Gold: The outlook remains on a knife-edge [Video]

![Gold: The outlook remains on a knife-edge [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-coins-on-a-weight-scale-gm173237086-20246712_XtraLarge.jpg)

Gold

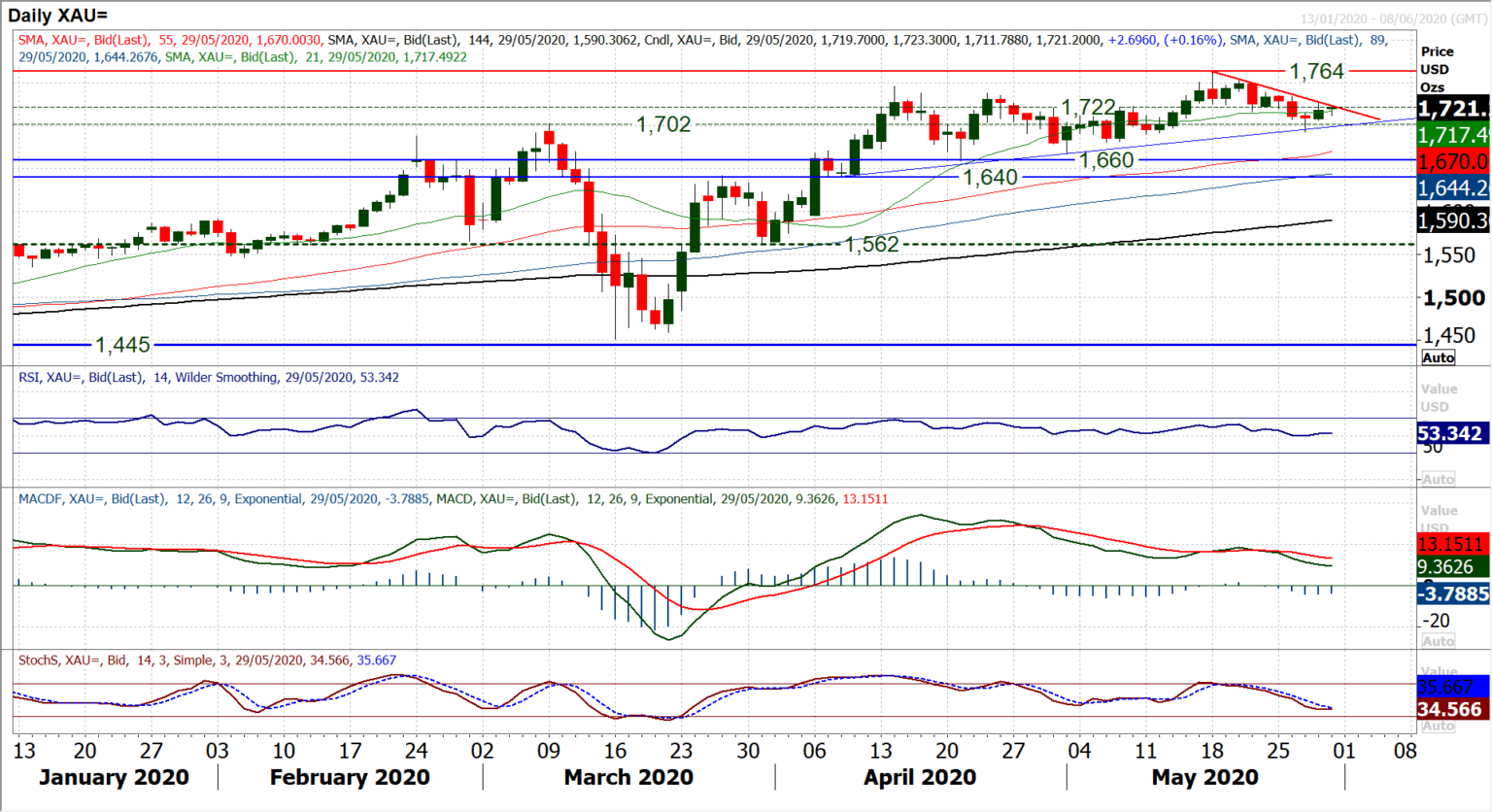

The outlook for gold remains on a knife edge. Following the rebound from $1693 on Wednesday the market has rallied back into the resistance around the $1722 pivot and a near term downtrend. Although the market closed positively yesterday, the candle hit the downtrend resistance and closed just under the pivot. Trading cautiously this morning, there is a real sense that this is a near term crossroads now. Picking up off a medium term uptrend on Wednesday and hitting the near term downtrend today, this Is a move that could be close to the bulls regaining control. However, the rebound has stalled today and needs to breach the downtrend (around $1724 today) but with a move above $1735 resistance at least needed to really suggest positive momentum is building again. For now, this is a waiting game. President Trump could easily announce something today that massively shakes the positive risk appetite and pulls strong positive momentum into gold once more. We remain medium term buyers of gold and see that this near term correction will be an opportunity. The corrective set up needs to be broken for that to take hold. Support at $1693 is growing in importance now and the support of a 7 week uptrend comes in at $1699 today.

Author

Richard Perry

Independent Analyst