 2024.

The sell-off has accelerated after the Aussie fell through 0.7410, the last stronghold from a previous bounce. The pair is sliding along the 20-day moving average, and the downtrend is heading towards the next support at 0.7230 from the daily chart.

However, a repeatedly oversold RSI may prompt sellers to take some chips off the table, causing a temporary rebound. 0.7440 is likely to cap the buyers’ push.

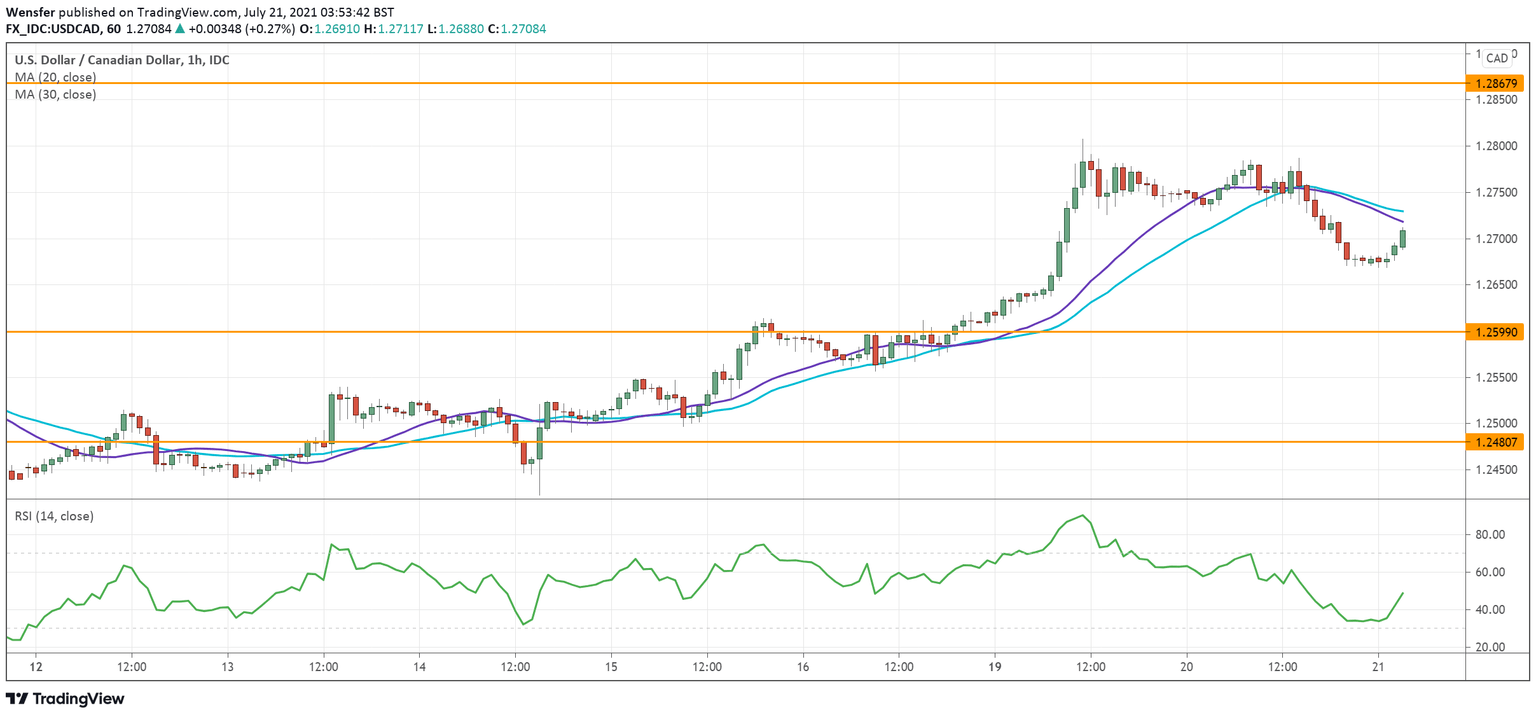

USD/CAD breaks above major resistance

The commodity-linked Canadian dollar took a hit after risk appetite receded. The pair saw strong momentum plays after it cleared 1.2650, a major resistance from last April.

Short-covering in a crowded bearish trend may have contributed to high volatility. This could be an inflection point for the greenback in the medium term.

In the meantime, February’s high at 1.2870 is the next target. Meanwhile, the RSI is back to the neutral area, and the direction is up as long as the price stays above 1.2600.

NAS 100 recovers from moving average

The Nasdaq index seeks support as investors grow wary of the Delta sell-off. The bearish breakout below the key short-term support at 14550 has put buyers under pressure.

Price action has so far bounced off the 30-day moving average but buyers will need more assurance to commit again. 14550 is the first support after a rebound above 14680.

A high RSI may slow down the pace of the rally. A recovery may only see the light of day if the bulls succeed in pushing above the major hurdle at 14880.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.