Gold Price Weekly Forecast: Buyers hope for a dovish Fed

- Gold price advanced to multi-week highs before losing its traction.

- XAU/USD stabilized above $1,950 despite the latest pullback.

- Federal Reserve rate decision, US GDP data will be watched closely next week.

Gold price climbed above $1,980 for the first time in two months this week but failed to preserve its bullish momentum. The Federal Reserve’s (Fed) policy announcements next week could trigger the next big action in XAU/USD, with investors potentially reassessing the interest rate outlook.

What happened last week?

The data from China, the world’s biggest consumer of Gold, revealed early Monday that the real Gross Domestic Product (GDP) expanded at an annual rate of 6.3% in the second quarter. This reading followed the 4.5% growth recorded in the first quarter but fell short of the market expectation of 7.3%. XAU/USD dropped below $1,950 with the initial reaction to this report, but managed to erase its daily losses as the 10-year US Treasury bond yield turned south in the American session.

Retail Sales in the US rose 0.2% on a monthly basis in June to $689.5 billion, compared to the market expectation for an increase of 0.5%, the data published by US Census Bureau showed on Tuesday. Retail Sales Control Group, which excludes receipts from automobiles, tobacco stores and gas stations, rose 0.6% in the same period. This print surpassed the market forecast for a decline of 0.3% by a wide margin and reaffirmed healthy consumer activity. In turn, the US Dollar (USD) managed to stay resilient against its rivals. Nevertheless, as the 10-year US yield continued to stretch lower, Gold regained its traction. The decisive move beyond $1,960 attracted technical buyers as well, providing an additional boost to XAU/USD.

Global bond yields slid on Wednesday after the data from the UK unveiled a noticeable decline in inflation in June, causing markets to scale back hawkish Bank of England (BoE) bets. Although the USD gathered strength mid-week, the sharp upsurge seen in XAU/GBP pair suggested that Gold was also able to capture some of the capital outflows out of Pound Sterling. As a result, XAU/USD kept its footing and consolidated at around $1,980.

The US Department of Labor announced on Thursday that there were 228,000 initial claims for unemployment benefits in the week ending July 15, the lowest print since the second week of May. The 10-year US T-bond yield staged a decisive rebound after this data and forced XAU/USD to erase some of its weekly gains.

A sharp upsurge seen in USD/JPY on reports claiming that the Bank of Japan (BoJ) would maintain its monetary policy settings at next week's meeting helped the USD build on its weekly gains on Friday. In the absence of data releases, XAU/USD extended its downward correction ahead of the weekend.

