Here’s why the Fed’s rate decision will not crash the market

In our previous updates about the SP500 (SPX), we shared our short- and long-term Elliott Wave (EW) Principle counts that explain why the index can reach as high as approximately 7120 before we should worry about a bear market like 2022, and found that

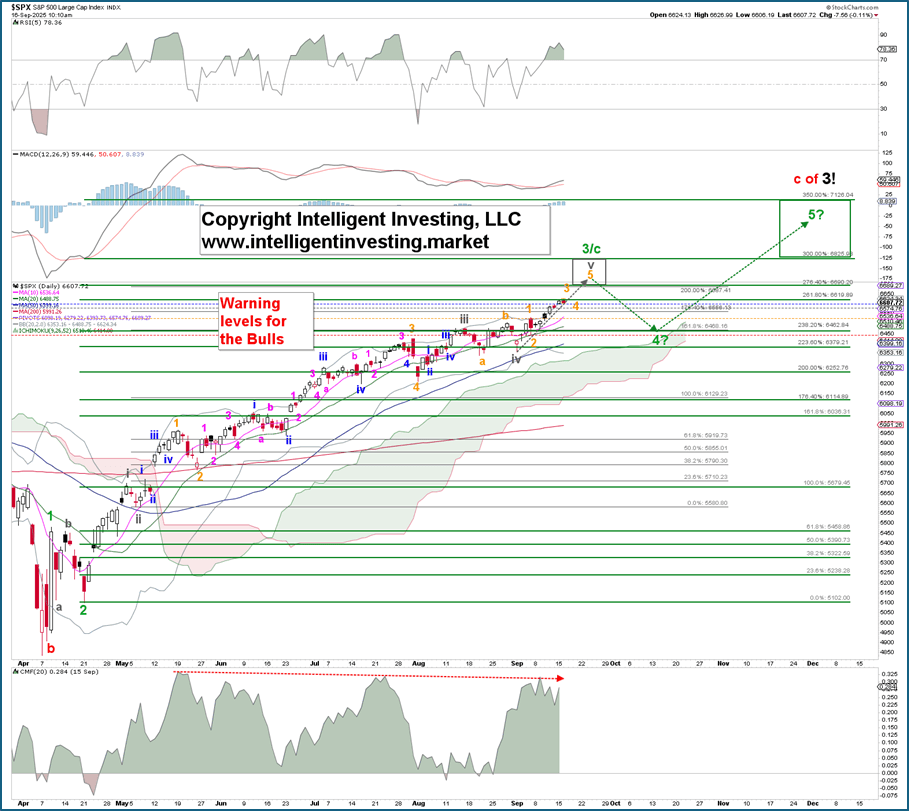

“… The ideal upside target for the current rally [gray Wave-v] is then 6690+/-10, which is where the gray 200.00% and green 276.40% extensions overlap; 6687 vs 6690, respectively. From there, a mild 4±1% pullback (green W-4?) can be expected before the green W-5 rallies the price to, ideally, the 350.0% extension at 7126.”

Back then, the index was trading around 6480, and it reached a new all-time high of 6626 today. Therefore, our assessment of a rally (gray W-v of green W-3/c) from the September 2 low was correct, and in the meantime, we adopted the alternative EW count as our primary. See Figure 1 below.

Figure 1. Our preferred short-term Elliott Wave count

Besides, like every impulse, the gray W-v is dividing into five smaller (orange) waves: 1, 2, 3, 4, and 5. The orange W-3 could reach as high as 6730, and the W-5 as high as 6795, based on a standard impulse. However, for now, we focus on the 6690+/-10 level for the completion of this rally. Everything else is a bonus that comes with increased risk.

The warning levels for this wave count, which have consistently kept our premium members on the right side of the markets by allowing us to stay long without much concern, have been raised as the SPX moved higher and are now set at: first at 6600 (25% chance that the gray W-v is over); second at 6579 (50% chance the gray W-v is over); third at 6529 (75% chance the gray W-v is over); and fourth at 6443 (W-v is definitely over).

Therefore, as shown previously, our EW count still points to the same upside target, 7120, since the April low can now be considered over. In the meantime, 6690+/-10 remains our interim target zone, where a 4+/-1% pullback could happen with higher probability. Therefore, the FED’s rate decision is unlikely to crash the market. It moves to its own rhythm.

Author

Dr. Arnout Ter Schure

Intelligent Investing, LLC

After having worked for over ten years within the field of energy and the environment, Dr.