Gold Price Forecast: XAU/USD keeps bullish bias intact ahead of the US NFP test

- Gold price bounces but remains in a familiar range on NFP Friday.

- The US Dollar finds demand amid US-China optimism, Trump-Musk feud.

- Gold price needs to scale key daily resistance at $3,377 to resume the uptrend.

- A weak May US jobs report could revive the Gold price record rally.

Gold price is reversing a part of the previous sell-off and defends $3,350 early Friday as traders reposition ahead of the all-important US Nonfarm Payrolls (NFP) data release.

Gold price at the mercy of US NFP and trade headlines

Despite staging a minor rebound, Gold price remains in a familiar range seen so far this week as all eyes remain on the critical US labor market report on Friday for a fresh directional impetus.

Trade optimism continues to keep the US Dollar (USD) afloat even as the recent slew of US economic data disappointed and revived dovish Federal Reserve (Fed) expectations. This resurgence in the USD demand limits any upside attempts in Gold price.

Hopes of a sustained US-China trade deal rekindled after US President Donald Trump said on Truth Social on Thursday that he had a "very good phone call" with Chinese President Xi Jinping, during which they discussed the intricacies of the trade deal.

Additionally, the ongoing spat over the spending bill between Trump and Space X founder Elon Musk took an ugly turn on Thursday, fuelling a big sell-off in Tesla shares.

Musk said Trump was in the Epstein files and should be impeached. Trump responded by saying that he was taking away Elon's subsidies, knocking off Tesla nearly 15% on the day.

This negatively impact risk sentiment and revived the USD’s appeal as a safe-haven currency.

At the moment, the US Dollar is drawing support from profit-taking as traders cash in on their USD shorts heading into the US NFP test.

The Greenback holds its recovery following a steep decline, triggered by the European Central Bank’s (ECB) hawkish policy signal, which sent the EUR/USD pair sharply higher, smashing the USD alongside.

Will a weak US NFP report boost Gold price?

The Nonfarm Payrolls (NFP) data is expected to show the US economy added 130K jobs in May. The April NFP data beat estimates with 177K job creation.

A reading below 100K level could cast doubts on the health of the US labor market, which will likely bring forward bets for a July Fed rate cut, boosting the non-yielding Gold price at the expense of the US Dollar.

If the data surprises with a reading above 200K, Gold price could come under strong bearish pressures. Strong US employment data would justify the Fed’s prudence on interest rates, lending support to the Greenback.

At the moment, the CME Group’s FedWatch Tool shows a 54% chance of the Fed lowering rates by 25 basis points (bps) in September.

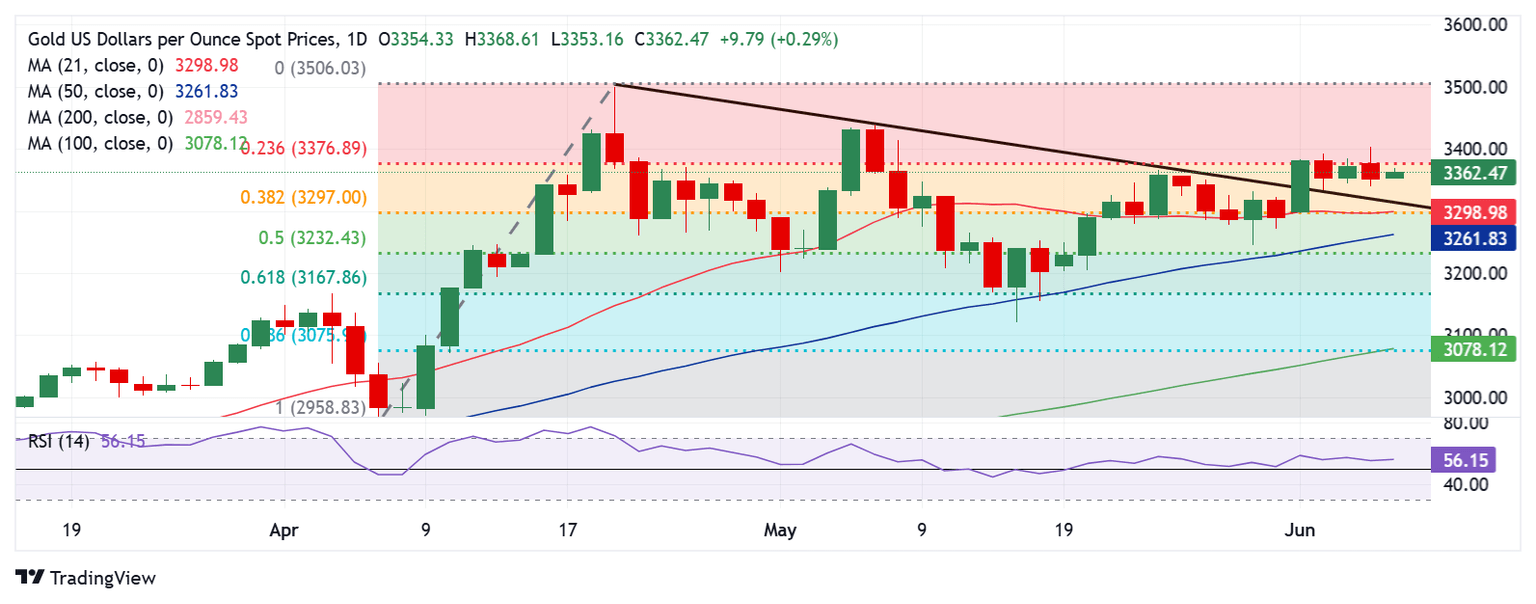

Gold price technical analysis: Daily chart

Nothing changes for Gold price, technically, as the bullish outlook remains intact.

Buyers continue to hold above the confluence of the 21-day Simple Moving Average (SMA) and the 38.2% Fibonacci Retracement (Fibo) level of the April record rally at $3,297.

Meanwhile, the 14-day Relative Strength Index (RSI) is holding well above the midline, adding credence to the bullish potential.

Gold buyers must yield a daily/ weekly closing above the 23.6% Fibo resistance at $3,377 to resume the recent uptrend toward the lifetime highs of $3,500.

Ahead of that, the May high of $3,439 must be taken out.

Alternatively, sellers could attempt control on a break below the falling trendline resistance-turned-support, now at $3,318.

The next powerful support is seen at the abovementioned confluence of $3,297.

Additional declines will challenge the 50-day SMA at $3,262, below which the last line of defense for buyers is aligned at $3,232, the 50% Fibo level of the same ascent.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Jun 06, 2025 12:30

Frequency: Monthly

Consensus: 130K

Previous: 177K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.