Gold Price Forecast: XAU/USD’s further upside hinges on all-important US inflation

- Gold price consolidates near two-week highs ahead of key US inflation.

- US inflation rate to exceed 7% YoY in January, boost aggressive Fed’s tightening bets.

- Golden cross confirmation eyed on the 1D chart for a fresh leg up in gold price.

Gold continued to accumulate gains on Wednesday, hitting the highest levels in two weeks at $1,836, although it eased a bit to $1,833 at the close. The bullish undertone in gold price was bolstered by the pullback in the US Treasury yields across the curve from over two-year highs, which undermined the dollar’s demand. Investors resorted to profit-taking ahead of the critical US inflation data due to be reported on Thursday. Additionally, investors remained worried over the impact of soaring inflation on economic growth while the Russia-Ukraine geopolitical risks also helped bolster gold’s safe-haven appeal. The extended rebound on Wall Street further added to the dollar’s misery, boding well for the bright metal.

Heading into the US inflation showdown, gold price has taken a breather after the recent upsurge, preserving most of Wednesday’s gains. The US dollar is attempting a bounce, as investors turn cautious ahead of the critical US data, which will provide clarity on the extent of the Fed’s tightening this year. The US annualized Consumer Price Index (CPI) is seen higher at 7.3% In January vs. 7.0% booked previously. A 40-year high inflation rate in America will likely compel the Fed to deliver aggressive and faster rate increases. Traders also digest the recent Fedspeak from Cleveland President Loretta Mester and her Atlanta counterpart Raphael Bostic, who said that all options are on the table for the size of policy makers’ first interest-rate increase in March. Meanwhile, the geopolitical developments around the Ukrainian border will be followed closed as well.

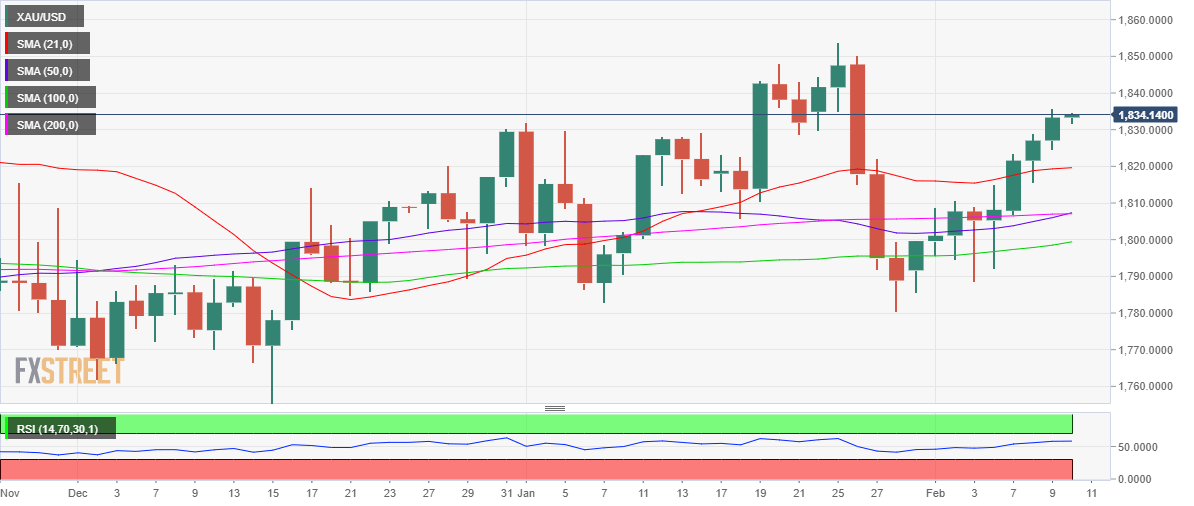

Gold Price Chart - Technical outlook

Gold: Daily chart

Gold price is gathering pace for the next leg higher, currently sitting close to two-week highs.

The 50-Daily Moving Average (DMA) pierced through the 200-DMA from below, indicating a Golden cross formation. Gold bulls, however, await a daily closing to validate the Golden cross.

The 14-day Relative Strength Index (RSI) is trading firmer above the midline, adding credence to the bullish view.

Therefore, a fresh upswing towards the $1,840 round figure could be in the offing on successful clearance of Wednesday’s high.

Further up, a test of the $1,850 psychological level remains in play.

However, a big beat on the US CPI reading could trigger a pullback in gold price towards the previous day’s low of $1,825, below which the 21-DMA at $1,820 will be challenged.

A sharp drop towards the 50- and 200-DMAs crossover around $1,807 will be witnessed if the selling pressure intensifies.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.