Gold Weekly Forecast: Chinese data and geopolitics to drive XAU/USD action

- Gold edged lower this week but managed to stabilize above $2,600.

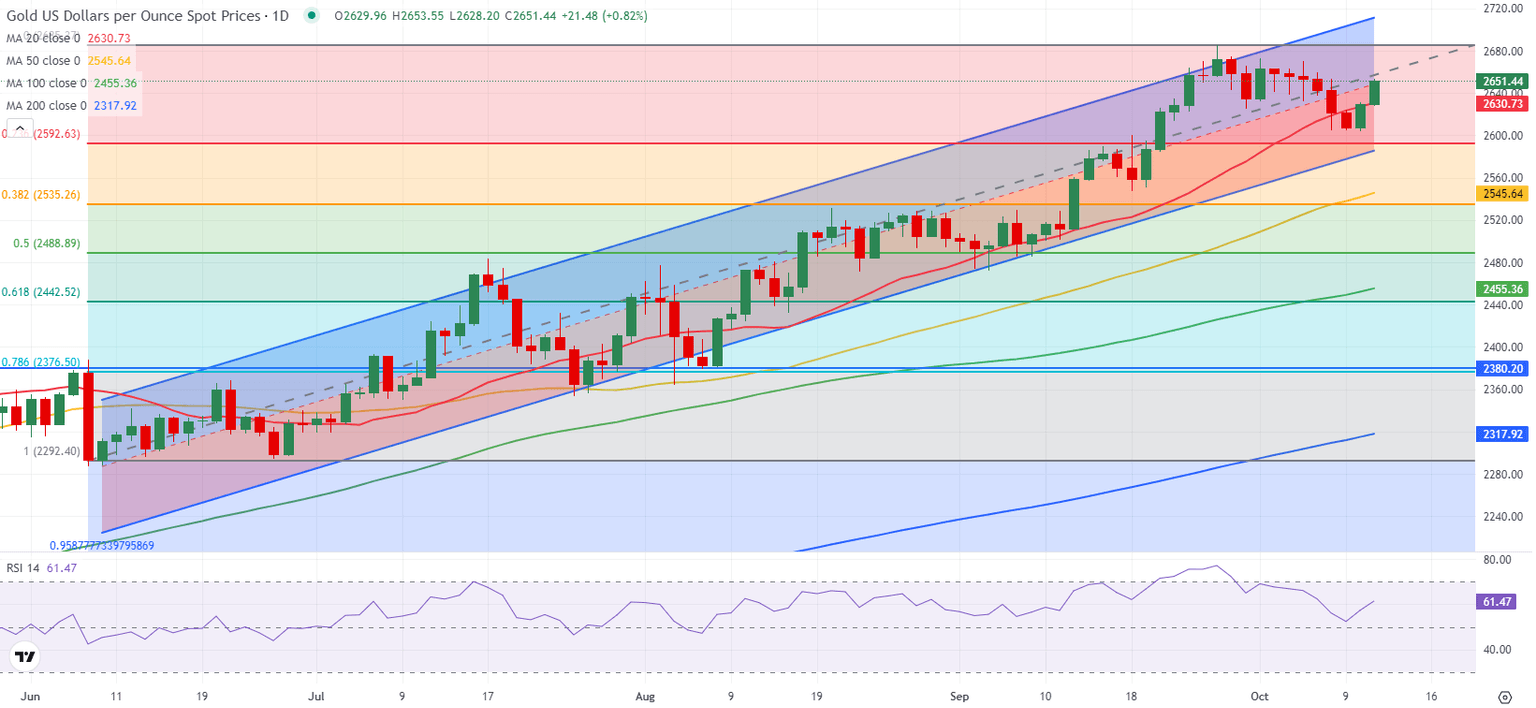

- The technical outlook suggests that sellers remain reluctant to bet on a deeper correction.

