Gold Price Forecast: XAU/USD likely to extend range play near $1,800 ahead of FOMC

- Gold recorded the first weekly loss in the previous five but showed resilience near the $1,790 area.

- COVID-19 jitters took its toll on the global risk sentiment and benefitted the safe-haven commodity.

- The focus will remain glued to the upcoming FOMC monetary policy meeting, starting this Tuesday.

Gold dropped to over two-week lows, around the $1,790 region on Friday, albeit showed some resilience at lower levels and finally settled with modest losses. The US dollar built on the previous day's goodish rebound from weekly lows and was supported by rising US Treasury bond yields. This, in turn, was seen as a key factor that undermined demand for the dollar-denominated commodity. Apart from this, a generally positive tone in the equity markets further acted as a headwind for the safe-haven precious metal.

Despite the negative factors, the downtick lacked any strong follow-through selling and the yellow metal managed to defend the $1,800 mark on the daily closing basis. Investors remain concerned that the fast-spreading Delta variant of the coronavirus could derail the global economic recovery. This, in turn, led to a turnaround in the global risk sentiment, which, along with retreating US bond yields, assisted the non-yielding yellow metal to regain some positive traction on the first day of a new trading week.

Moving ahead, the spotlight this week will remain on the FOMC monetary policy meeting, starting Tuesday. The US central bank is more likely to signal that it is in no rush to taper its asset purchases or hike interest rates anytime soon. Nevertheless, the outcome will play a key role in influencing the USD price dynamics and help investors to determine the next leg of a directional move for the XAU/USD. In the meantime, developments surrounding the coronavirus saga will be looked upon for some trading impetus.

Short-term technical outlook

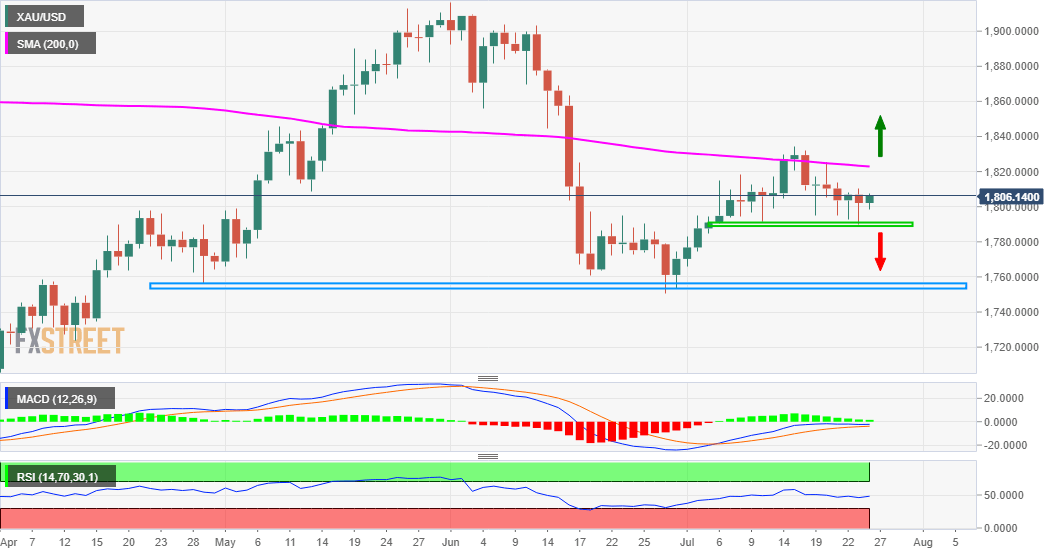

From a technical perspective, the emergence of some dip-buying reinforced strong support near the $1,790 level, which should now act as a key pivotal point for short-term traders. A convincing break below will be seen as a fresh trigger for bearish traders and prompt some aggressive technical selling. The next relevant support is pegged near the $1,765-60 region ahead of monthly swing lows, around the $1.750 region.

On the flip side, any subsequent positive move is likely to confront stiff resistance near the very important 200-day SMA, currently around the $1,823 area. A sustained move beyond will mark a near-term bullish breakout and set the stage for additional gains. The XAU/USD might then accelerate the positive move towards the $1,845-46 region, en-route the next major hurdle near the $$1,866 area. Some follow-through buying has the potential to lift the commodity further and allow bulls to eventually aim to reclaim the $1,900 round-figure mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.