Gold: the bull run is extremely strong [Video]

![Gold: the bull run is extremely strong [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/safe-investment-gm147322399-17568598_XtraLarge.jpg)

Gold

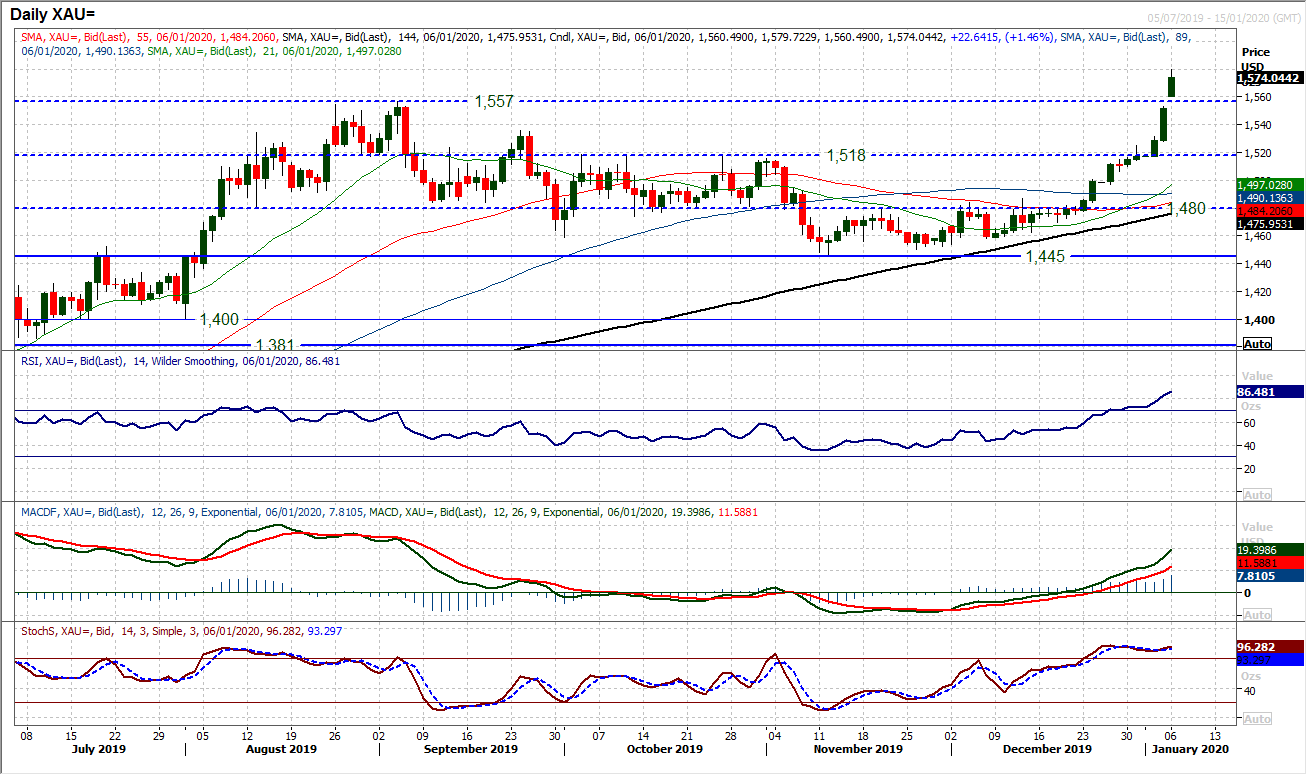

The drive higher on gold over the festive period was given rocket boosters on Friday’s geopolitical news. The market has paid scant regard for the 2019 high of $1557, gapping through the resistance to a new high dating back to 2013. The market has been on a big bull run ever since the breakout above $1480 and has shown little sign of stopping. However, the one caveat is that the market is increasingly stretched. Gold is trading entirely outside the 2.0 SD Bollinger Bands today (the upper band is at $1556 currently). Furthermore, the RSI is into the high 80s now which is becoming extremely stretched. These conditions show the bull run is extremely strong, but excessive too. Care must be taken with chasing gold higher in this situation. Profit-taking is increasingly possible now. There is a gap at $1553 from Friday’s high, whilst $1557 is the old key high which is also a basis of support now. The next resistance is $1600 (psychological) and minor at $1616 (March 2013 high, but is little realistic resistance.

Author

Richard Perry

Independent Analyst