Gold: The market remains very much devoid of real direction [Video]

![Gold: The market remains very much devoid of real direction [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-coins-on-a-weight-scale-gm173237086-20246712_XtraLarge.jpg)

Gold

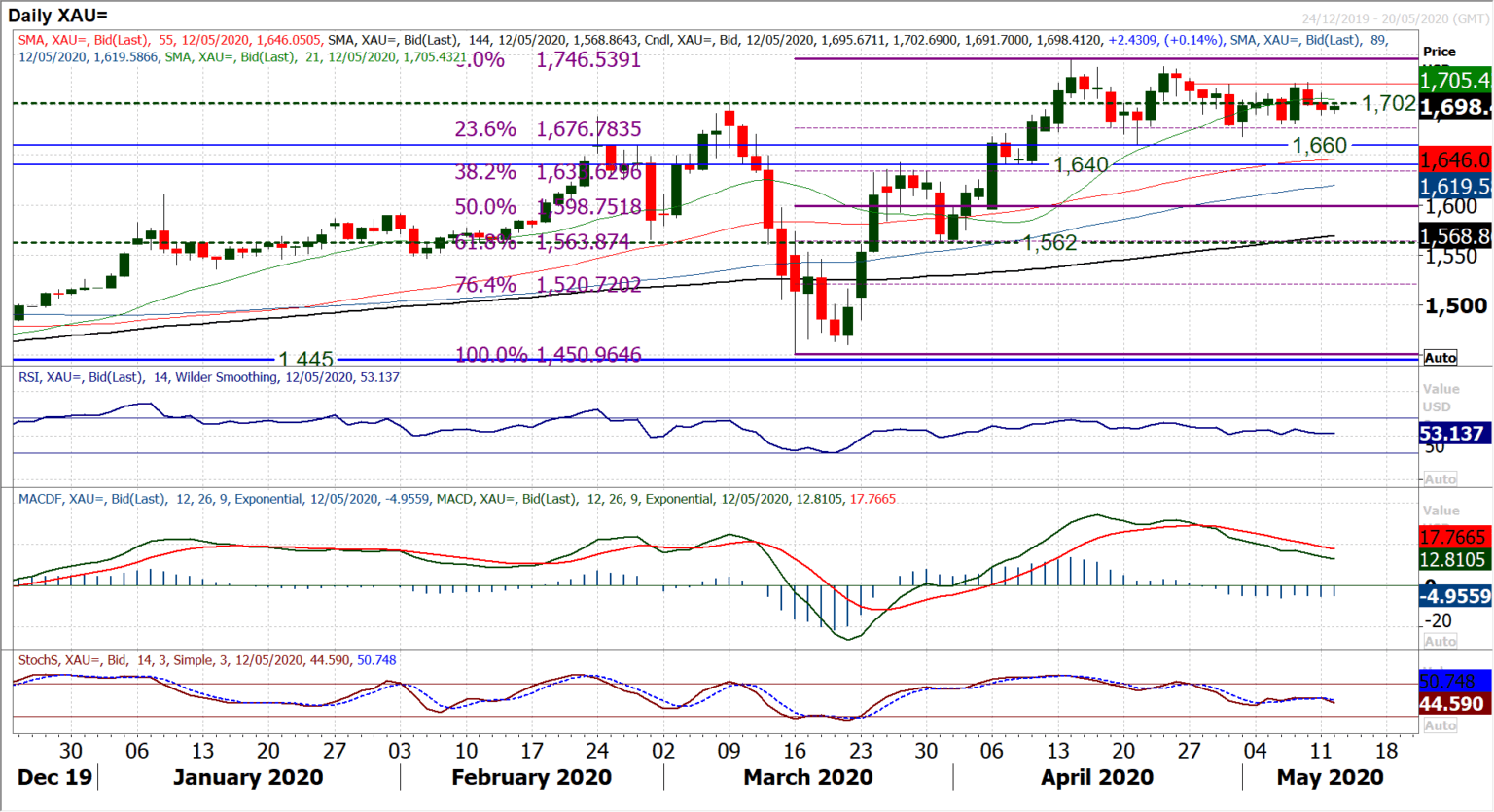

Gold continues to trade within the range $1660/$1746. Signals are increasingly mixed within this range as a lack of conviction remains. Including today, it is now 11 sessions in a row where the market has traded at the $1702 pivot. With a couple of (very minor) closes below the pivot in the past two sessions, there is the mildest of negative biases within the range, but essentially the market remains very much devoid of real direction. This is reflected in the momentum indicators, where the RSI and Stochastics are ticking around their mid-points. MACD lines continue to tail off as the strong momentum of the early April rally has dissipated into consolidation. You can tighten support and resistance within the band. In the past week, there is support around $1681, with resistance firming at $1722. We continue to see the medium to longer term case is strong for further upside and an eventual break to multi-year highs. As such we favour buying into weakness within the range, with strong support $1640/$1660. For now though, this remains a market in need of decisive direction.

Author

Richard Perry

Independent Analyst