Gold: You take the stairs up but the elevator back down! [Video]

![Gold: You take the stairs up but the elevator back down! [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/stacked-gold-bars-13094022_XtraLarge.jpg)

Gold

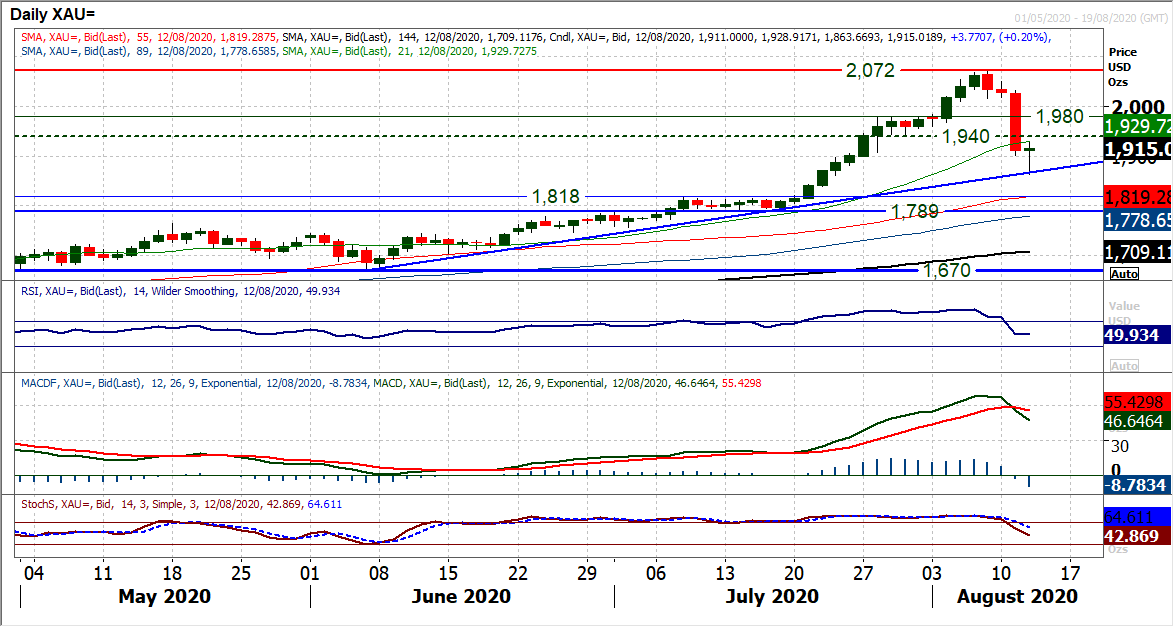

We have been discussing the prospect of a near term gold correction, but the aggressive nature of the pullback has been something to behold. You take the stairs up but the elevator back down! Losing -$115 on the day yesterday is a mammoth sell-off, and it is continuing today. We have been talking about the support of the two month uptrend (today at $1867) being an eventual pullback area, but never imagined it would get there so fast. Momentum indicators have gone into sharp reversal, with RSI back under 50, along with crosses on MACD and Stochastics. The aggressive sell-off could mean that the next real price support at $1789/$1818 comes into play. This has been a fast moving market, and we would prefer to let the dust settle somewhat now. Our view remains that gold is a buy into supported weakness, but the support part of that is now crucial. Catching a falling knife is a dangerous game, especially when the floodgates of selling have been opened. Contrarians will already be eyeing a slowing of selling momentum overnight and a pick up of $40 from the early low at $1863 is coming through. Initial resistance is $1929 (an overnight lower high) and $1940 (an old consolidation range low).

Author

Richard Perry

Independent Analyst