Gold Price Weekly Forecast: Has XAU/USD found the bottom?

- Gold price extended its slide and touched its lowest week since early January below $1,820.

- Hawkish Fed bets dominated the markets following US data releases and Fedspeak.

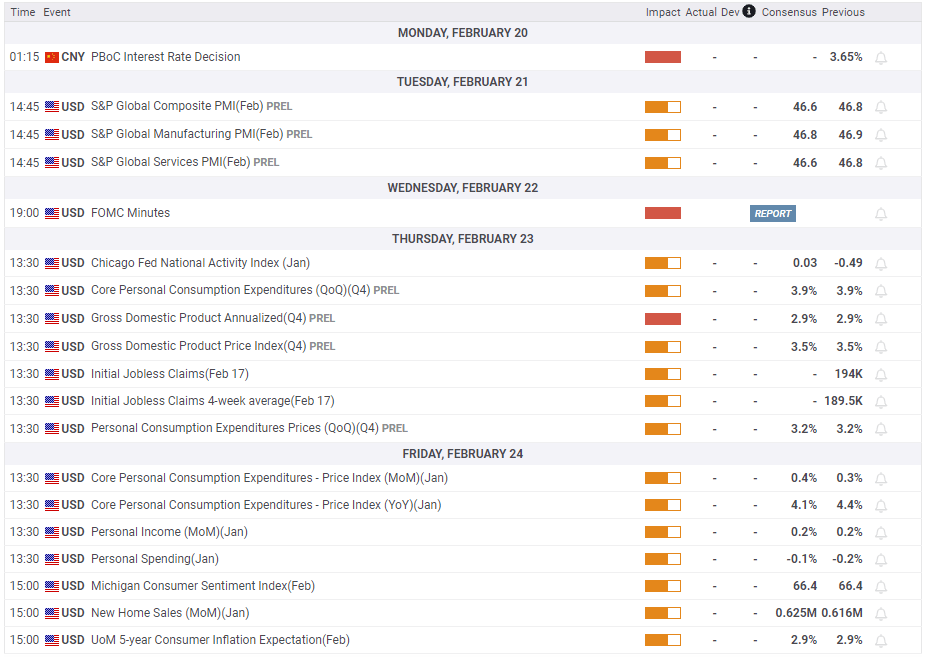

- PMI surveys, FOMC Minutes and PCE inflation data stand out in next week's calendar.

Gold price has continued to decline and lost more than 1% this week to close below $1,840 as macroeconomic data releases and hawkish comments from Federal Reserve (Fed) officials triggered a rally in the US bond yields and the US Dollar. XAU/USD’s technical outlook suggests that the pair has more room on the downside before an upward correction and next week’s data releases from the US should help investors figure out where the bottom lies for the precious metal.

What happened last week?

The risk-averse market atmosphere at the beginning of the week helped the US Dollar preserve its strength and XAU/USD closed the day modestly lower. With investors refraining from making large bets ahead of Tuesday’s highly-anticipated inflation report from the US, however, the pair’s downside remained limited on Monday.

The US Bureau of Labor Statistics monthly publication revealed that the Consumer Price Index (CPI) edged lower to 6.4% in January from 6.5% in December. The Core CPI, which excludes volatile food and energy prices, rose 0.4% on a monthly basis, matching December’s monthly increase and the market consensus. The underlying details of the report showed that the core services inflation, the component that The Fed pays close attention to, came in at 7.2% on a yearly basis. With the immediate reaction to US inflation figures, Gold price fluctuated wildly. Following an initial spike to $1,872, XAU/USD quickly reversed its direction and dropped all the way to $1,843 before ending the day near Monday’s closing level of $1,855.

As the dust settled, market participants realized that the Fed is unlikely to pause its rate increases after March with key parts of inflation remaining uncomfortably high. On Wednesday, the US Census Bureau reported Retail Sales rose by 3% in January, compared to analysts’ estimate of 1.8%. The upbeat data fed into the view that the US central bank could stay on the tightening path without worrying too much about a recession just yet. Moreover, this figure also reminded markets that consumer activity in the US is still healthy and the Fed is yet to see the impact of the tight policy on demand. In turn, the benchmark 10-year US Treasury bond yield rose nearly 2% on the day and weighed heavily on XAU/USD.

On Thursday, the Core Producer Price Index (PPI) came in at 5.4% in January, much higher than analysts’ estimate of 4.9%, and allowed US yields to continue to stretch higher. Moreover, the US Department of Labor announced that there were less than 200,000 Initial Jobless Claims for the fifth straight week, highlighting tight labor market conditions.

In the meantime, Cleveland Fed President Loretta Mester said the Fed will need to go above 5% and stay there for a while to control inflation. Mester also noted that she saw a 'compelling case' for a 50 basis points (bps) rate hike at the last FOMC meeting but added she was not ready to say if a bigger increase in the policy rate will be needed in March. Similarly, St. Louis Fed President James Bullard noted that continued policy rate increases will help them ‘lock in a disinflationary trend' in 2023. The benchmark 10-year US Treasury bond yield gained more than 1% for the third straight day on Thursday and continued to stretch higher toward 3.9% early Friday, helping the USD outperform its rivals and forcing XAU/USD to drop below $1,830 for the first time since early January.

