Gold Price News and Forecast: Gold prices elevated on trade war and global growth risks

Gold Technical Analysis: XAU/USD enters Asia clinging to three-weeks highs near 1480 level

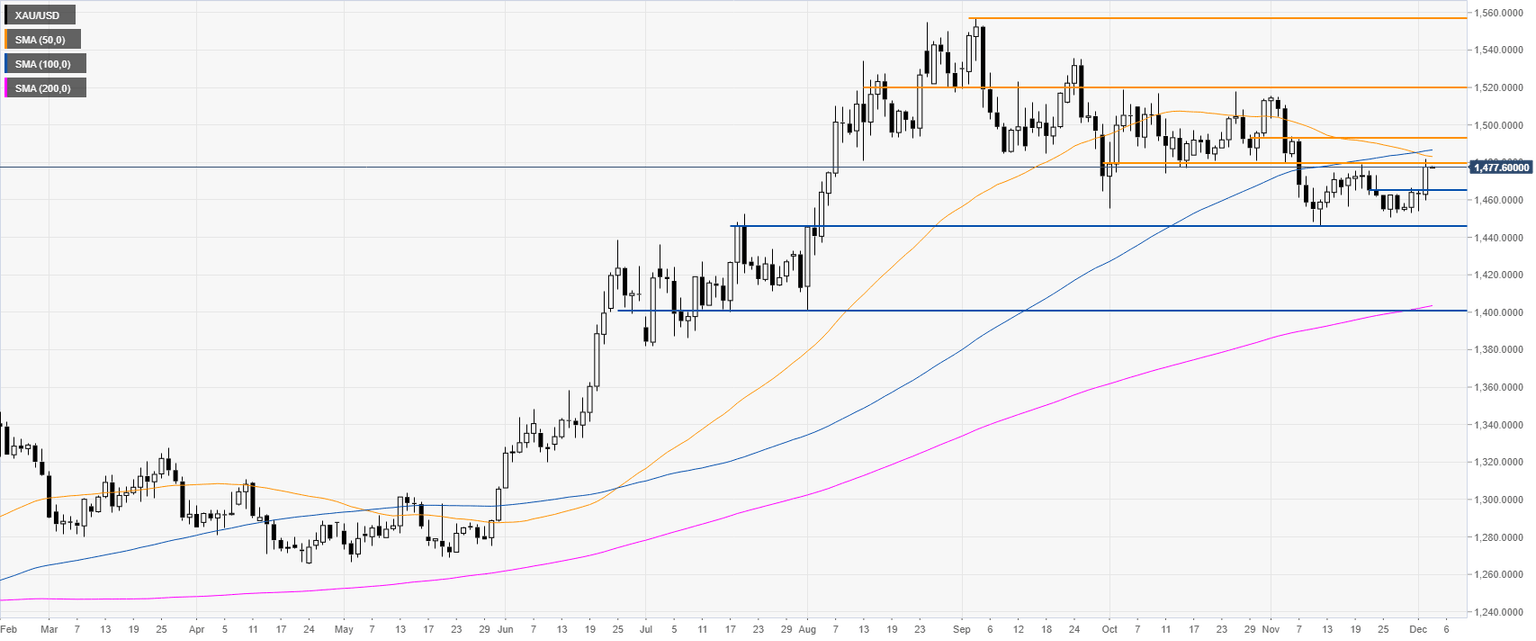

Gold bounced sharply from the November lows while breaking above the 1465 resistance level. The market is trading below the 50 and 100-day simple moving averages (SMAs).

The metal is testing the 1480 resistance and the 200 SMA. A break above this level can send gold up towards 1493 and 1520 if the buyers gather enough momentum. Support is seen at the 1465 level.

Gold prices elevated on trade war and global growth risks

The prices of gold were rising to their best levels in around a month overnight following various headlines over the last few days which leaves the US and Chinese 'phase-one' deal on the brink of collapse, critically and potentially failing to prevent the 15th December fresh tariffs kicking in on Chinese imports. Such an eventuality put trade deals at a serious impasse once again.

Author

FXStreet Team

FXStreet