Next week

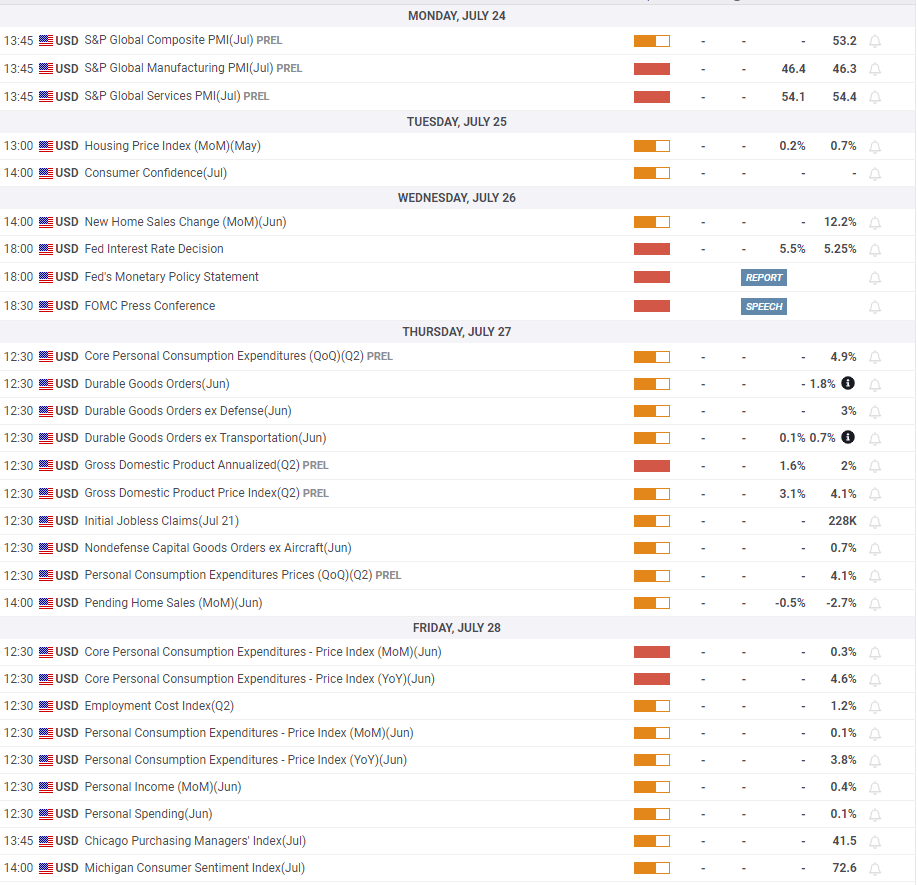

S&P Global will release the preliminary July PMI surveys on Monday. In case the Composite PMI drops below 50, from 53.2 in June’s final reading, growing recession fears could weigh on US T-bond yields and the USD. Market participants, however, could stay away from taking large positions ahead of the Fed’s policy announcements on Wednesday.

The US central bank is widely expected to raise its policy rate by 25 basis points (bps) to the range of 5.25-5.5% following the July meeting. In June, the Summary of Economic Projections showed that the majority of policymakers saw it appropriate to raise the policy rate at least twice more this year. Federal Open Market Committee (FOMC) Chairman, Jerome Powell, pointed that out whenever he spoke publicly on policy in the following weeks.

After the latest inflation data showed that the Consumer Price Index (CPI) rose only 3% on a yearly basis in June, down noticeably from 4% in May, investors turned reluctant to price in additional rate increases beyond July.

In case the Fed’s policy statement, or FOMC Chairman Jerome Powell in the post-meeting press conference, acknowledges softer-than-expected inflation readings and refrains from reiterating the need for one more rate hike, this could be seen as a dovish surprise. As a result, US yields could turn south and XAU/USD could gather bullish momentum.

On the other hand, a continuous push-back against the market expectation could help the USD outperform its rivals. Powell could reiterate the data-dependent approach and mention that one more rate increase will be in line with their projections. In that scenario, XAU/USD could come under renewed bearish pressure.

On Thursday, the US Bureau of Economic Analysis will release the first estimate of the second-quarter Gross Domestic Product (GDP) growth. The US economy is forecast to expand at an annual rate of 1.8% in Q2, a slightly softer pace than the 2% growth recorded in Q1. Even if a hawkish Fed outcome could help the USD find demand, a weaker-than-forecast Q2 growth could revive recession fears and weigh on the USD. A strong GDP print, at or above 2%, could have the opposite effect and lift the USD, causing XAU/USD to turn south.

Finally, the Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred gauge of inflation, will be watched closely by market participants ahead of the weekend. Without seeing the market reaction to the Fed outcome and the US GDP data, it’s difficult to piece together different scenarios explaining how Gold price could be impacted. Nonetheless, the monthly Core PCE inflation will be the key component to watch. A stronger-than-estimated increase in that data could support the USD.

