Gold Weekly Forecast: Further XAU/USD decline toward $1,800 remains on the cards

- Gold failed to stage a convincing rebound this week.

- Risk-averse market environment ramped up the demand for the USD on Friday.

- 200-day SMA turns into strong resistance near $1,845.

After losing more than 2% in the previous week, the XAU/USD pair extended its slide on Monday and touched its lowest level since early December at $1,817. However, the pair staged a rebound on Tuesday and fluctuated in a relatively tight range in the remainder of the week before coming under renewed bearish pressure and settling below $1,830 on Friday.

What happened last week

Last week, the sharp upsurge witnessed in the US Treasury bond yields provided a boost to the USD and caused XAU/USD to suffer heavy losses. The benchmark 10-year reference preserved its bullish momentum and closed in the positive territory on Monday but snapped its five-day losing streak on Tuesday amid a lack of significant fundamental drivers.

On Wednesday, the data published by the US Bureau of Labor Statistics revealed that the Core Consumer Price Index (CPI), which excludes volatile food and energy prices, stayed unchanged at 1.6% on a yearly basis as expected. On Thursday, the US Department of Labor announced that the weekly Initial Jobless Claims increased by 181,000 to 965,000. Although this reading missed the market expectation of 795,000, it had little to no impact on risk sentiment.

While speaking at an online event organized by Princeton Bendheim Center for Finance on Thursday, FOMC Chairman Powell reassured markets that they are not even thinking about raising rates any time soon. "We are strongly committed to using our tools until the job is well and truly done," Powell reiterated and added that they will communicate it well in advance when they start considering tapering asset purchases. Powell’s dovish tone made it difficult for the greenback to gather strength and helped XAU/USD limit its losses.

The data from the US showed on Friday that Retail Sales in December declined by 0.7%. Moreover, the University of Michigan's Consumer Sentiment Index continued to weaken in January's preliminary reading. The souring market mood ahead of the weekend, as reflected by the severe drop witnessed in US stocks, allowed the USD to outperform its rivals and forced XAU/USD to return to the lower half of its weekly range.

Finally, President-elect Joe Biden unveiled the highly-anticipated coronavirus relief plan, which will be worth around $1.9 trillion and will include $2,000 direct payments to Americans. However, due to the fact that markets had already priced in additional fiscal stimulus, the market reaction remained relatively muted to this announcement.

