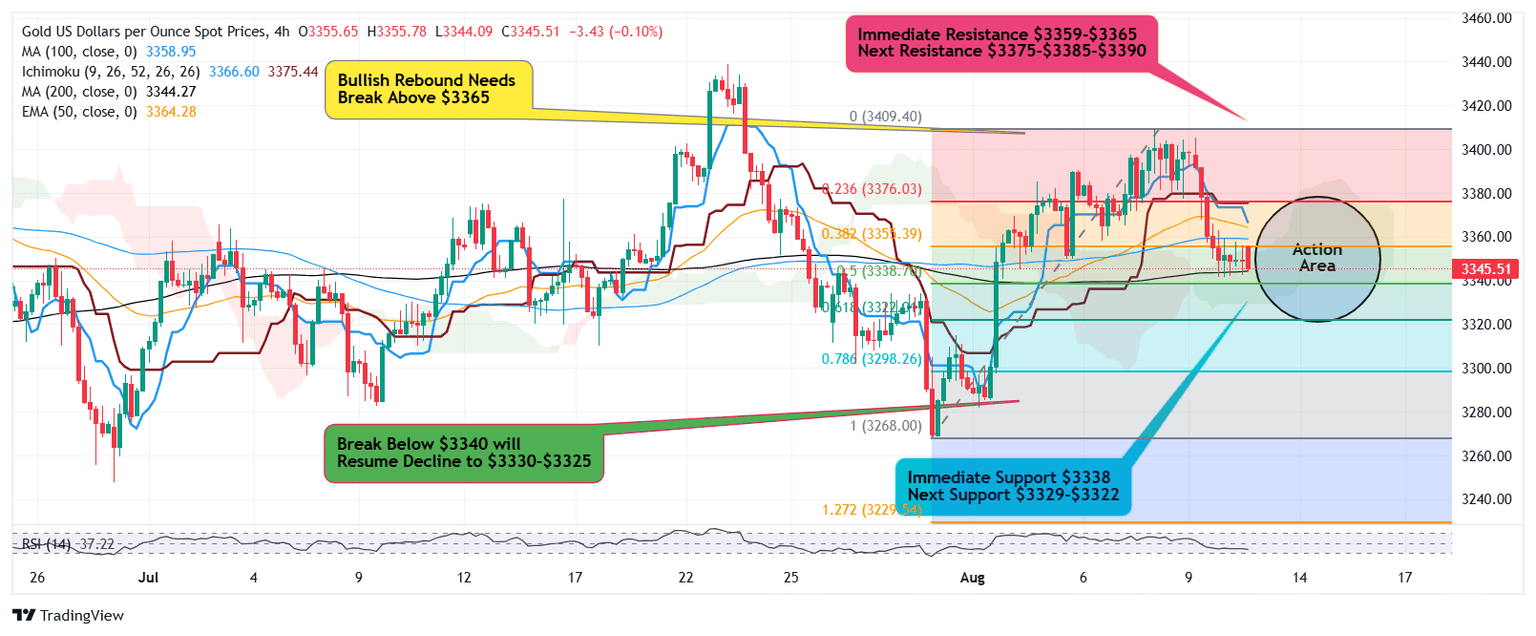

Gold pushes on $3,340 support as US CPI data looms while bulls need break above $3,365-$3,375

-

Intraday gains remain capped at $3359 resistance.

-

Support base $3340 under pressure to break, exposing risks to $3322-$3298

-

Markets await release of US CPI data for range breakout.

Dollar maintaining stability above 98.40 keeps sentiments afloat while pushing Gold prices towards long held local demand zone $3340

Just below $3340, sits 50% Fibonacci zone $3338

Repeated attack on a support weakens holding strength and as obvious, a next break below the belt will expose next leg lower which aligns with golden ratio 61.8% Fibonacci zone at $3322

Next major support is positioned at discounted zone 78.6% Fibonacci zone $3298

If CPI numbers trigger a Gold rebound, bulls need to clear through immediate hurdle $3359 followed by immediate resistance $3365 which brings next overhead resistance $3375 which is turning point for further acceleration towards next leg higher $3385-$3390 turning short trend bullish.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.