Gold Price Forecast: XAU/USD re-attempts $3,400; US trade talks in focus

- Gold price challenges $3,400 again as US trade talks grab attention.

- The US Dollar returns to the red after the Fed raises concerns over economic uncertainty.

- Gold price yearns for acceptance above $3,435 for a sustained upside.

The gold price is back on the bids early Thursday, challenging the $3,400 mark amid renewed weakness in the US dollar and a revival of safe-haven demand.

Gold price looks north amid trade and geopolitical risks

Markets remain broadly upbeat due to China’s cut in the Reverse Repo Rate and in anticipation of US President Donald Trump’s expected announcement of a major trade deal. The Wall Street Journal (WSJ) and the New York Times cited that Trump is likely to announce a framework of a trade deal with the UK later in the American morning on Thursday.

However, the optimism fails to lift the sentiment around the US Dollar (USD) as the US Federal Reserve (Fed) voiced its concerns over the heightened economic uncertainties in the face of Trump’s erratic trade policies.

The Fed kept the federal funds rate unchanged in the range of 4.25% to 4.50% on Wednesday, maintaining a cautious stance on the policy outlook. The Fed’s policy statement read that risks of higher inflation and unemployment had risen, further clouding the US economic outlook.

During the press conference, Fed Chairman Jerome Powell stated that “it isn't clear whether the economy will continue its steady growth or wilt under mounting uncertainty and a possible spike in inflation,” according to Reuters.

Further, Gold price continues to derive support from safe-haven inflows, courtesy of the ongoing geopolitical tensions in the Middle East and between Russia and Ukraine. Ukraine's air force reported that Russian aircraft had launched guided bombs on the Sumy region of northern Ukraine in the early hours of Thursday morning. This occurred just a few hours after a three-day ceasefire declared by Russian President Vladimir Putin took effect.

Meanwhile, Oman said on Wednesday that it brokered a truce between Washington and Houthis, saying neither side will target the other. However, Houthi leaders have insisted on social media that they have no intention of ceasing their attacks.

In the Asian sub-continent, Pakistani Prime Minister Shehbaz Sharif vowed response after the Indian armed forces early Wednesday carried out missile attacks on nine terror targets in Pakistan and Pakistan-Occupied Kashmir (PoK), Heavy exchanges of artillery fire have been reported along the Line of Control (LoC) dividing Indian- and PoK, according several media outlets.

Amidst heightened trade uncertainties and geopolitical risks, Gold price is likely to remain the go-to safety net for investors. They keenly await the US-Sino trade talks from May 9 to May 12 in Geneva, especially after US President Trump said Wednesday that there is no potential for pulling back 145% tariffs on China.

Any retracement in Gold price due to optimism over potential US trade deals will remain a good dip-buying opportunity as policymakers globally grapple with the impact of Trump's tariffs. The daily technical setup also remains favourable for Gold buyers in the near term.

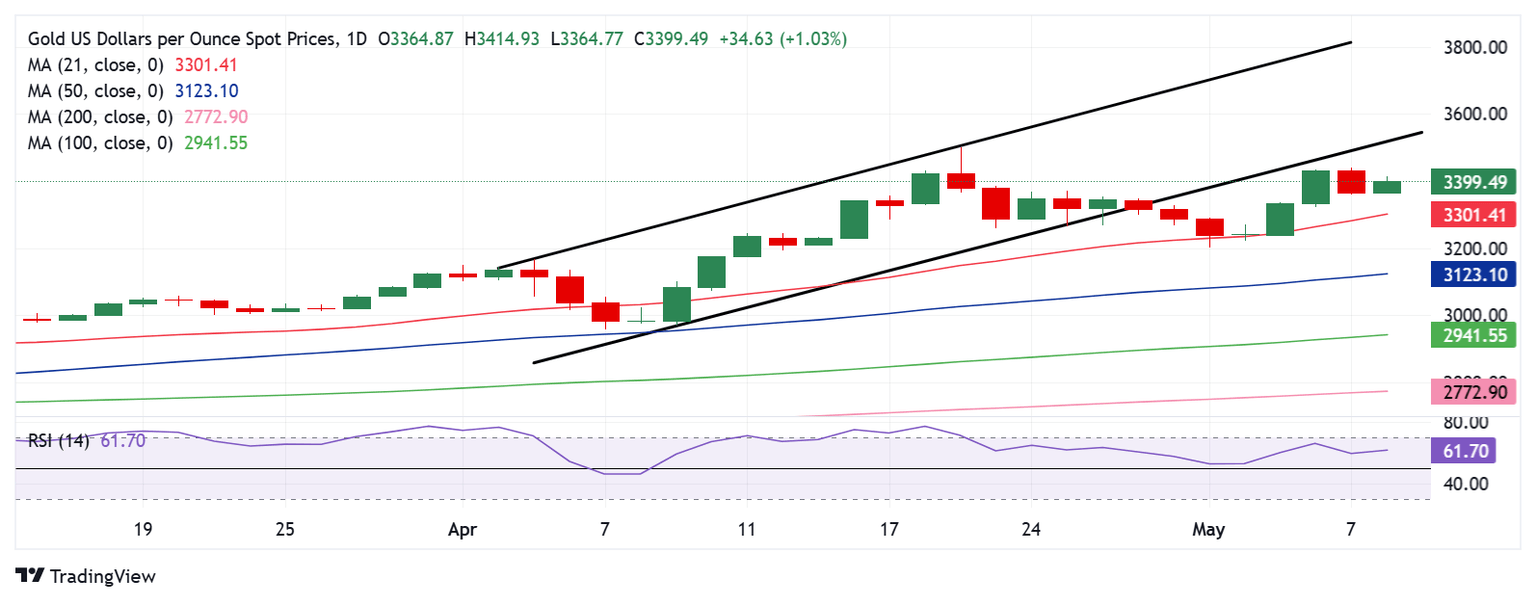

Gold price technical analysis: Daily chart

Gold price is poised to retake the channel support (now resistance) after finding buyers once again near $3,360.

The 14-day Relative Strength Index (RSI) appears bullish, as it remains above the midline near 62, suggesting that further upside remains in the offing.

Gold price must establish a firm foothold above the two-week high of $3,435 for a sustained upside momentum. The next topside target is at the record high of $3,500.

Further up, the channel support (now resistance) at $3,525 will be on buyers’ radars.

On the downside, the $3,360 is the initial support line, below which the 21-day Simple Moving Average (SMA) at $3,301 will be tested. Deeper declines will challenge the May 2 low of $3,223.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.