How to trade USD/JPY ahead of the US ADP employment change news

The U.S. Dollar (USD) inched higher against the Japanese Yen (JPY) last week, increasing the price of the USDJPY pair to more than 108.00, ahead of the release of U.S. ADP Employment Change news.

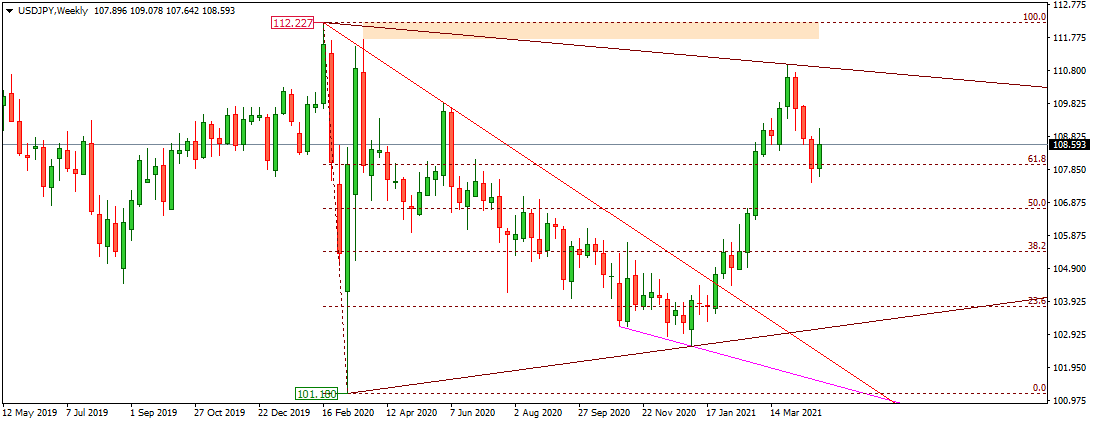

Technical analysis

As of this writing, the USDJPY pair affirms around 108.59. If the price keeps increasing, the pair might face some hurdles near the listed price levels.

Short-Term resistance levels

109.62 – the high of June 07, 2020.

110.00 – the psychological level.

110.87- the upper trendline arm.

On the downside, the pair is likely to find some support near the listed price levels.

Short-Term support levels

107.47 – the low of April 18, 2021

106.67 – the major horizontal support

106.00 – the psychological number

US ADP employment change news

The U.S. Automatic Data Processing, Inc. anticipates releasing stats for the U.S. ADP employment change news on May 05, 2021. According to economists’ consensus, the U.S. ADP employment change data might improve in April and register a reading of 750K, as compared to the reading of 517K, in the month before.

The U.S. employment change news reflects the total number of headcounts with jobs in hand within the country. An increase in the employment figures means more people are being employed. Improved employment figures increase the purchasing power of consumers. Generally speaking, a high reading for the U.S. employment change data suggests a bullish trend for the USDJPY and vice versa.

Conclusion

Considering the price movement of the pair over the past few days, it may be a better option in the short term if the USDJPY was sold at around $109.76. Due to the volatile nature of the market, however, prices may change and lead to different outcomes.

Author

Usman Ahmed

Forex92

Usman Ahmed is a currency trader and financial market analyst with more than a decade of active trading experience.