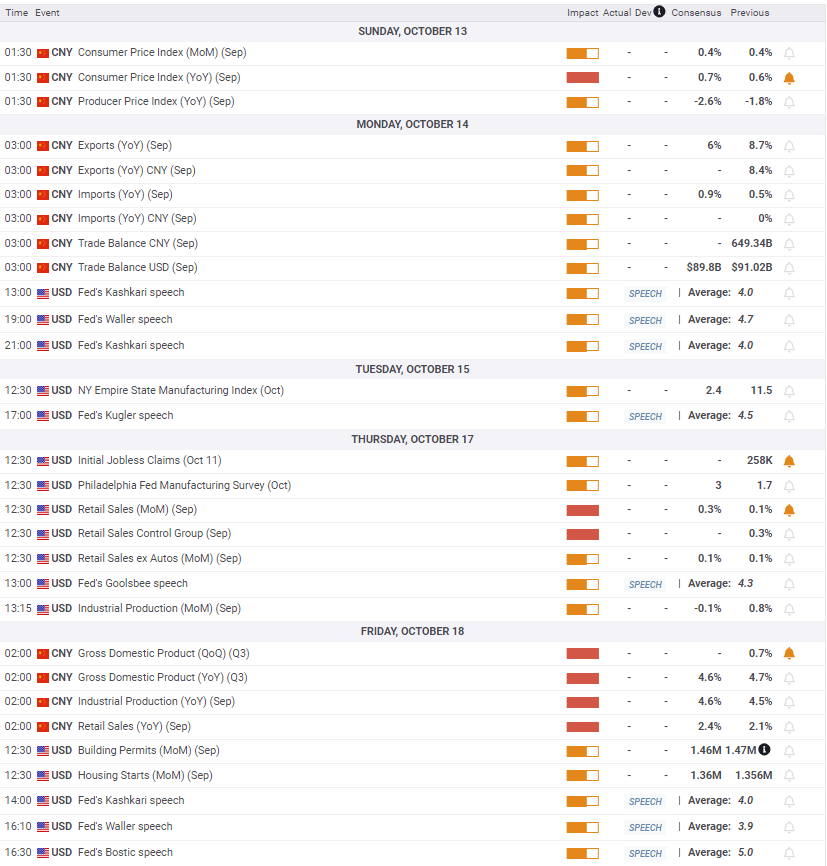

- Investors will keep a close eye on macroeconomic data releases from China next week.

Gold (XAU/USD) declined sharply in the first half of the week but regained its traction after coming within a touching distance of $2,600. Investors will scrutinize macroeconomic data releases from China next week, while keeping a close eye on geopolitical developments.

Gold stages limited correction

Gold edged lower at the beginning of the week and closed in the red on Monday as the positive impact of the previous Friday’s upbeat September employment data continued to be felt on the USD. Meanwhile, although geopolitical tensions remain high, they haven’t escalated any further with Israel taking its time in mulling its retaliatory response to Iran. In turn, the broad-based USD strength caused XAU/USD to stay on the back foot.

The National Development & Reform Commission (NDRC), China’s state planner, said on Tuesday that the downward pressure on China's economy is increasing, adding "China's economy is facing more complex internal, external environments."

Growing concerns over an economic downturn in China, the world’s biggest consumer of Gold, caused the precious metal to continue to stretch lower. Reflecting this sentiment, China's Shanghai Composite Index fell nearly 7%, and Hong Kong's Hang Seng Index lost over 1% on Wednesday.

The hawkish tone in the minutes of the Federal Reserve's (Fed) September policy meeting helped the US Dollar (USD) outperform its rivals late Wednesday, not allowing XAU/USD to stage a rebound. The publication showed that even though a substantial majority of Fed officials supported the 50-basis-point (bps) rate cut, there was even a broader consensus that this initial step would not lock the Fed into any specific pace for future rate cuts. Additionally, some participants favored only a 25 bps reduction in the policy rate cut, while "a few others" mentioned they could have supported that decision as well.

The US Bureau of Labor Statistics reported on Thursday that annual inflation in the US, as measured by the change in the Consumer Price Index (CPI), softened to 2.4% in September from 2.5% in August. The core CPI, which excludes volatile food and energy prices, rose 3.3% on a yearly basis, surpassing the market expectation of 3.2%. Finally, the CPI and the core CPI increased 0.2% and 0.3%, respectively, on a monthly basis. Other data from the US showed that the number of first-time applications for unemployment benefits climbed to 258,000 in the week ending October 5 from 225,000 in the previous week. The disappointing Initial Jobless Claims reading didn’t allow the USD to benefit from the inflation report and helped XAU/USD find its footing.

In the absence of fundamental drivers, Gold continued to stretch higher on Friday but struggled to gather bullish momentum. The final data of the week from the US showed that the Producer Price Index (PPI) rose 1.8% on a yearly basis in September, arriving above the market forecast of 1.6%.

Gold investors await key data releases from China

The US economic calendar will not feature any high-tier data releases in the first half of the week. On Thursday, the US Census Bureau will release Retail Sales data for September. The market reaction to this data could be straightforward, with a positive surprise supporting the USD and a negative reading having the opposite impact on the currency’s valuation. Nevertheless, this data by itself is unlikely to have a strong enough effect to alter Gold’s direction.

Meanwhile, market participants will pay close attention to macroeconomic data releases from China. In the Asian session on Monday, Trade Balance figures could set Gold’s tone at the beginning of the week. A sharp decline in the trade surplus could feed into concerns over China’s economic health and weigh on Gold. Early Friday, the third-quarter Gross Domestic Product (GDP), which is forecast to show an annualized growth of 4.6%, alongside the Industrial Production and Retail Sales data for September, will be scrutinized by investors. On a yearly basis, Industrial Production and Retail Sales are anticipated to rise by 4.6% and 2.4%, respectively. Again, disappointing data releases are likely to hurt Gold, while positive surprises could be supportive for the yellow metal.

Investors will continue to assess geopolitical developments next week as well. If Israel carries on with a retaliatory attack against Iran, a deepening crisis in the Middle East could help Gold benefit from safe-haven demand.

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart rose toward 60 after falling to the neutral 50 area earlier in the week, suggesting that Gold’s bullish bias remains intact following a technical correction.

On the upside, the midpoint of the ascending regression channel coming from June aligns as immediate resistance at $2,660 before $2,675 (static level) and $2,700-$2,710 (round level, upper limit of the ascending channel).

In case XAU/USD drops below $2,600-$2,590 (lower limit of the ascending channel, Fibonacci 23.6% retracement of the June-September uptrend) and starts using this level as resistance, technical sellers could take action. In this scenario, $2,545-$2,535 (50-day Simple Moving Average, Fibonacci 38.2% retracement) could be seen as the next bearish target.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.