In the absence of high-tier data releases on Friday, XAU/USD stayed on the back foot and finished the week in negative territory below $1,830.

Next week

On Monday, stock and bond markets in the US will be closed in observance of Presidents Day and trading action is likely to remain subdued.

S&P Global will release the preliminary February Manufacturing and Services PMI surveys for the US. Headline PMIs for both sectors are forecast to come in below 50 and show an ongoing contraction in the private sector’s business activity. Market participants will pay close attention to commentary in the Services PMI survey. In case the publication shows that rising wages continue to ramp up input price pressures in the service sector, the US Dollar is likely to preserve its strength and limit XAU/USD’s potential recovery gains. On the other hand, lower-than-expected headline PMI prints combined with employment-related commentary that reveals a decline in the private sector’s payrolls could weigh on the USD and help the pair edge higher.

On Wednesday, the Fed will publish the minutes of its last policy meeting. It will be interesting to see whether some policymakers saw the need for the Fed to reconsider 50 bps rate hikes in case they saw enough evidence to suggest that the slowdown in inflation was temporary. Such a development could revive bets for a 50 bps hike at the next meeting and weigh heavily on Gold price. Nevertheless, markets are unlikely to read too much into the minutes ahead of the March meeting, where the revised Summary of Projections will be unveiled.

The US Bureau of Economic Analysis (BEA) will publish the first revision to the fourth-quarter Gross Domestic Product growth, which stood at 2.9% in the first estimate. It’s worth noting that it’s very rare to see a significant revision to the GDP.

Finally, the BEA’s Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred gauge of inflation, will be watched closely by investors. The Core PCE inflation is forecast to rise by 0.4% on a monthly basis but the annual figure is expected to decline to 4.1% in January from 4.4% in December. The market reaction should be straightforward with a softer-than-expected monthly PCE inflation weighing on the USD and vice versa. Considering that the CPI report already revealed that inflation remained sticky in January, it would be surprising to see this data have a long-lasting impact on markets.

Traders will also keep an eye on US T-bond yields given the strong inverse correlation with XAU/USD. The 10-year yield stays within a touching distance of the critical 4% level. If the 10-year yield fails to rise above that level and stages a downward correction, that action could translate into a rebound in Gold price. On the other hand, XAU/USD is likely to stay under bearish pressure if that resistance fails.

