Gold regains strength on dovish Fed signals and soft labor data

Gold (XAUUSD) is showing signs of recovery, supported by safe-haven demand and evolving macro conditions. Volatile markets, softening labor data, and uncertainty around Fed leadership have clouded the policy outlook. Recent JOLTS and jobless claims reports indicate growing labor market weakness, increasing expectations for Fed rate cuts. At the same time, global tensions and dovish signals from other central banks continue to shape price action. These combined forces are keeping gold supported despite near-term pullbacks.

Gold supported by rising rate cut bets and macro volatility

Gold is attempting to stabilize after a sharp retreat, with price showing signs of recovery from recent lows. The pullback reflects broader market caution, as volatility remains high across major asset classes. Uncertainty surrounding the Federal Reserve’s leadership outlook has added to market caution, raising questions about the direction of future policy. Still, gold attracted renewed interest as buyers responded to persistent geopolitical risks and the lack of clarity surrounding future policy direction.

Moreover, shifting labor conditions continue to cloud the monetary policy outlook. The latest JOLTS report showed a sharp drop in job openings to 6.54 million, while weekly jobless claims rose to 231,000. These figures point to growing weakness in the labor market and strengthen the argument for Fed rate cuts. Markets are now re-evaluating the timing of potential rate cuts, with expectations building around a June move.

Shifting global policy signals and persistent geopolitical tensions are also influencing gold’s near-term outlook. The Bank of England and the European Central Bank delivered dovish policy statements, weakening the Euro and the Pound. This lifted the Dollar and temporarily weighed on gold. Yet tensions in the Middle East and the unresolved U.S.–Iran nuclear standoff continue to support demand for safe-haven assets.

Gold sustains uptrend after testing key channel resistance

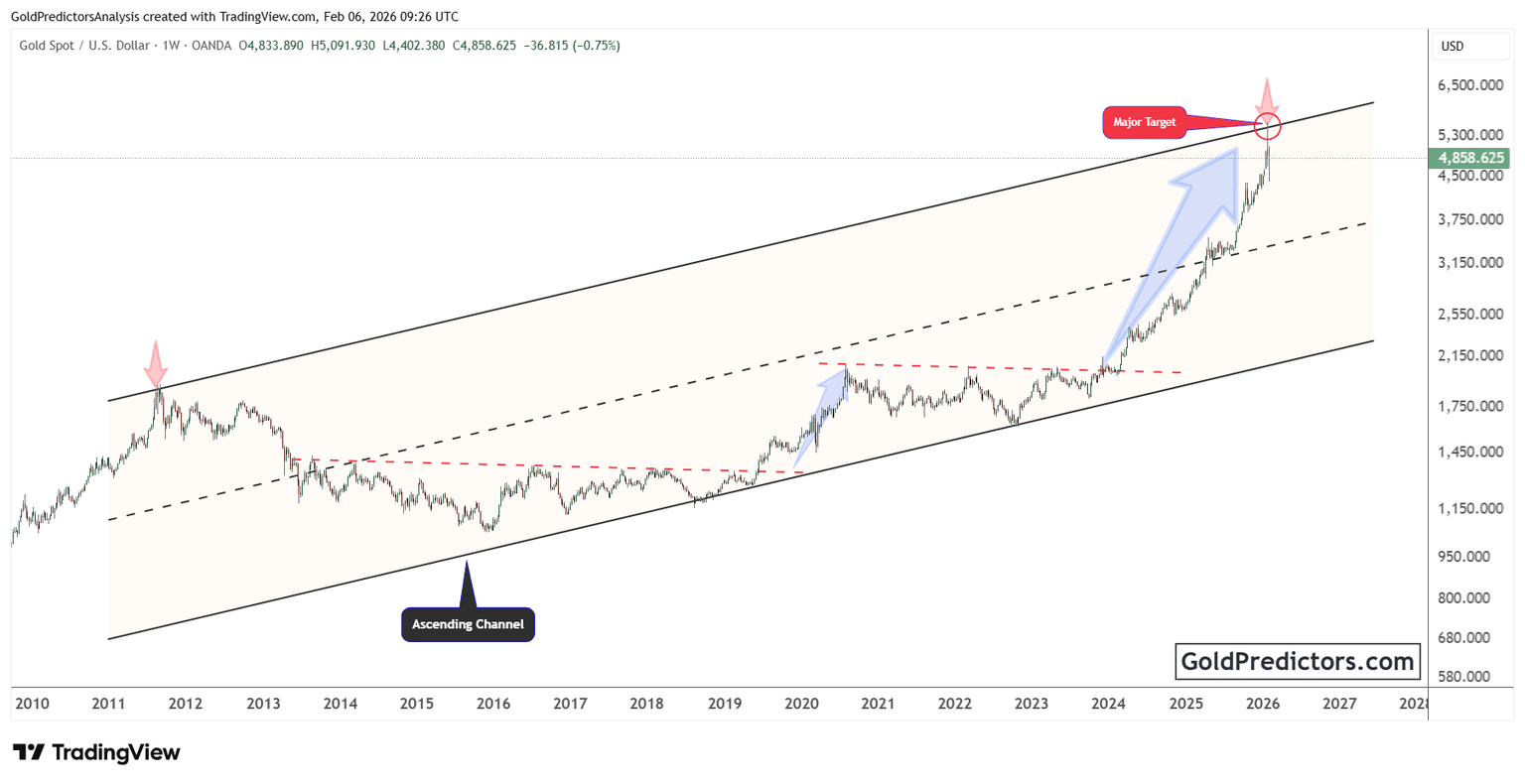

The gold chart below shows a well-defined ascending channel that has guided price action since 2011. Following an extended consolidation between 2013 and 2019, gold launched into a sharp rally that carried price toward the channel’s midline. However, that advance eventually stalled, resulting in another multi-year consolidation that built a solid base within the broader structure.

A decisive breakout occurred in 2024, launching a vertical rally from the established base. Gold surged through long-standing resistance and accelerated toward the upper boundary of the channel. This steep ascent marked a clear shift in momentum and confirmed a structural transition into a renewed phase of strength.

Recently, the price approached a key target near the upper boundary of the ascending channel. Although gold faced a pullback near this zone, the broader uptrend remains intact. The structure still supports the potential for further upside, particularly if price holds above prior resistance levels. The upper boundary remains a critical technical zone to monitor for either breakout continuation or renewed rejection.

Gold outlook: Dovish policy and global tensions keep floor intact

Gold remains in a strong position despite recent volatility. Soft labor data and dovish global signals are increasing pressure on the Fed to ease. At the same time, geopolitical tensions continue to drive safe-haven demand. Technically, gold holds above key support within its long-term channel. As long as price maintains this level, the broader structure continues to support further upside potential.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.