Gold surges past $5,000 on geopolitical risks and Fed rate cut signals

Gold (XAU/USD) climbed to a new all-time high near $5,050 as rising global risks and policy uncertainty fueled safe-haven demand. Failed peace talks between Russia, Ukraine, and the US, along with Trump’s abrupt tariff threats, have rattled markets. Meanwhile, the US Dollar has dropped to its lowest level in months as markets price in more easing. These factors continue to support gold, with markets now turning to this week’s FOMC meeting for fresh policy signals.

Gold surges to all-time high on global unrest and Fed rate cut expectations

Gold continued its climb to new highs following increased geopolitical threats and unstable policy signals. Recent discussions among Russia, Ukraine, and the US ended without a deal. Russia escalated attacks during the negotiations, deploying drones and missiles. Although talks are set to resume on February 1, the absence of meaningful progress has kept geopolitical risks elevated and continues to support gold’s upside.

At the same time, Trump’s unpredictable trade approach deepened uncertainty across financial markets. After pulling back his initial tariff threat following a tentative Greenland deal with NATO, he sparked fresh concern by threatening a 100% tariff on Canada over its trade ties with China. These abrupt policy shifts have shaken confidence in U.S. alliances and monetary credibility. In response, the US Dollar Index (DXY) has fallen to its lowest level, further boosting demand for non-yielding assets like gold.

Meanwhile, expectations of further monetary easing in the US are adding fuel to the rally. The US Dollar has dropped to its lowest level. Markets are now pricing in at least two additional Fed rate cuts this year. Non-yielding gold stands to benefit from this environment. Attention shifts to the upcoming FOMC meeting, particularly Powell’s remarks on the policy outlook. Any dovish tilt would likely strengthen the bullish case for gold.

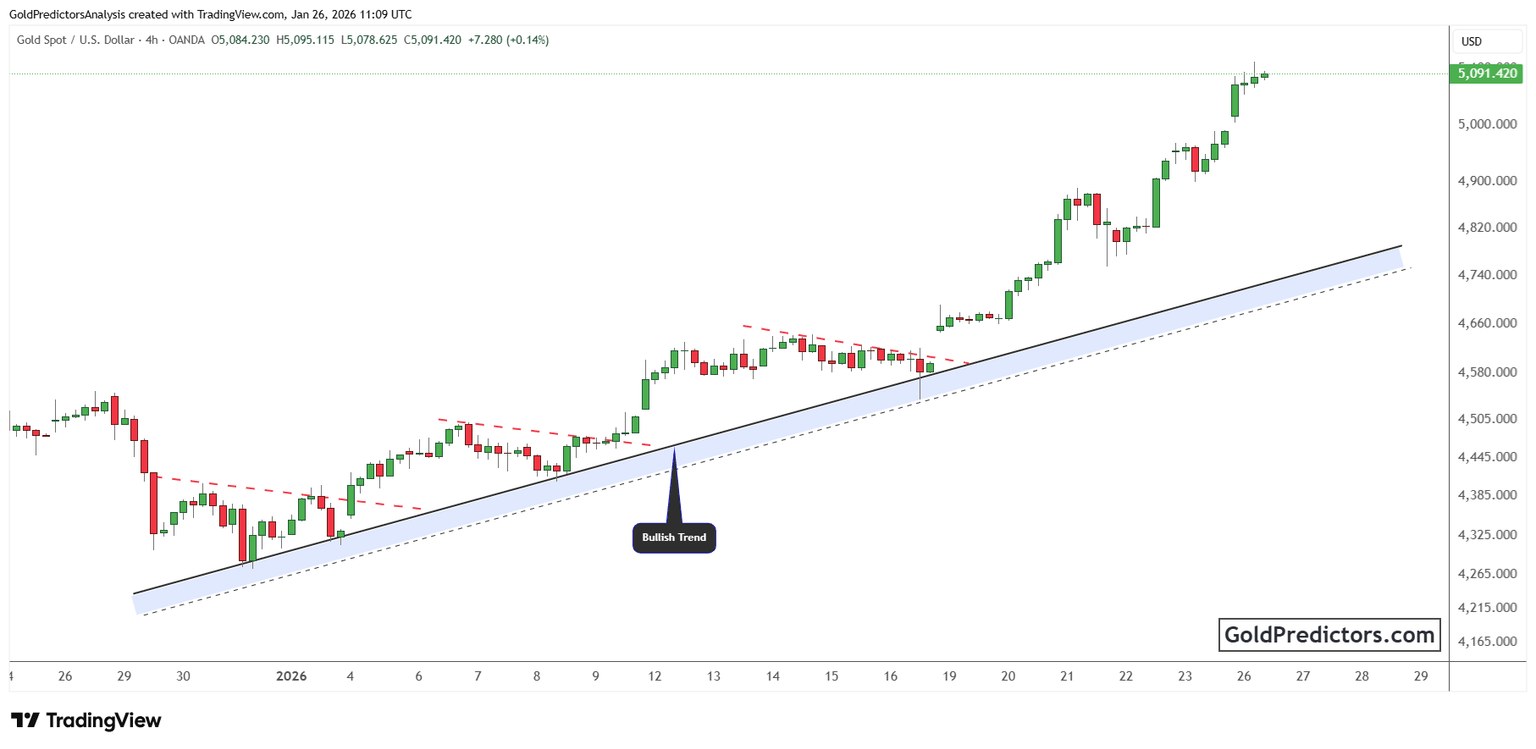

Gold maintains bullish structure above key rising trendline

The gold chart below shows a strong uptrend, with price consistently respecting a rising trendline that has guided the move since late December. Each pullback has found support along this trendline, reflecting steady accumulation on every decline. The structure remains bullish, with a series of higher lows forming along the way.

Throughout the rally, gold has moved in distinct phases marked by brief consolidations. These pauses, often seen as tight ranges or shallow pullbacks, allowed the market to reset before continuing higher. The most recent breakout followed a short consolidation in mid-January, propelling price decisively above $5,000.

Gold is currently trading near $5,070, with bullish momentum intact. The rising trendline continues to support the move, providing a clear reference for further upside. As long as this trendline holds, momentum favors additional upside, with $5,500 and higher levels still in play.

Gold outlook: Global instability and Fed policy fuel bullish momentum

Gold remains in a strong uptrend as geopolitical instability, trade uncertainty, and monetary policy shifts drive safe-haven demand. The failure of peace talks and renewed tariff threats have deepened market uncertainty, while expectations of Fed easing continue to weaken the Dollar. With momentum intact and price holding above key support, the bullish outlook stays firmly in place ahead of this week’s FOMC decision.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.