Gold Price Forecast: XAU/USD stable at around $3,230

XAU/USD Current price: $3,232.75

- Moody downgraded the US’s government’s credit rating, hitting the US Dollar.

- The Reserve Bank of Australia is likely to cut interest rates early on Tuesday.

- XAU/USD retreated from near $3,250, holding on to modest intraday gains.

Gold price is up on Monday, with the bright metal peaking at $3,249.84 during Asian trading hours amid broad US Dollar (USD) weakness. The Greenback fell throughout the first half of the day amid discouraging United States (US) news. Moody's downgraded the US government's credit rating from Aaa to Aa1 due to concerns about the country´s growing debt.

Asian shares tumbled, further weighed by mixed Chinese data. April Retail Sales were up 5.1% YoY in April, missing expectations, while Industrial Production in the same period was up 6.1%, better than the 5.5% anticipated, although below the previous 7.7%

The USD found some near-term demand after Wall Street’s opening, as US indexes partially shrugged off the downbeat mood and trade mixed. As a result, the XAU/USD pair retreated towards the current $3,230 price zone.

Several US Federal Reserve (Fed) speakers hit the wires at the beginning of the week, but their remarks failed to impress, holding on to their cautiously optimistic stance, still concerned about the impact of tariffs on inflation.

The Reserve Bank of Australia (RBA) will announce its decision on monetary policy in the upcoming Asian session. The RBA is widely anticipated to cut the Official Cash Rate (OCR) by 25 basis points (bps) to 3.85% from the current 4.1%.

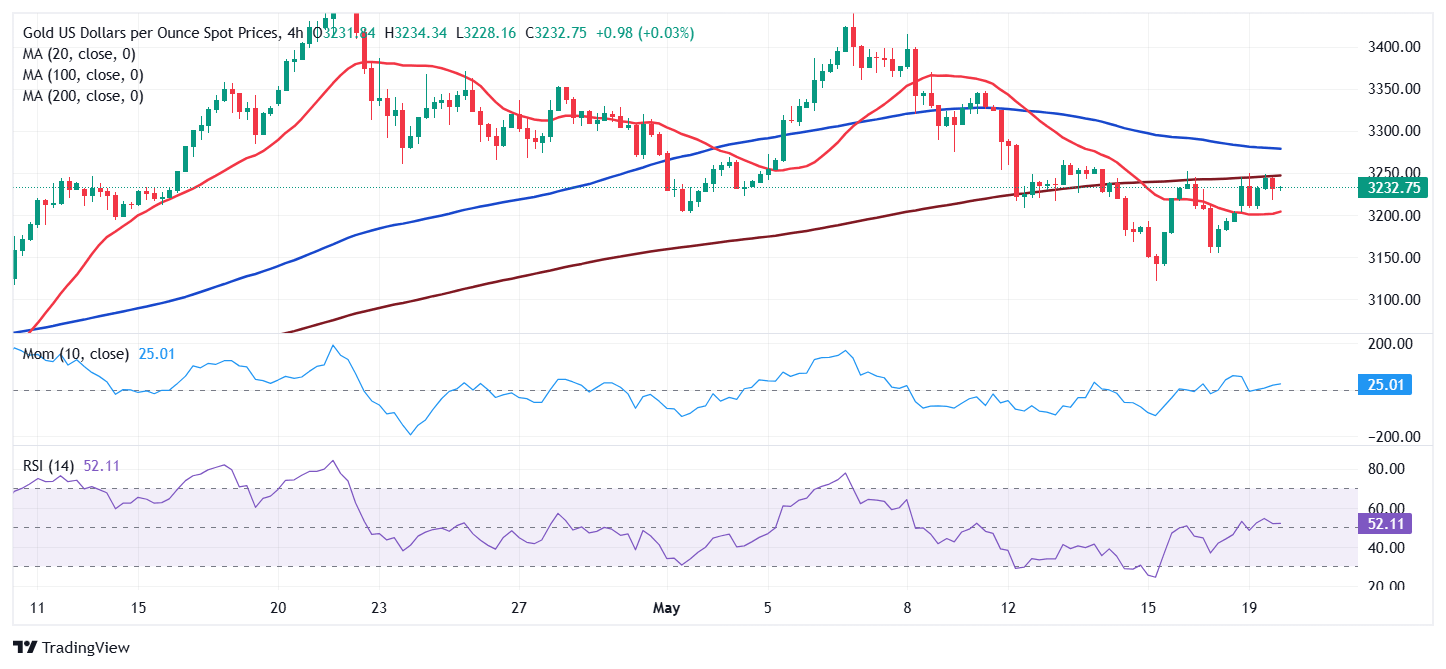

XAU/USD short-term technical outlook

The daily chart for the XAU/USD pair shows it trades at the upper end of Friday’s range, with little bullish impulse. Technical indicators turned marginally higher, but remain within negative levels, while a bearish 20 Simple Moving Average (SMA) stands well above the current level, providing resistance at around $3,293. The 100 and 200 SMAs keep advancing far below the current level, suggesting sellers are out of the picture at the time being.

In the near term, and according to the 4-hour chart, XAU/USD is neutral. The pair trades between directionless moving averages, with a flat 20 SMA providing intraday support at $3,204.70. At the same time, the Momentum indicator turned lower while holding above its 100 level, while the Relative Strength Index (RSI) indicator heads nowhere at around 51.

Support levels: 3,215.90 3,204.70 3,187.10

Resistance levels: 3,250.00 3,265.80 3,288.70

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.