Inflation flurry: The usual suspects, and then some

Summary

Consumer price inflation continued to rip higher in May, with prices rising 0.6% and the year-over-year rate leaping to 5.0%. A handful of categories most closely tied to the reopening of the service sector and supply bottlenecks once again accounted for an outsized share of the rise. But don't fully wave away May's strength. The long-awaited pickup in housing costs has arrived, which will support firm gains even after the current surge of pent-up demand and the most acute supply issues subside.

New gain, same main drivers

Consumer price inflation continued to tear higher in May, with prices up 0.6%. Over the past three months, prices are up at an 8.5% annualized rate and illustrate that the jump in the year-ago rate of inflation is being driven by more than easy base comparisons after last spring's lockdowns. Headline CPI is up 5.0% over the past year, while core inflation, which excludes what is usually the most volatile components–food and energy, is up 3.8%. That's the largest one-year gain in 28 years.

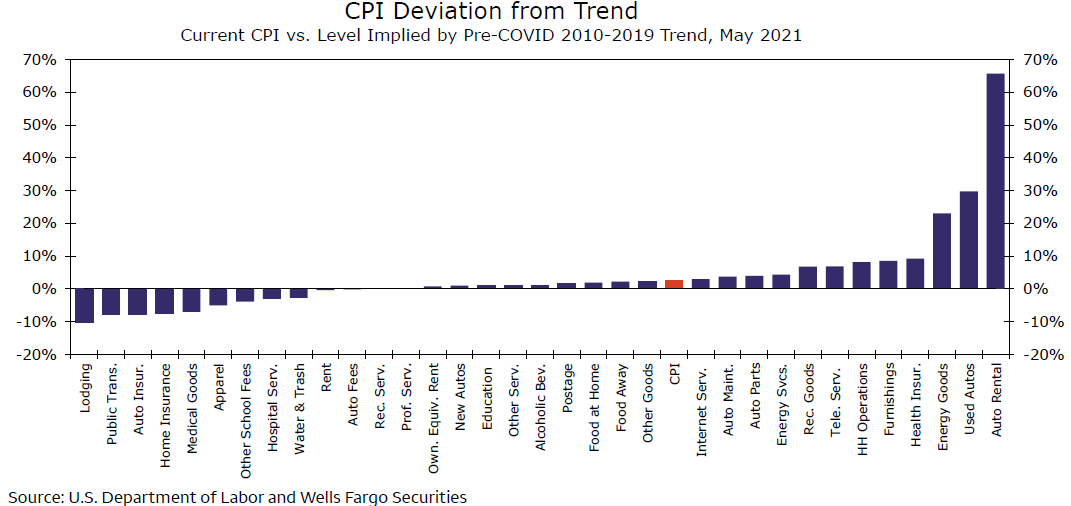

But similar to April, much of May's increase in prices can be traced to a handful of small components currently at the center of reopenings and supply shortages (see chart). For example, airfares were up7.0%, rental car prices jumped another 12.1% and hotel prices inched higher. Apparel prices rose 1.2%as we now have places to go but nothing fit to wear. And new and used vehicle prices were up 1.6% and7.3%, respectively, as semiconductor shortages have continued to impact new production and ripple downstream.

The outsized gains in a few select sectors support the Fed's view that the current degree of price pressures are temporary. However, we see signs of inflationary pressures broadening out, which we believe will keep monthly price gains from merely falling back to their pre-pandemic trend after the current flurry of activity.

Food prices rose 0.4% last month and further strength lies ahead. Restaurants and groceries are facing double whammies with food and labor costs. Agricultural commodity prices are up about 60% over the past year and are sitting at a decade high, while average hourly earnings at restaurants have soared at an a24.4% annualized rate the past three months (see chart).

The long-awaited pickup in housing costs after scorching price increases in the purchase market is also starting to manifest. The owner's equivalent rent (OER) rose 0.3%, which was the largest gain since mid-2019. OER accounts for 30% of the core CPI and 24% of the headline measure, so a sustained turnaround in this component will supply another sizable boost to inflation. There were signs of firming in rental prices as well. Rents rose 0.2% (0.24%), the strongest monthly increase since the pandemic struck and consistent with the continued rise in market measures of daily asking rents beginning to feed into the Consumer Price Index.

More to come

The head-turning monthly gains in inflation are not done, in our view. The price level for some categories beneting hugely from social distancing falling by the wayside, such as airfares, hotels, apparel, and auto insurance, remain below levels predicted by their pre-COVID trends (see chart). That comes as the overall price level is 2.5% above its pre-pandemic trendline, suggesting that there has already been a shift to a higher inflation environment and recent gains are more than simply “catch up.”

Author

Wells Fargo Research Team

Wells Fargo