Gold technical outlook

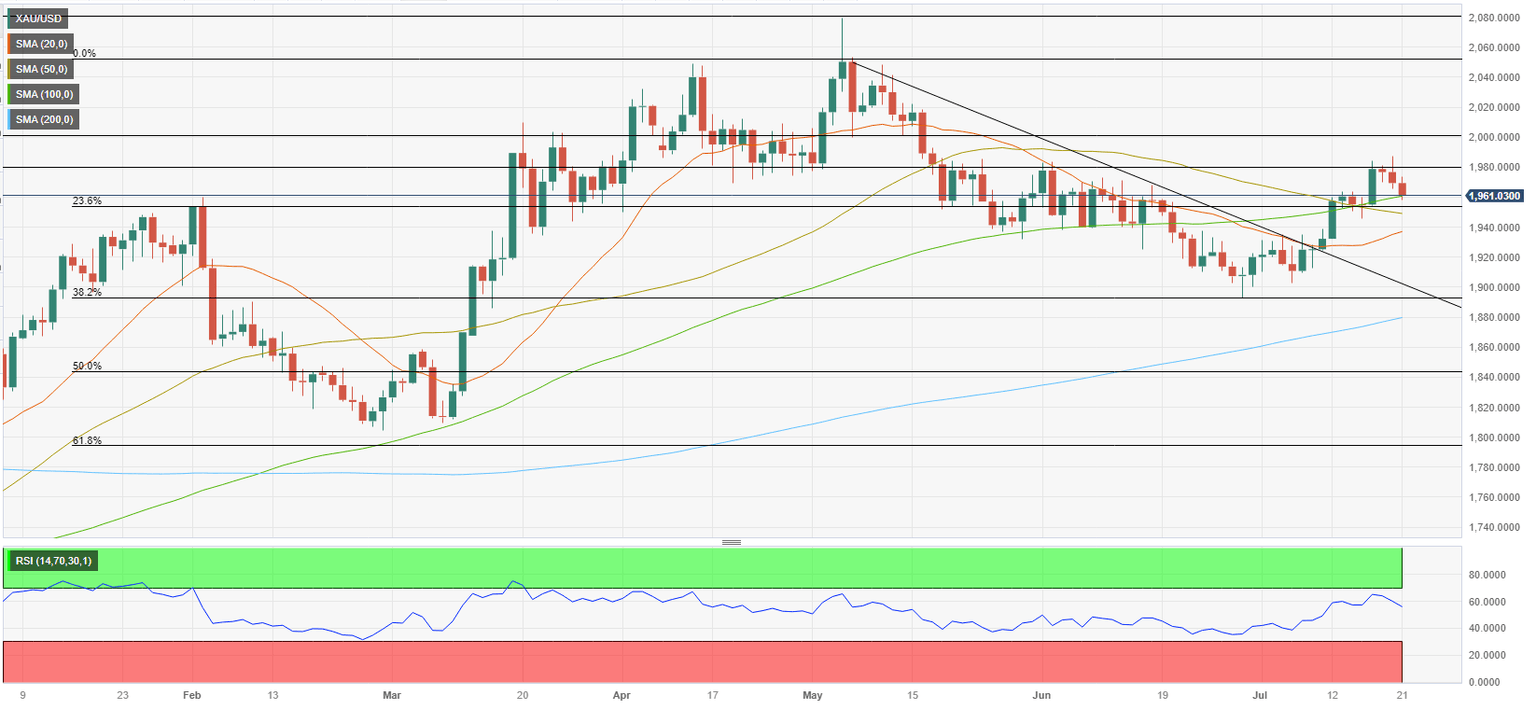

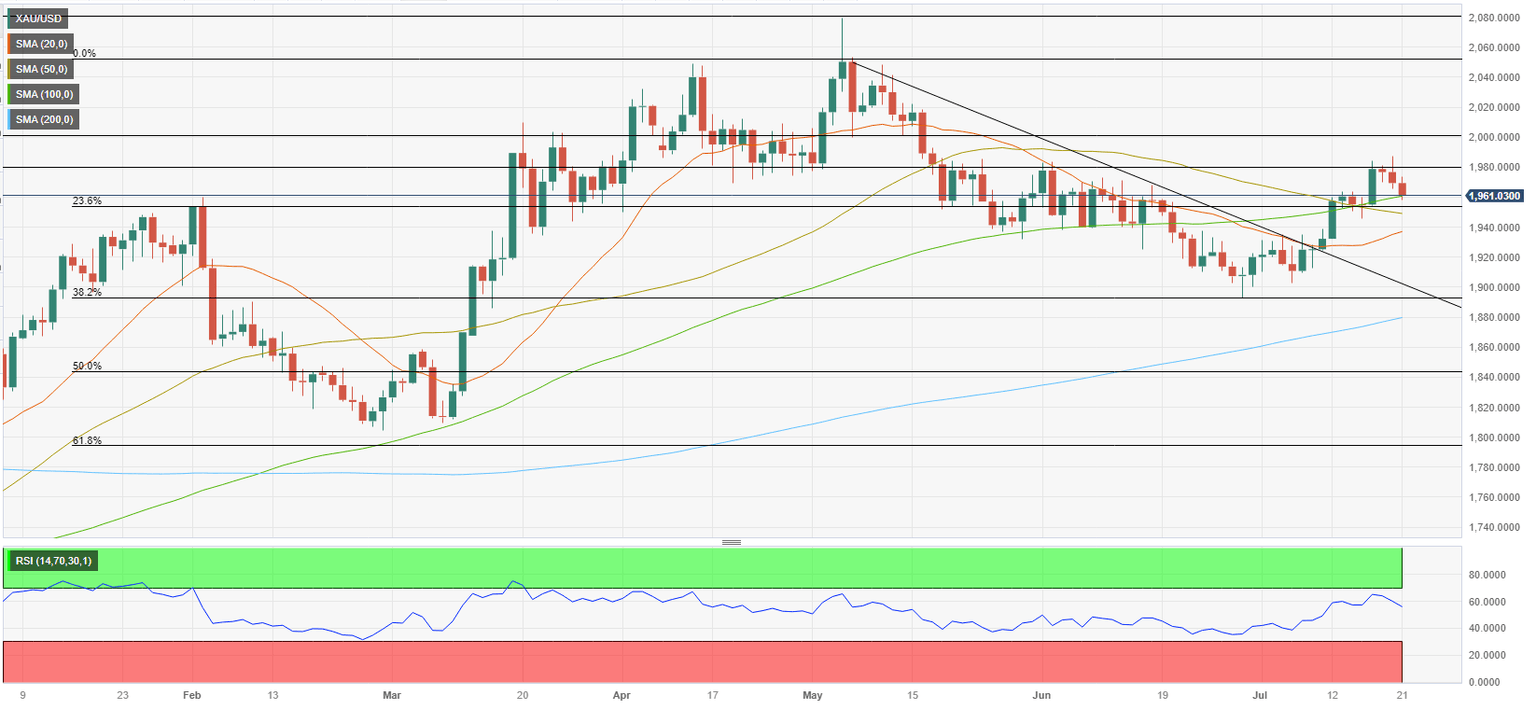

Key technical area for Gold seems to have formed in $1,950-$1,960, where the 100-day Simple Moving Average (SMA), Fibonacci 23.6% retracement of the latest uptrend and the 50-day SMA align. If XAU/USD manages to stabilize above the upper limit of that range and starts using it as support, it could face interim resistance at $1,980 (static level) before targeting $2,000.

A daily close below $1,950 could attract sellers and open the door for a fresh leg lower. In that case, the 20-day SMA aligns as initial support at