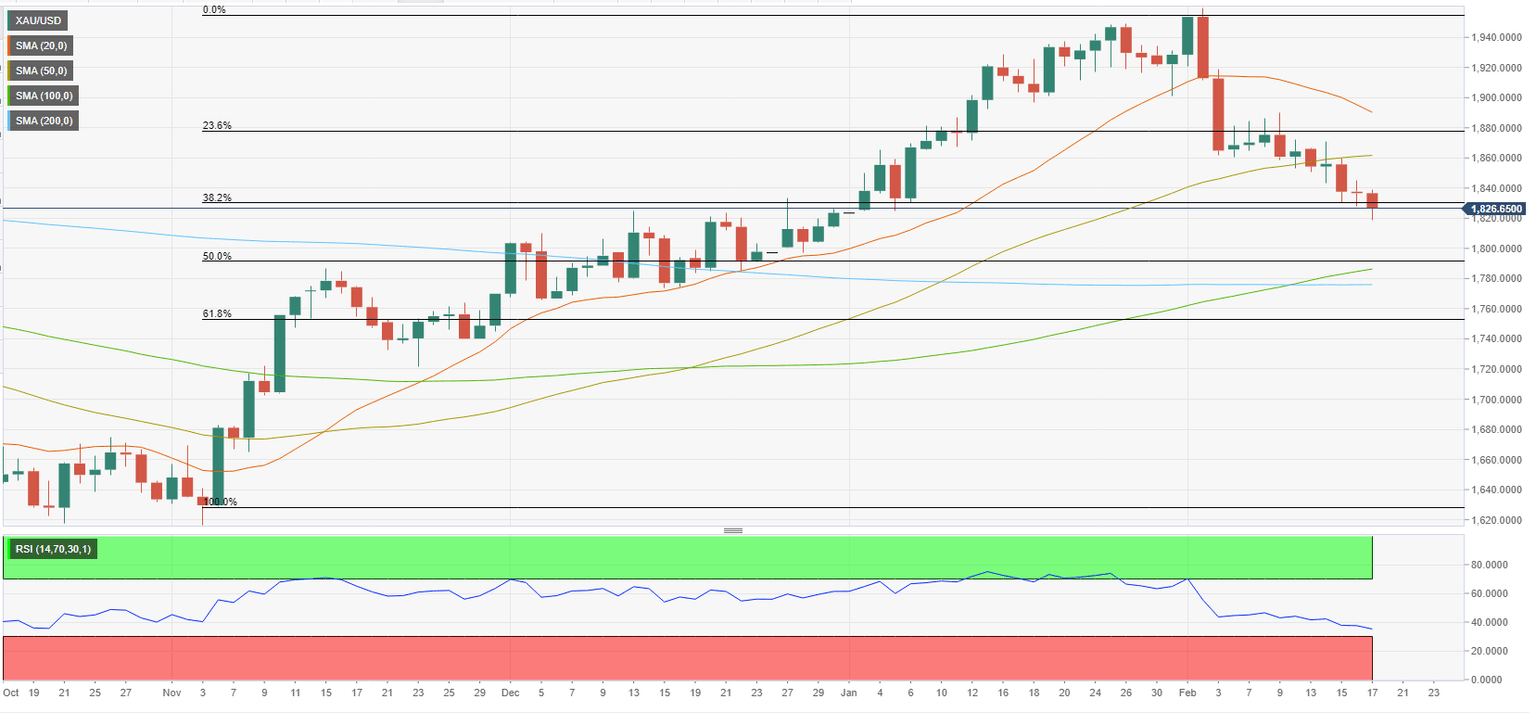

Gold price technical outlook

$1,830 (Fibonacci 38.2% retracement level of the latest uptrend) aligns as a key pivot level for Gold price. In case this level is confirmed as resistance, XAU/USD could extend its slide toward $1,800 (psychological level). Just below that support, the 100-day SMA, the 200-day SMA and the Fibonacci 50% retracement level form strong support area at $1,780/$1,790.

On the upside, the 50-day SMA acts as dynamic resistance at $1,860 ahead of $1,880 (Fibonacci 23.6% retracement). With a daily close below the latter, XAU/USD is likely to face the interim hurdle at $1,890 (20-day SMA) before aiming for $1,900 (psychological level).

It's also worth noting that the Relative Strength Index (RSI) indicator on the daily chart dropped below 40 for the first time since the beginning of the latest uptrend in early November. This development suggests that Gold price has more room on the downside before it looks for a technical correction.

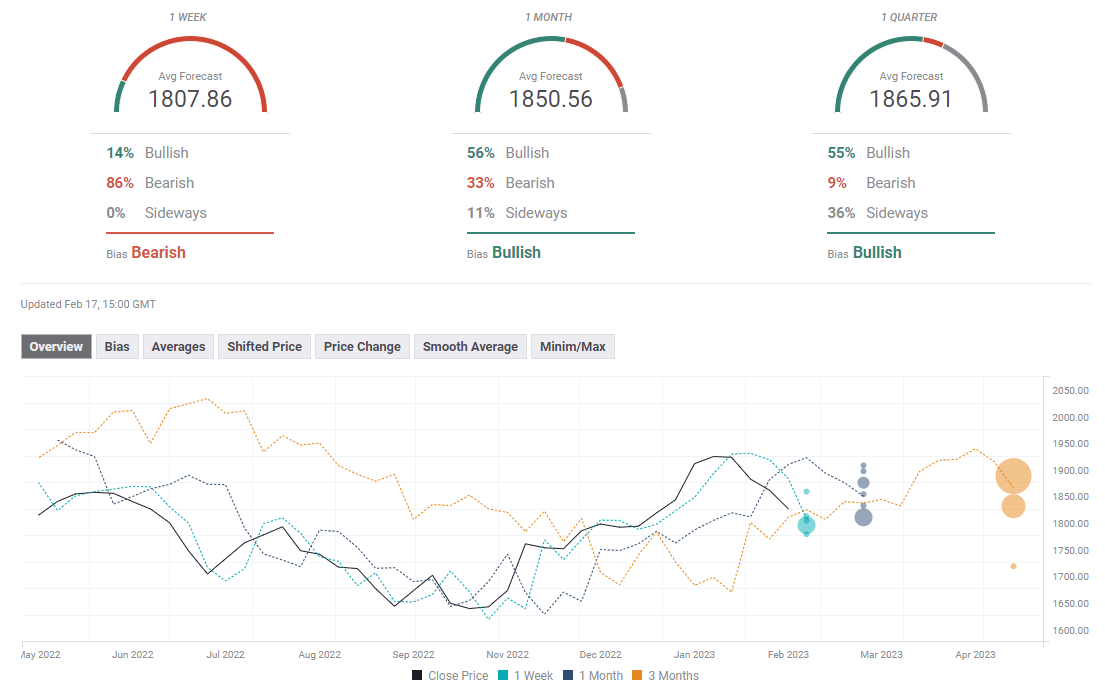

Gold price forecast poll

The FXStreet Forecast Poll points to an overwhelmingly bearish bias in the short term, with the one-week target aligning at $1,807. The one-month outlook stays slightly bullish, with several of the polled experts expecting Gold price to rise above $1,900 in that time period.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.