Gold price outlook: Triangle breakouts signal bullish momentum amid US-EU trade tensions

Gold (XAUUSD) is holding firm as global uncertainty intensifies. Investors are reacting to stalled US-EU trade talks and growing political pressure on the Federal Reserve. These issues are shaking confidence in the US Dollar and boosting gold's appeal. At the same time, rising interest in Bitcoin and strong equity markets are challenging gold's momentum. Despite this, both fundamentals and technicals support the metal's long-term strength.

US-EU trade tensions and Fed criticism boost Gold’s safe-haven appeal

Gold continues to attract demand as geopolitical uncertainty grows. The fading chance of a US-EU trade agreement before the August 1 deadline has triggered market anxiety. This has boosted gold's appeal as a hedge against political and economic instability.

Concerns over the Federal Reserve's independence are also adding pressure to financial markets. Comments from Treasury Secretary Scott Bessent and criticism from President Trump have raised doubts about the Fed's autonomy. This undermines confidence in the US Dollar and increases demand for alternative stores of value, such as gold.

However, gold's upward momentum faces resistance. Institutional interest in Bitcoin is increasing, drawing capital away from traditional safe-haven assets. Meanwhile, strong equity markets, especially in the tech sector, continue to attract investors who expect the Fed to cut rates. These competing forces are limiting gold's breakout potential despite ongoing global risks.

Symmetrical triangle breakouts highlight bullish trend in Gold

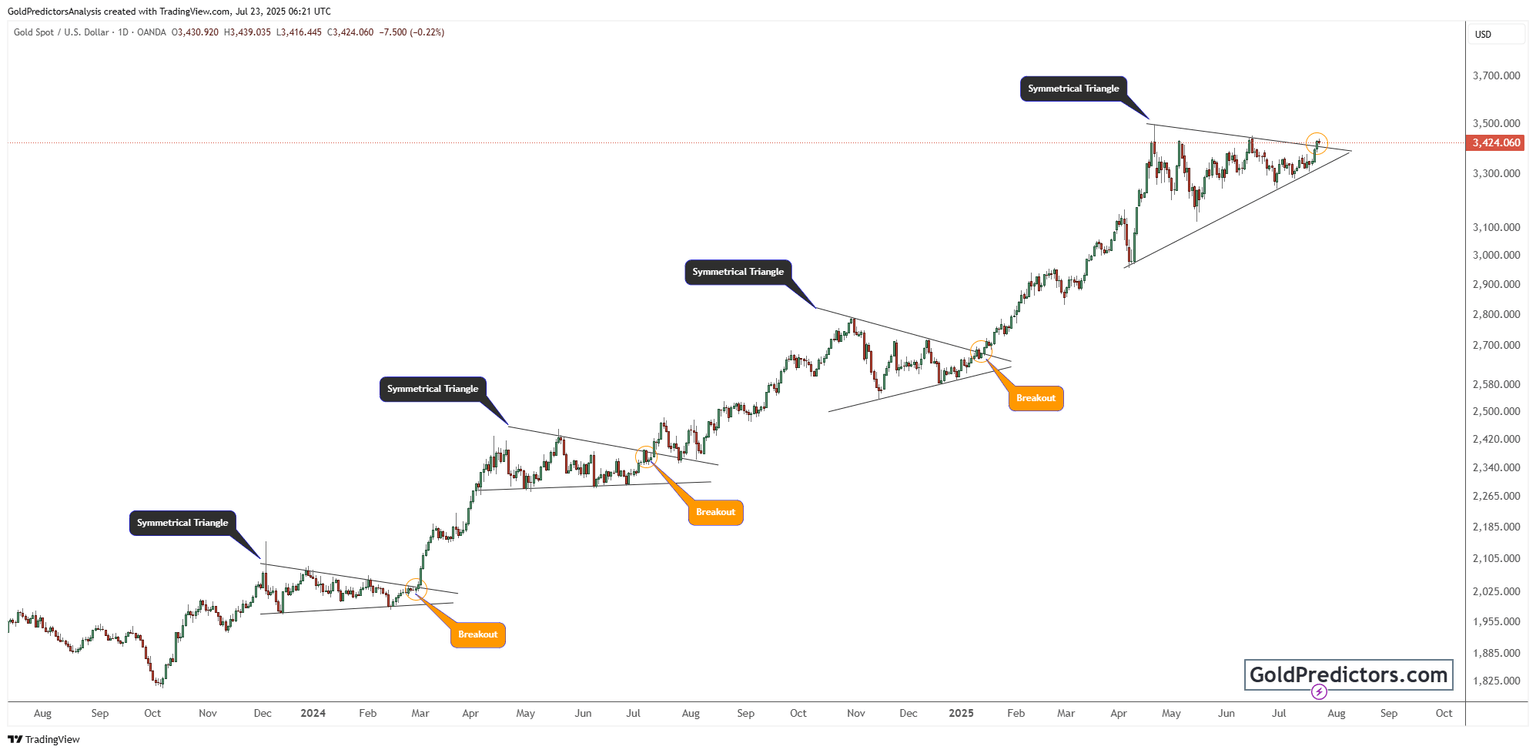

The gold chart below shows a strong bullish outlook supported by a consistent technical setup. The chart highlights a repeated pattern of symmetrical triangles, each followed by a clear breakout. This consistent formation signals a sustained upward trend that has developed over the past year. These triangles represent consolidation phases, where gold prices pause and gather momentum before resuming their upward trend.

Between late 2023 and mid-2025, gold formed multiple key symmetrical triangles. One instance appeared in December 2023 and escalated in February 2024—another triangle formed shortly after, leading to a breakout in mid-April. A similar pattern emerged in June and escalated in early July 2024. Yet another breakout occurred around January 2025, reinforcing the strength and reliability of this technical behavior.

Currently, a new symmetrical triangle is forming as prices consolidate near $3,430. The price action is once again testing resistance, suggesting a possible breakout toward the $3,600–$3,700 range. Each past breakout was confirmed by strong bullish candles, adding weight to the current pattern. While failure to break out could trigger a correction, the technical bias remains firmly bullish.

Conclusion

Gold remains supported by a mix of geopolitical tensions, policy uncertainty, and strong technical signals. Investors continue to view it as a reliable hedge despite competition from Bitcoin and equities. The consistent formation of bullish patterns on the chart strengthens the outlook for further gains. As long as trade risks and Fed concerns persist, gold is likely to stay in demand.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.