Gold Price Forecast: XAU/USD runs into key $3,350 resistance zone ahead of US PMI data

- Gold’s comeback from three-week lows falters once again near $3,350 early Thursday.

- US Dollar consolidates the latest upswing amid threat to Fed’s independence, ahead of US PMI data.

- Gold remains stuck in a familiar range, lacks a clear directional bias as Powell’s speech at Jackson Hole looms.

Gold is reversing a part of the previous rebound from three-week lows of $3,311 in Thursday’s Asian session, awaiting the preliminary S&P Global US Manufacturing and Services PMIs for the next directional impetus.

Friday’s speech by US Federal Reserve (Fed) Chair Jerome Powell at the Jackson Hole Economic Symposium also remains in the spotlight.

Gold pops and drops, with eyes on US PMIs

Gold remains at the mercy of the US Dollar (USD) dynamics, retreating from a three-day high slightly above $3,350, as of writing, as the USD clings to recovery gains seen earlier in the session.

The Minutes of the Fed’s July meeting seem to have come to the rescue of the Greenback, as it showed late Wednesday that only two policymakers supported an interest rate cut last month.

However, the support could be temporary for the Greenback as the policy meeting was before the July jobs and Consumer Price Index (CPI) data publication, and, since these releases, markets have almost sealed in two interest rate cuts by the Fed this year.

Therefore, the focus shifts to the preliminary US business activity data for August, due later in the day, to gauge the health of the economy, which could significantly impact the markets’ pricing of Fed rate cuts.

On Wednesday, the US Dollar witnessed a steep sell-off as concerns over the Fed’s independence resurfaced after US President Donald Trump called on Federal Reserve Governor Lisa Cook to resign.

People within the Trump administration accused her of violating financial regulations around mortgage filings. In response, Cook said that she “has no intention of being pressured to step down, adding that she will fight allegations by the Trump team.

Fed concerns-led USD downfall helped Gold stage a turnaround from three-week troughs.

Looking ahead, the US preliminary PMI data will likely set the tone for the USD markets heading into Powell’s Jackson Hole speech on Friday.

Markets believe that Fed Chair Powell would push back against bets of aggressive interest rate cuts, after having maintained a cautious stance on policy, in the face of the potential impact of Trump’s tariffs on inflation.

A bout of profit-taking in Gold cannot be ruled out as traders resort to repositioning ahead of the highly anticipated Powell’s appearance.

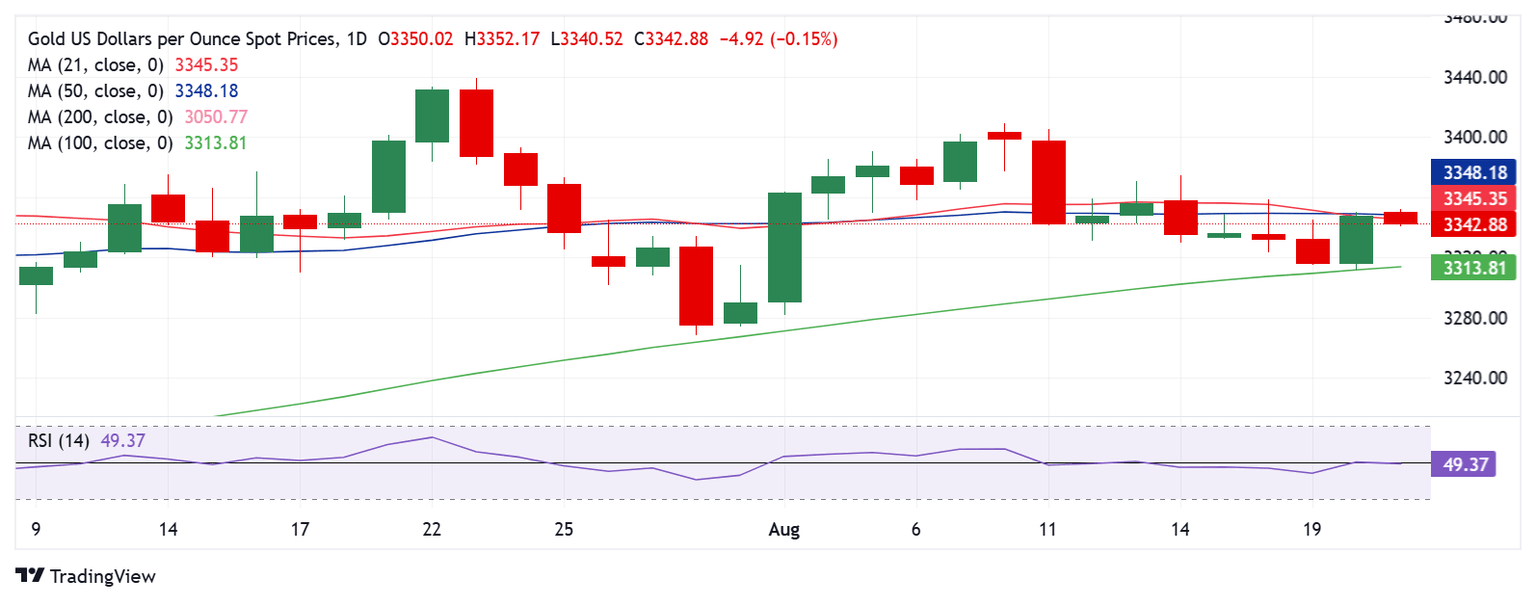

Gold price technical analysis: Daily chart

The daily chart indicates a lack of clear directional bias for Gold, at the moment, as the 14-day Relative Strength Index (RSI) hangs close to the 50 level.

However, with a Bear Cross in play, the extension of the latest pullback cannot be ruled out.

The 21-day Simple Moving Average (SMA) closed below the 50-day SMA on Tuesday, confirming a Bear Cross.

Sellers need to find a strong foothold below the 100-day SMA at $3,314 for a sustained downtrend.

Further south, the July 31 low of $3,274, below which the July 30 low of $3,268 will be tested en route to the $3,250 psychological barrier.

On the flip side, Gold buyers need to take out the strong resistance near $3,350, the confluence zone of the 21-day SMA and the 50-day SMA, to negate any near-term bearish bias.

The next bullish targets are seen at the previous week’s high of $3,375 and the $3,400 round level.

Economic Indicator

S&P Global Manufacturing PMI

The S&P Global Manufacturing Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US manufacturing sector. The data is derived from surveys of senior executives at private-sector companies from the manufacturing sector. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity in the manufacturing sector is generally declining, which is seen as bearish for USD.

Read more.Next release: Thu Aug 21, 2025 13:45 (Prel)

Frequency: Monthly

Consensus: 49.5

Previous: 49.8

Source: S&P Global

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.