Ichimoku cloud analysis: GBP/USD, Brent, USD/CAD

GBP/USD, “Great Britain Pound vs US Dollar”

GBPUSD is trading at 1.3706; the instrument is moving below Ichimoku Cloud, thus indicating a descending tendency. The markets could indicate that the price may test the cloud’s downside border at 1.3715 and then resume moving downwards to reach 1.3545. Another signal in favor of a further downtrend will be a rebound from the resistance level. However, the bearish scenario may no longer be valid if the price breaks the cloud’s upside border and fixes above 1.3805. In this case, the pair may continue growing towards 1.3905. To confirm further decline, the asset must break the rising channel’s downside border and fix below 1.3655.

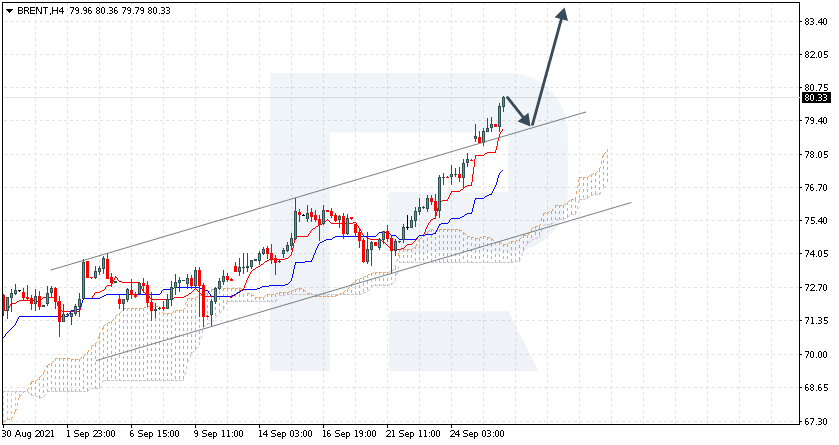

Brent

Brent is trading at 80.33; the instrument is moving above Ichimoku Cloud, thus indicating an ascending tendency. The markets could indicate that the price may test Tenkan-Sen and Kijun-Sen at 79.45 and then resume moving upwards to reach 83.55. Another signal in favor of a further uptrend will be a rebound from the rising channel’s upside border. However, the bullish scenario may no longer be valid if the price breaks the cloud’s downside border and fixes below 72.55. In this case, the pair may continue falling towards 71.65.

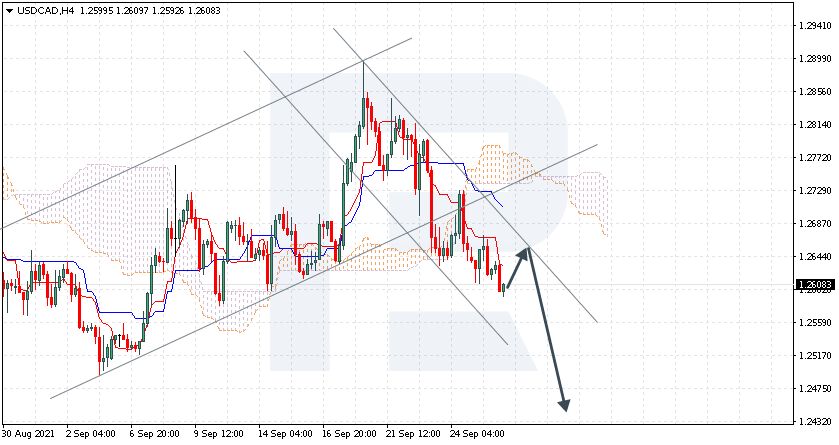

USD/CAD, “US Dollar vs Canadian Dollar”

USDCAD is trading at 1.2608; the instrument is moving below Ichimoku Cloud, thus indicating a descending tendency. The markets could indicate that the price may test Tenkan-Sen and Kijun-Sen at 1.2650 and then resume moving downwards to reach 1.2445. Another signal in favor of a further downtrend will be a rebound from the descending channel’s upside border. However, the bearish scenario may no longer be valid if the price breaks the cloud’s upside border and fixes above 1.2785. In this case, the pair may continue growing towards 1.2875.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.