Next week

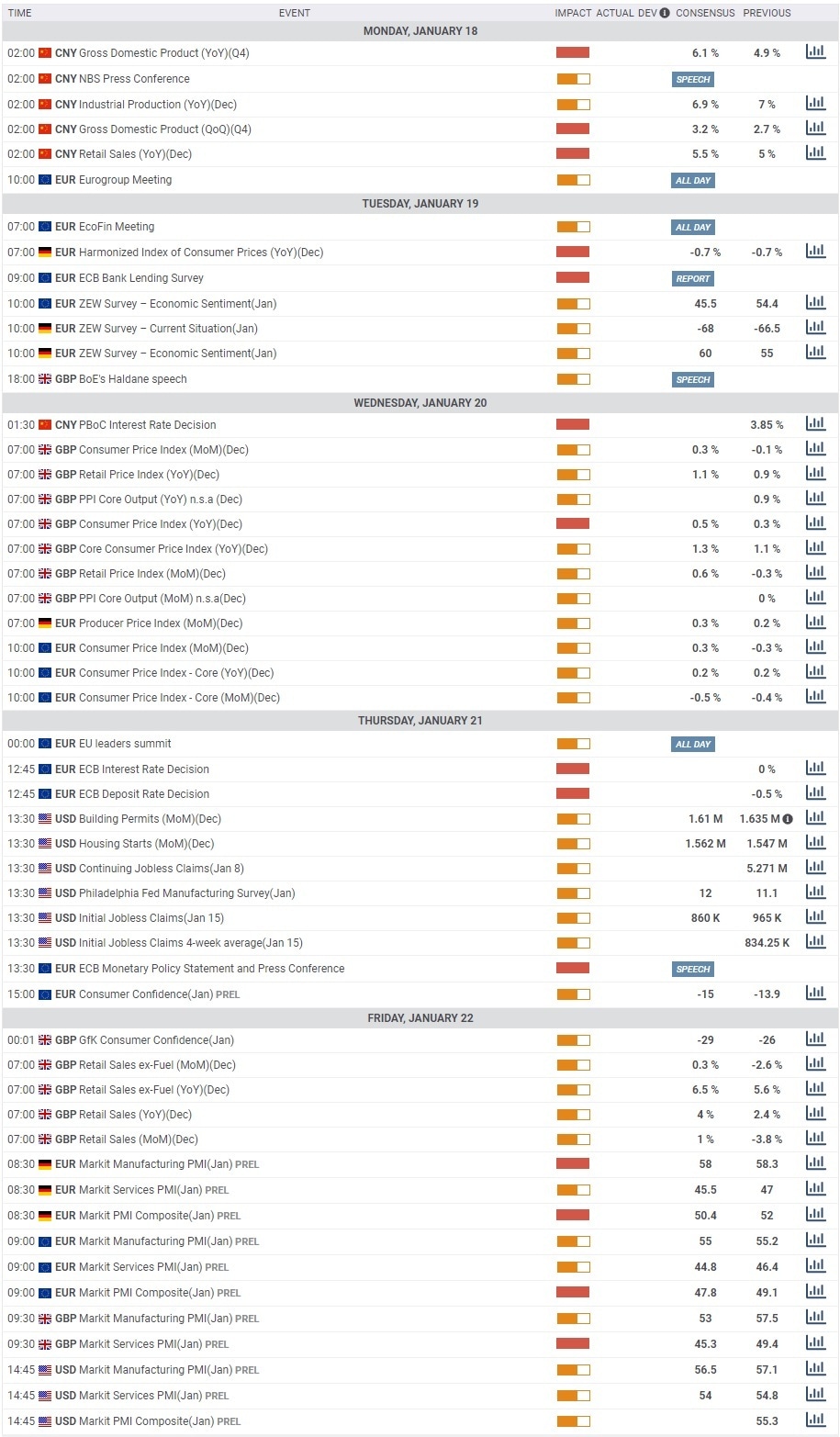

On Monday, the fourth-quarter GDP data from China will be watched closely by the market participants. Analysts expect the Chinese economy to grow by 6.1% on a yearly basis in the last quarter of 2020 and a weaker-than-expected reading could weigh on risk sentiment and help the precious metal start the new week on a firm footing.

On Wednesday, the Eurostat will release the Consumer Price Index (CPI) data for the eurozone. Earlier in the week, the European Central Bank’s (ECB) December Meeting Accounts showed that policymakers were concerned about the euro exchange rate and its potential negative impact on the inflation outlook. If CPI figures trigger a selloff in the EUR/USD pair, strong demand for the buck could also weigh on XAU/USD.

On the last day of the week, the IHS Markit will publish the preliminary Manufacturing and Services PMI reports for the UK, the eurozone, Germany and the United States.

Gold technical outlook

With Friday's plunge, XAU/USD closed below the 200-day SMA for the first time since early December, suggesting that sellers are likely to remain in control of the pair's action in the near term. Additionally, the Relative Strength Index (RSI) indicator on the daily chart is still above 30, showing that there is more room on the downside before gold becomes technically oversold.

The initial support aligns at $1,817 (January 11 low) ahead of $1,800 (psychological level). With a daily close below $1,800, the selloff could continue toward $1,775, the starting point of December uptrend.

On the upside, the 200-day SMA seems to have turned into the first significant hurdle at $1,845. If gold manages to clear that level, the next resistance aligns at $1,860 (50-day SMA) before $1,900 (psychological level).

Gold sentiment poll

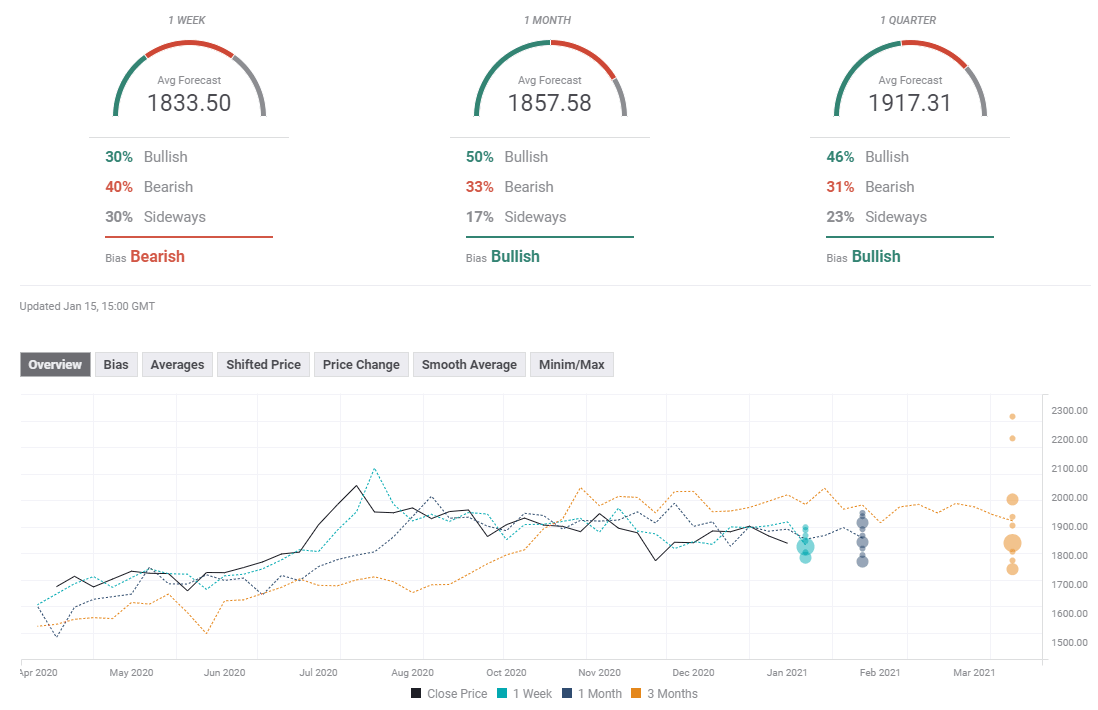

According to the FXStreet Forecast Poll, 40% of experts see XAU/USD staying under pressure in the near-term. Following this week's price action, a bearish shift could also be seen on the one-month view, which now has an average target of $1,857 compared to $1,893 last week.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.