around $1,935 ahead of $1,910 (static level) and $1,900 (psychological level, Fibonacci 38.2% retracement).

Meanwhile, the Relative Strength Index (RSI) indicator on the daily chart retreated below 50, suggesting that XAU/USD lost its bullish momentum but is yet to signal a reversal.

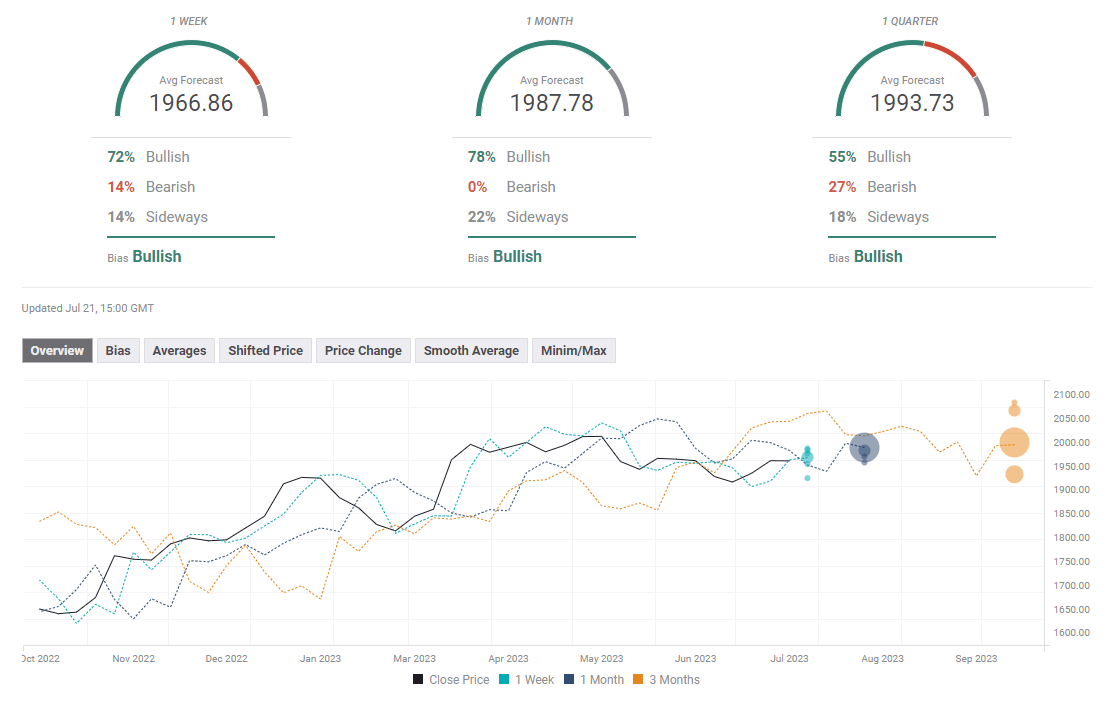

Gold sentiment poll

Gold sentiment poll

FXStreet Forecast Poll shows that a majority of experts expect XAU/USD to continue to push higher in the near term. The one-week and the one-month average targets align at $1,966 and $1,987, respectively.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.