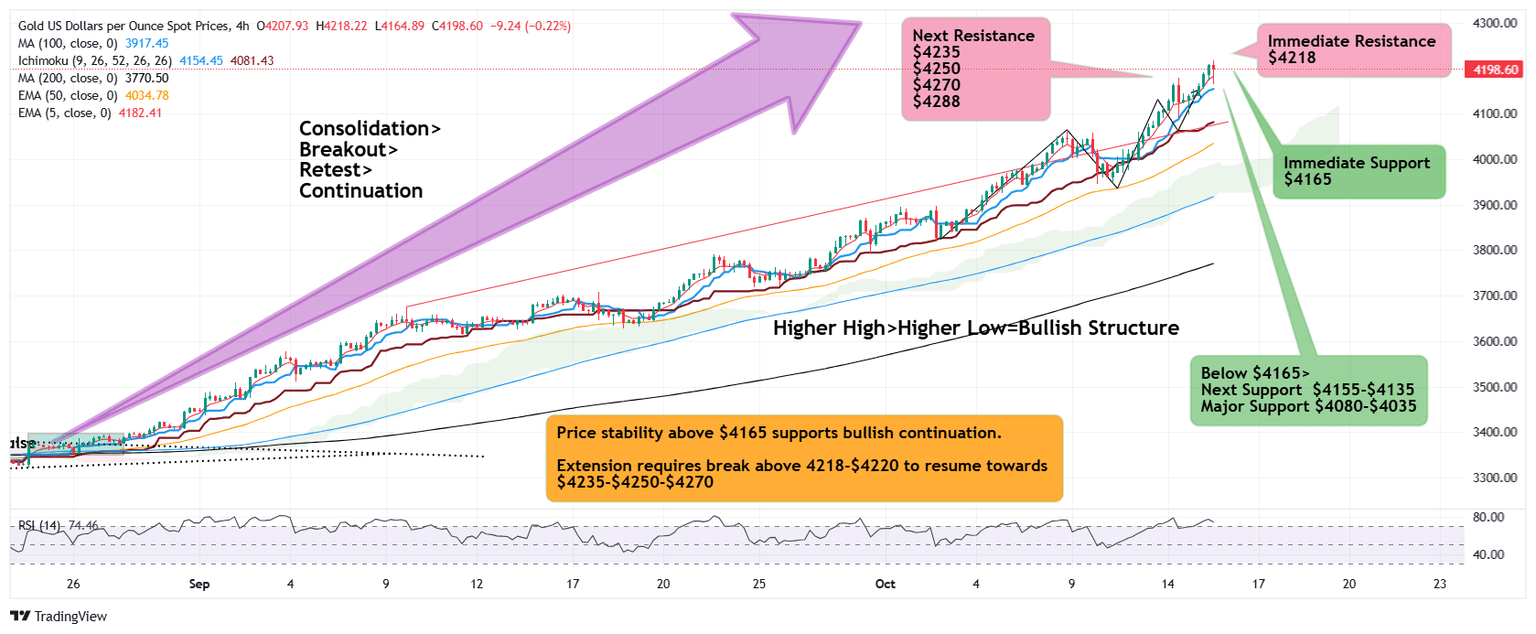

Gold rallies to $4,218 on elevated safe haven buying, what's next?

Gold continues to establish new record high as the prevailing bullish rally maintains sequential Higher High-Higher Low structure as all stars seem to be in collusion to boost Gold prices in a seemingly unstoppable rally until initial signs of exhaustion begin to appear.

Asian session began with strength and European session witnessed rally extending to new record high at $4218 followed by a quick drop to $4165 which was again quickly absorbed by liquidity hunters resulting in bounce back off the lows rebounding to $4206

For now, bullish momentum remains intact supported by price stability above $4165 while strong break and follow up stability above $4220 will resume upside to advance towards next overhead extension $4235 opening the way to accomplish next leg higher $4250 & $4270 followed by $4300

Fundamental drivers

.Markets are pricing the growing expectations of at least two cuts in key interest rate by the Federal Reserve for this year which is bolstering Gold prices at present. Any dovish tilt will lower the real yields boosting Gold prices.

.Dollar Index struggles below 200 Day SMA 99.70 as dollar demand loses grip pushing the index to 98.70

.Lingering US Government shutdown shows no signs of agreement in Congress to resolve the deadlock increasing the chaos in administration and causing further concerns among investors.

.Geo political instability in various countries is worsening the crisis situation and increasing the political risks as well as fiscal concerns.

.Central banks (Peoples Bank of China in particular) continue accumulating Gold to reserves in a strategic move to ward off the risks of dollar dependence as the US grapples with its ever mounting national debt of $37 trillion and its debt servicing getting more difficult.

.Frequent volatility in global stocks and indices create sense of fear and uncertainty among global investors driving smart money flow towards more trusted investment in Gold which has proven its store of value in times of crisis.

.ETF inflow keeps rising at record pace, boosting structural demand and prices of Gold.

.CTAs as well as leading Banks have been revising bullish forecasts further up which instils confidence among Gold investors and a significant sense of FOMO is driving Gold prices in record run that seems unstoppable at least for the time being as any price pullback is quickly being bought leading to yet another higher high-higher low structure, keeping the prevailing bullish momentum intact.

.Trade tariff escalations resume with The US President Donald J Trump announcing additional 100% tariff on China, over and above the 30% tariff already in place which has reignited the simmering tensions.

Technical drivers

.The Gold price momentum is currently in a strong bullish structure, confirmed by a clear sequence of Higher Highs (HH) and Higher Lows (HL).The price reaction to pullback towards local demand zone $4165 ,that aligns with 30 minute 50 EMA, a strong buying intervention has been noticed rebounding to immediate resistance $4206 implying a break above preceding hurdle (Break of Structure).

The current sideways price behaviour is a consolidation before breakout and goal scoring between buy side liquidity and sell side liquidity.

The current consolidation phase may be an attempt to seek additional liquidity and order flows before deciding on next bullish extension towards $4235-$4250-$4270

.If Gold fails to clear above $4206, the zone that capped gains of recent bounce off the lows of $4165, or gets rejection/fails to clear through $4218, a selling pressure may be witnessed retesting $4165 below which $4155-$4150 followed by 1 hourly 50 EMA at $4135 is likely. This zone may again accumulate defensive longs before resuming impulsive move which is conditioned by presence of a bullish price formation such as Change of Character(COCH) or Break of Structure(BOS).

Bullish Scenario:

If Gold succeeds clearing through intraday high and immediate resistance zone $4218-$4220, expect further advance towards next Fibonacci extension $4235 followed by $4250-$4270 while major resistance could be psychological benchmark $4300

Bearish Scenario:

Failure to break above or rejection from $4218-$4220 immediate resistance will resume selling and profit booking led selling to revisit $4165 below which next support sits at $4250 and 1 hourly 50 EMA $4135 while major support sits at $4080 - $4035

Overall Outlook:

The prevailing price action and stability above 1 Hourly 50 EMA $4165 suggests bullish momentum and a decisive break above $4220 will call for further bullish move to continue advance towards $4250-$4270-$4300

However, heights and record highs are mostly news sensitive and very prone to flash crash which urges caution on heights as any news may trigger massive sell off at the drop of a hat.

It is highly recommended to exercise strict risk management, position sizing and remain updated with the latest news developments to avoid ugly surprises.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.