How to trade US inflation with EUR/USD, scenarios and levels to watch

- October's Inflation levels are critical for the Fed's rate hike timing after the taper decision.

- The dollar enters the decision in a balanced mode, allowing every tick up or down to matter.

- EUR/USD is set to move differently according to five scenarios.

How long is transitory inflation – or is it about to get out of control? The persistent rise in consumer prices is troubling Americans and is expected to hold up – the Core Consumer Price Index is set to remain at 4%. That is stubbornly high. Any change could rock the dollar.

Quick Background

Supply chain issues, labor shortages and the grand reopening have sent inflation to the highest levels in a decade and prompted the Federal Reserve to taper down its $120 billion/month bond-buying scheme. When the Fed ends purchases, it is set to begin raising interest rates, thus boosting the dollar's attractiveness.

Fed Chair Jerome Powell announced a tapering of $15 billion per month and left the door open to changing the pace, potentially accelerating the process. The Nonfarm Payrolls report showed an impressive increase of 531,000 jobs and also an acceleration in wage growth to 4.9% YoY. That also implies higher prices – and now comes the CPI report for October.

Time to get out of range?

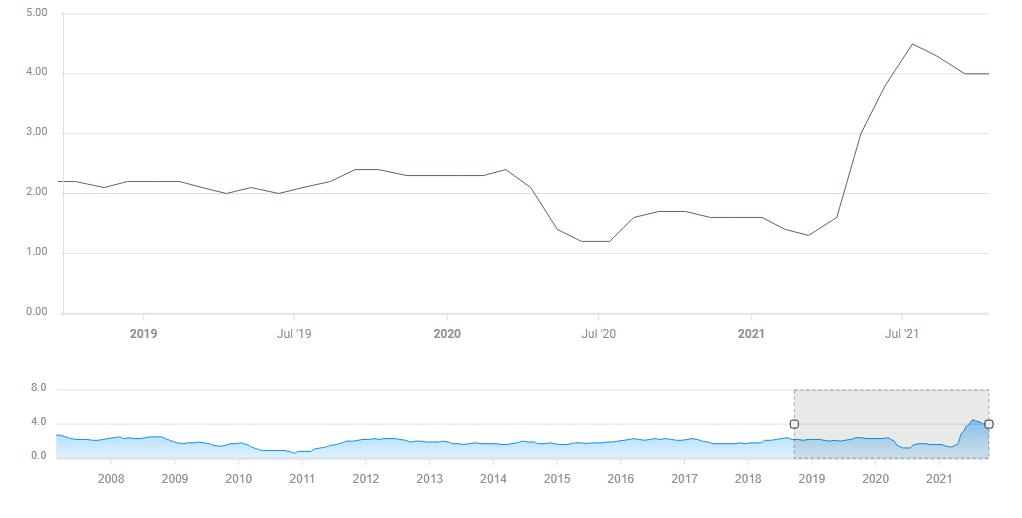

Core CPI, which represents inflation excluding volatile food and energy, is the figure that matters to the Fed and markets. It stood at 4% YoY in the past two months, in remarkable stability. However, this could change now. It is essential to note that current levels are roughly double what was seen before the pandemic.

Source: FXStreet

Sentiment and Levels

The dollar enjoyed a tailwind last week after the Fed announced tapering and the European Central Bank insisted it would not raise rates in 2022. Since then, that dollar bias has disappeared, as 10-year bond yields drifted lower. Another factor weighing on the greenback is the upbeat market mood, which diminishes demand for the safe-haven greenback.

At this juncture, the market calm balances out the dollar and the euro in the short-term, allowing an equal opportunity for movements in both directions.

Levels from top to bottom: 1.1690, 1.1670, 1.1640, 1.1615 (early November high), 1.1605 (50-4h-SMA and 100-4h-SMA converge), 1.1580 (mid-November range separator), 1.1550 and 1.1510.

Five scenarios for EUR/USD

Markets await a repeat of 4% YoY and 0.3% MoM on Core CPI. The yearly figure matters more and every change can make a difference.

- Within expectations: This release is the rare case in which only one figure meets the definition of "as-expected" – 4%. In this case, the dollar will likely shake but remain in the same trading range, with EUR/USD left to look for fresh drivers in the following days.

- Above expectations: A level of 4.1% or 4.2% would be considered a significant beat that could be the first accelerator of the Fed's tapering process, pending other data. It could send the dollar higher, pushing EUR/USD below one support line.

- Well above expectations: A Core CPI read of 4.3% or higher could already trigger a substantial dollar surge in response to aggressive pricing of a rate hike, perhaps already in March 2022. In such a scenario, EUR/USD could slip under two support lines.

- Below expectations: A small miss with 3.8% or 3.9% would somewhat cast doubts about the narrative of persistently high inflation and remove thoughts about the Fed accelerating its taper process. The dollar could slide, resulting in EUR/USD climbing topping one resistance.

- Well below expectations: An unlikely drop to 3.7% or below would be a big score for "Team Transitory" and would cause markets to doubt the chances of a 2022 rate hike. In this case, EUR/USD could surge above two resistance lines.

Conclusion

October's inflation figures are critical for the prospects of interest rates and the next dollar moves. There is no bias and every small change could rock markets.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.