Indian Rupee Price News: Turnaround may be temporary, Trump's trade tweets eyed

- The Indian Rupee has been gaining ground amid market calm.

- Optimism about US-Sino trade talks has supported the currency, but it may be misguided.

- The technical outlook for USD/INR remains bullish.

The Indican rupee has staged a remarkable recovery, but the factors behind its turnaround may be temporary, eventually sending it back down. External forces drive the currency and not by Prime Minister Narendra Modi's policies, nor by pollution in Delhi, and nor Kashmir. It lies in the hands of the nation's giant neighbor to the north – China – and its relations with the US.

Indian Rupee Price Drivers

The INR price has been recovering as hopes for a US-Sino trade deal have risen. US Commerce Secretary Wilbur Ross has said that an agreement between the world's largest economies has a "very high probability of happening." Ross' words join optimism from Larry Kudlow, the chief economic adviser at the White House, who said that both sides are getting close to an agreement.

The safe-haven US dollar has been on the back foot while currencies of emerging markets such as India have been on the rise. However, it is too soon to party in Mumbai, the financial capital of South Asia.

Beijing has been eerily silent about talks, and in Washington, President Donald Trump has yet to have his say – potentially via a tweet. Earlier this week, the president said that talks are "going along very well" but also criticized China's practices. Moreover, Trump denied reports that the US is ready to roll back previous tariffs.

So far, the administration has yet to announce the cancelation of duties planned for December 15. Without that, global commerce and growth may struggle to recover.

While President Trump and his Chinese counterpart Xi Jinping fail to confirm an accord, the Indian rupee's price may come under fresh pressure.

USD/INR Technical Analysis

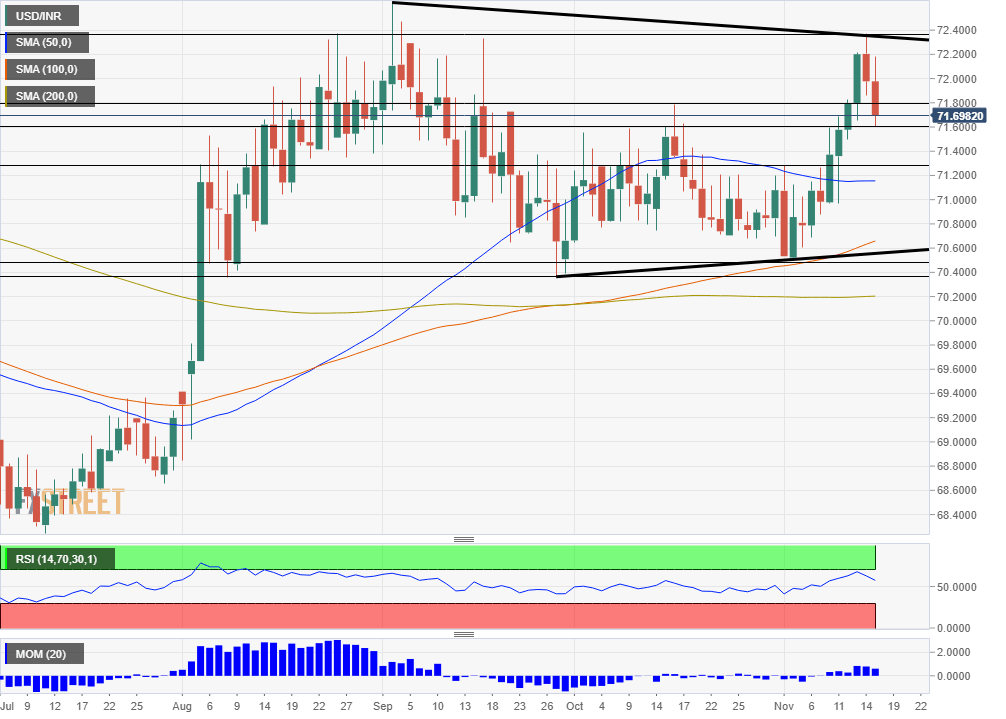

The USD/INR daily chart is showing upside momentum – thus dollar positive and rupee negative. Moreover, the Relative Strength Index (RSI) has moved away from 70 – thus distancing itself from overbought conditions – and allowing for more rises.

Support awaits at 71.60, which capped dollar/rupee in early October. Further down, 71.25 capped the currency pair in early November and now comes into play. Lower, 70.50, and 70.35 – the lowest since August – await it. The 200-day SMA awaits at 70.20.

Resistance is at 71.80, a swing high from late October. It is followed by 72.40, which held the USD/INR price down in both August and September. The early September peak of 72.60 is the next level to watch.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.