Gold Price Forecast: XAUUSD downside appears capped ahead of United States Retail Sales

- Gold price pulls back as US Dollar stays afloat with US Treasury bond yields.

- Market stay cautiously optimistic amid geopolitical tensions concerning the Poland missile strike.

- Gold price teases rising wedge breakdown on the 4H chart but bears look unconvinced.

Gold price is extending its pullback from a new three-month high of $1,787, snapping its four-day bullish momentum this Wednesday. Investors digested the latest geopolitical headlines surrounding Poland while awaiting the critical Retail Sales data from the United States slated for release later in the North American session.

US Dollar trades choppy after US President Joe Biden’s missile comments

Gold price is consolidating recent gains amid a choppy price action witnessed by the US Dollar across its major rivals, reacting to the broader market sentiment. Risk flows seem to be returning, weighing on the overnight recovery in the US Dollar. United States President Joe Biden said at an emergency NATO meeting early Wednesday, "based on the trajectory; it is unlikely that the missile is fired from Russia." His comments come after a Russian-made missile landed in Poland and killed two people on Tuesday. In response, Poland's President Andrzej Duda "we do not have any conclusive evidence at the moment as to who launched this missile.” Risk sentiment took a big hit on the renewed geopolitical news, rescuing the US Dollar and capping the rally in Gold price.

However, markets witnessed a sudden positive shift in risk sentiment after comments from United States President Joe Biden helped dial down some tensions surrounding the Poland missile strike. Traders continue to remain cautiously optimistic, as the leaders of the United States, Canada, the European Union, France, Germany, Italy, Japan, the Netherlands, Spain and the United Kingdom said in the common statement, they offer our full support for and assistance with Poland’s ongoing investigation. The US Dollar demand, therefore, remains afloat, affecting the US Dollar-sensitive Gold price.

All eyes turn toward the United States Retail Sales data

With geopolitical tensions playing their part, gold price also remains expectant of the upcoming economic releases from the United States this Wednesday, with the Retail Sales most eagerly awaited after the Producer Price Index (PPI) unexpectedly softened in October. The United States factory gate prices fell to 0.2% MoM and 8.0% YoY in October, further hinting that inflation is easing and bolstering expectations of a 50 basis points (bps) rate hike by the US Federal Reserve (Fed) in December. The PPI data triggered a fresh sell-off in the US Dollar across the board, as the US Treasury bond yields also tumbled amid dovish Federal Reserve bets.

Looking ahead, the US Dollar’s fate will hinge on the Retail Sales data, which is expected to tick higher to 1.0% in October on a monthly basis while excluding Autos, the gauge is seen rising by 0.4% in the reported month. An unexpected decline in the United States Retail volume could reinforce expectations of a smaller Federal Reserve rate increase, which could trigger a fresh US Dollar selling wave while reviving the Gold price upsurge once again. US Federal Reserve Governor Christopher Waller’s speech will be closely scurtinized after his comments over the weekend revived the US Dollar buyers.

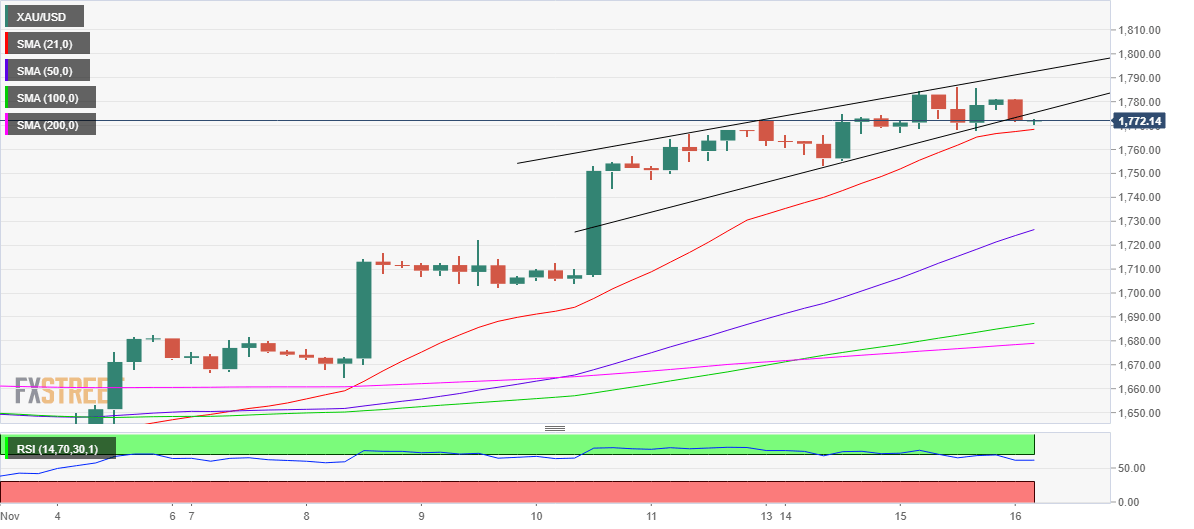

Gold price technical outlook: Four-hour chart

Gold price has breached the rising trendline support at $1,775 on a four-hour time frame. Bears need a four-hourly candlestick close below the latter to confirm a rising wedge breakdown.

Even if the bearish pattern is validated, gold buyers may find immediate support in the rising 21-Simple Moving Average (SMA) at $1,768.

A sustained move below the latter will extend the correction from three-month highs, prompting sellers to target the November 14 low at $1,753.

The Relative Strength Index (RSI) has turned flat but holds comfortably above the midline, suggesting that bulls will likely stay in control, despite the pullbacks.

On the upside, buyers need to rescale the wedge support-turned-resistance at $1,775 to resume the uptrend toward $1,780. The next relevant upside barrier is seen at the multi-week high of $1.787, as bulls prepare to take out the $1,800 threshold.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.