Gold Price Forecast: XAU/USD retains the $2,900 level amid risk aversion

XAU/USD Current price: $2,909.49

- US President Donald Trump’s trade war spurred global concens, stocks sell-off.

- Resurgent demand for safety sent Gold prices to fresh one-week highs.

- XAU/USD retreats from fresh weekly highs, retains its positive bias.

Spot Gold reconquered the $2,900 threshold early on Tuesday, following United States (US) President Donald Trump’s tariffs announcement. Levies on Canada and Mexico of 25% came into effect alongside an additional 10% on imports coming from China.

Canada responded with reciprocal tariffs, China with 15% levies on agricultural products, while Mexico announced tariffs and non-tariffs counter-measures will come next Sunday. As a result, risk aversion fueled demand for the bright metal and sent the US Dollar (USD) into a selling spiral throughout the first half of the day, as markets fear the unleashed trade war would affect US economic growth and boost inflationary pressures.

The USD recovered some ground after Wall Street’s opening, finally finding near-term demand of panic. US indexes, in the meantime, followed their overseas counterparts and are in sell-off mode, with the three major indexes down roughly 2% each.

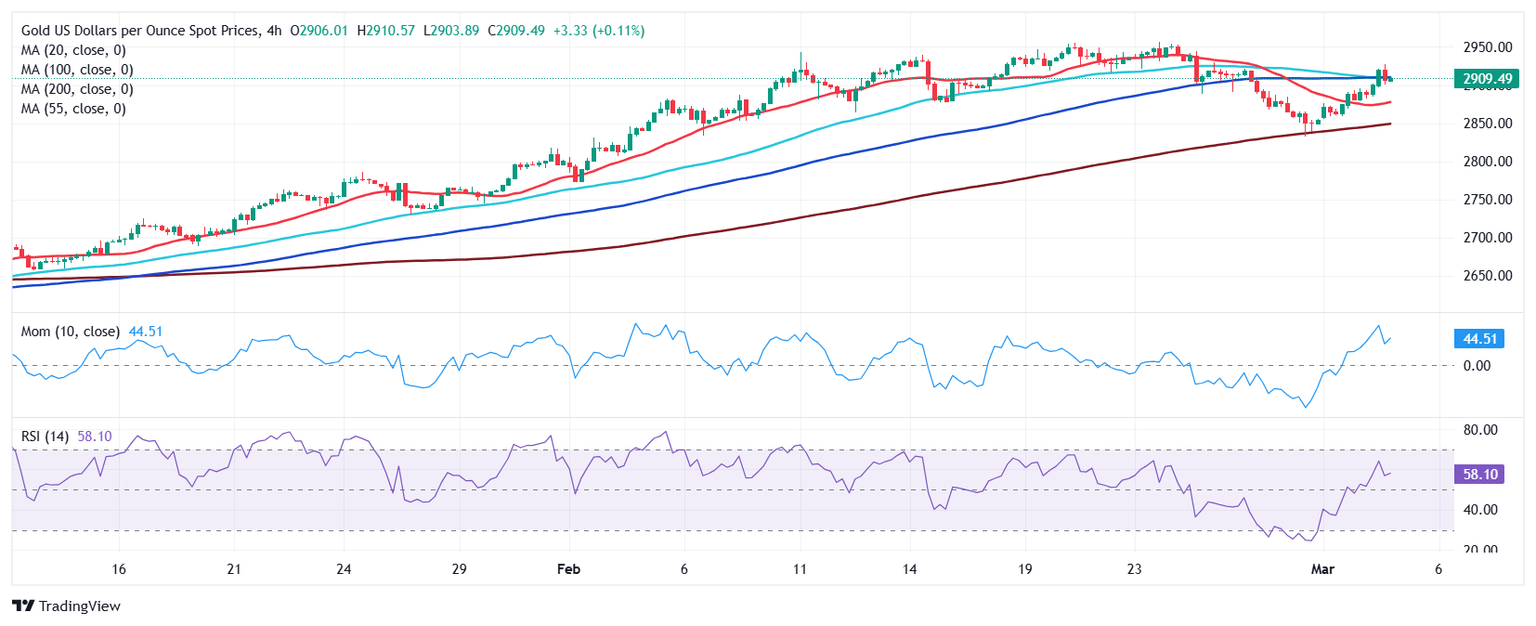

XAU/USD short-term technical outlook

XAU/USD, in the meantime, retains the $2,900 mark but retreated from an intraday peak of $2,927.91. The daily chart shows the pair is up for a second consecutive day, with another leg north still in doubt. XAU/USD is currently battling to overcome a mildly bullish 20 Simple Moving Average (SMA) while the 100 and 200 SMAs recovered their upward slopes far below the current level. Technical indicators, in the meantime, advance with moderated strength and within neutral levels, not enough to confirm a higher high.

The near-term picture shows Gold corrected overbought conditions. In the 4-hour chart, XAU/USD hovers around a flat 100 SMA while developing far above bullish 20 and 200 SMAs. Technical indicators, in the meantime, retreated from their early peaks, maintaining their downward slopes, although well above their midlines.

Support levels: 2,894.25 2,876.90 2,858.70

Resistance levels: 2,927.90 2,941.40 2,956.10

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.