Ichimoku cloud analysis: GBP/USD, NZD/USD, XAU/USD

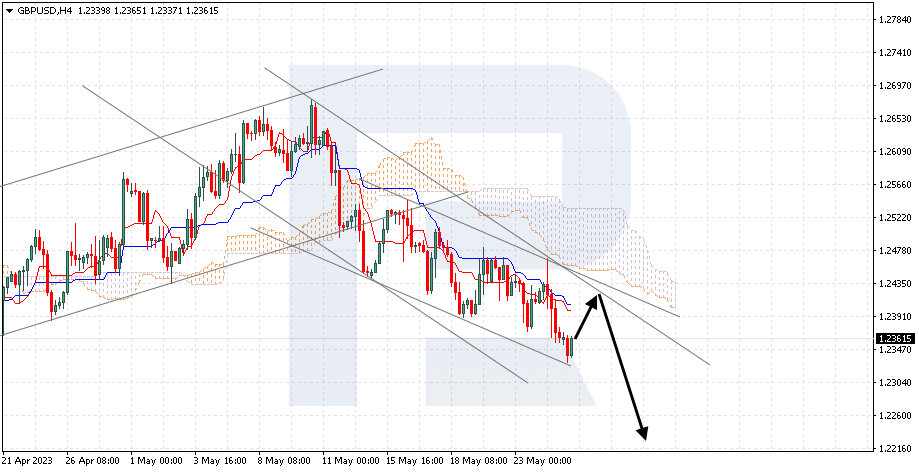

GBP/USD, “Great Britain Pound vs US Dollar”

GBPUSD has secured above the support level. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Kijun-Sen line at 1.2415 is expected, followed by a decline to 1.2235. An additional signal confirming the decline will be a rebound from the upper border of the descending channel. The scenario can be cancelled by a breakout of the upper border of the Cloud, securing above 1.2565, which will mean further growth to 1.2655.

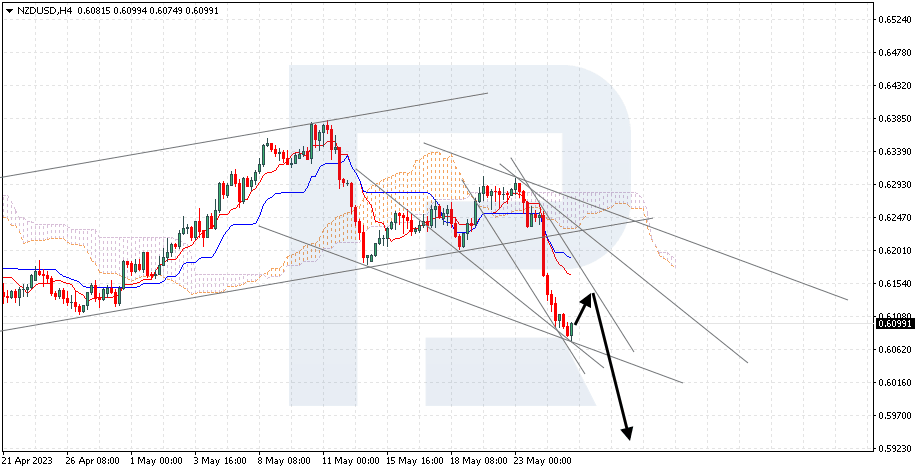

NZD/USD, “New Zealand Dollar vs US Dollar”

NZD/USD is rebounding from the lower border of the descending channel. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Tenkan-Sen line at 0.6135 is expected, followed by a decline to 0.5935. An additional signal confirming the decline will be a rebound from the upper border of the descending channel. The scenario can be cancelled by a breakout of the upper border of the Cloud, securing above 0.6305, which will mean further growth to 0.6405.

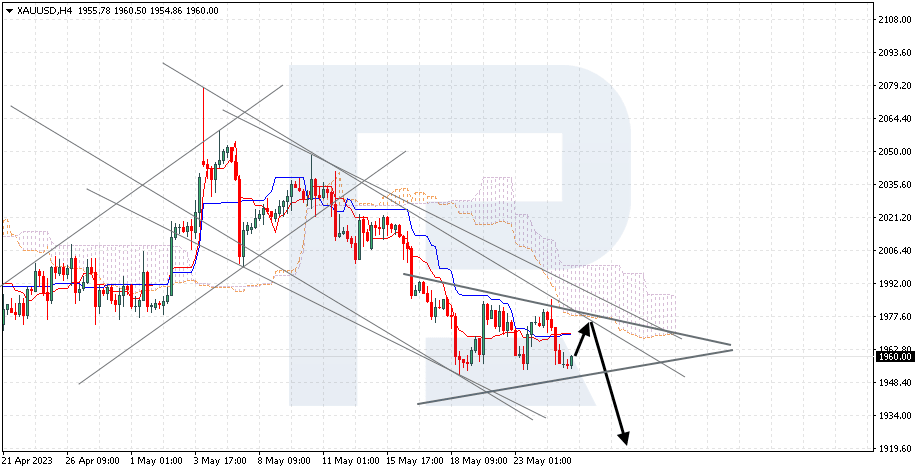

XAU/USD, “Gold vs US Dollar”

Gold is testing the lower border of the Triangle pattern. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the lower border of the indicator at 1970 is expected, followed by a decline to 1920. An additional signal confirming the decline will be a rebound from the upper border of the Triangle pattern. The scenario can be cancelled by a breakout of the upper border of the Cloud, securing above 2005, which will mean further growth to 2035. Meanwhile, the decline could be confirmed by a breakout of the lower border of the Triangle pattern, securing under 1945.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.