Important change in trend US stocks, T-bonds, US dollar [Video]

![Important change in trend US stocks, T-bonds, US dollar [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse4-637299025173341169_XtraLarge.jpg)

1/13 Recap - The S&P opened with a 12 handle gap up and then traded another 6 handles higher into a 9:58 AM high of the day. From that high, the S&P declined 34 handles into a 10:51 AM low. From that low, the S&P rallied 19 handles into an 11:40 AM high. From that high, the S&P declined 34 handles into a 12:48 PM low. From that low, the S&P rallied 22 handles into 2:02 PM high. From that high, the S&P declined 57 handles into a 3:55 PM low of the day. From that low, the S&P bounced 9 handles into the close.

1/13 – Following a 9:58 AM peak, the major indices had a strong down day per the following closes: INDU - 176.70; S&P 500 - 67.32; and the NASDAQ Composite - 381.58.

Looking ahead - We at the second day of a huge 2 – 3 day cluster of planetary events. This may not be resolved until Tuesday, given that Monday, January 17 is a US market holiday.

The NOW Index is in the NEUTRAL ZONE.

Coming events

(Stocks potentially respond to all events).

2. A. 01/12 PM – Saturn 0 US MC. Major change in trend US Stocks, T-Bonds, US Dollar.

B. 01/13 AC – Neptune 90 US Mars. Important change in trend US Stocks, T-Bonds, US Dollar.

C. 01/13 AC – Mercury in Aquarius turns Retrograde. Major change in trend Corn, Copper, Oats, Soybeans, Wheat.

D. 01/14 AC – Saturn Contra-Parallel US Mercury. Important change in trend US Stocks, T-Bonds, US Dollar.

E. 01/14 AC – Mercury Perihelion. Major change in trend CORN, Gold, Oats, OJ, Soybeans, Wheat.

F. 01/14 AC – Full Moon in Cancer. Major change in trend Financials, Grains, Precious Metals and especially Silver.

G. 01/14 AC – Uranus in Taurus turns Retrograde. Major change in trend Cattle, Copper, Cotton.

Stock market key dates

Market Math

DJIA* – 1/18, 1/20, 1/24, 1/25-26, 1/28 AC.

S&P 500* - 1/18, 1/19, 1/28 AC.

Fibonacci – 1/13, 1/21, 1/25.

Astro – 1/12-13, 1/14, 1/18, 1/24, 1/25-26, 1/28 AC.

Please see below the S&P 500 10 minute chart.

Support - 4600 Resistance – 4720.

Please see below the S&P 500 Daily chart.

Support - 4600 Resistance – 4720.

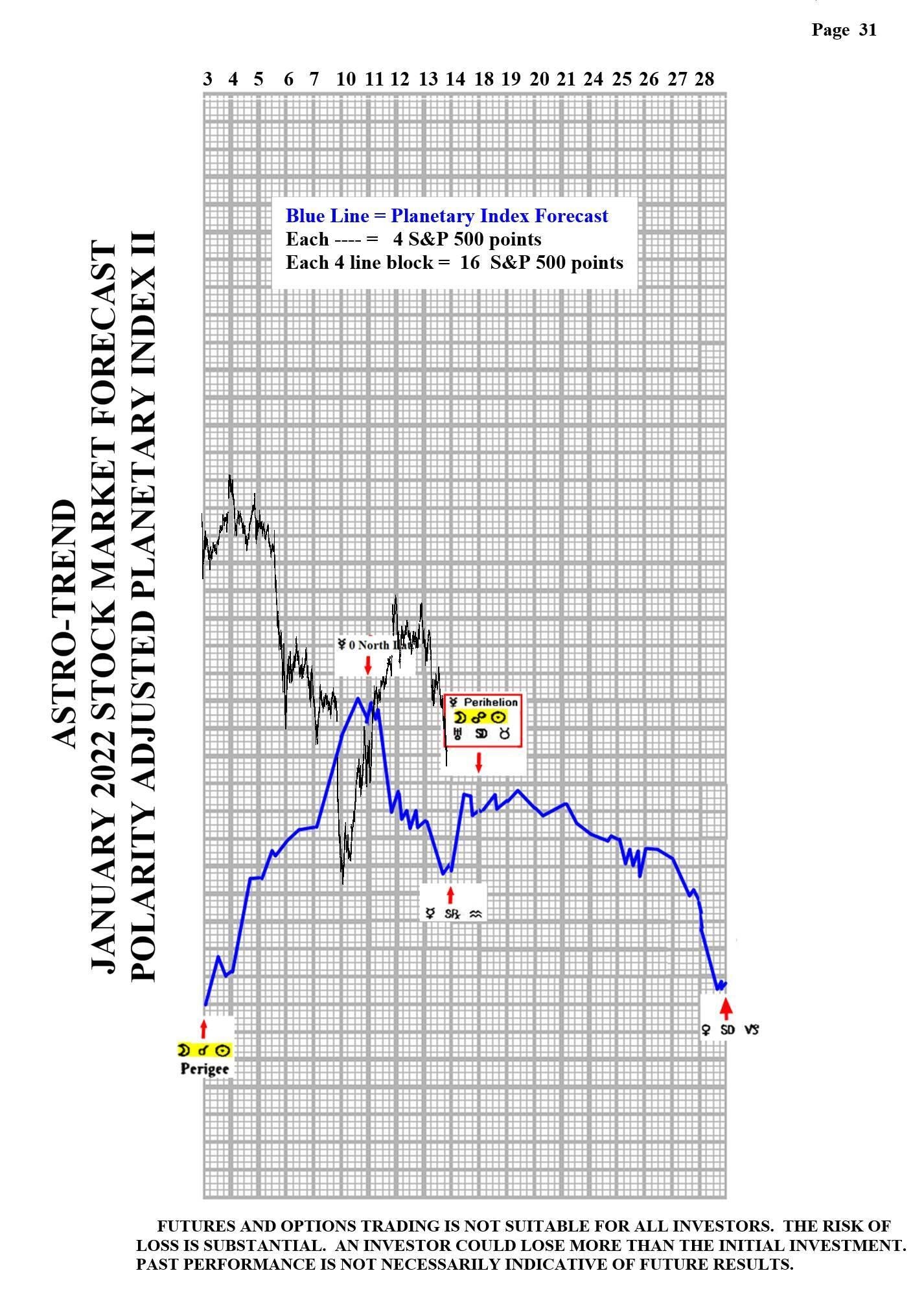

Please see below the January Planetary Index charts with S&P 500 5 minute bars for results.

Author

Norm Winski

Independent Analyst

www.astro-trend.com