Gold Price Forecast: XAU/USD gains bearish traction below $2,000

XAU/USD Current price: $1,990.15

- Mixed United States data weighed on the market mood.

- Market players await clues about US debt ceiling talks.

- XAU/USD plunged below $2,000 and points to extend its slide.

Spot Gold is down on Tuesday, piercing the $2,000 threshold during the American afternoon. Market players resumed buying the US Dollar after Wall Street’s opening and following a string of United States (US) data.

US Retail Sales increased in April, although by less than anticipated. The figure reflected some strength in consumer spending categories, printing a modest 0.4% monthly advance and reverting previous losses. Additionally, April Capacity Utilization increased by 79.7%, as expected, while Industrial Production in the same month rose 0.5%, better than anticipated. Finally, the NAHB Housing Market Index printed at 50 in May, improving from the previous 45.

The data dampened the mood, with US indexes trading in the red after a positive start to the day. European indexes changed direction before the close and finished the session with modest losses. Meanwhile, government bond yields jumped. The 10-year Treasury note currently yields 3.56%, up 5 basis points (bps), while the 2-year note offers 4.10% raising 10 bps on the day.

Further weighing on sentiment, market players await clues from debt-ceiling negotiations. President Joe Biden and lawmakers will meet in a few hours to try to reach an arrangement to extend it and avoid a default.

XAU/USD price short-term technical outlook

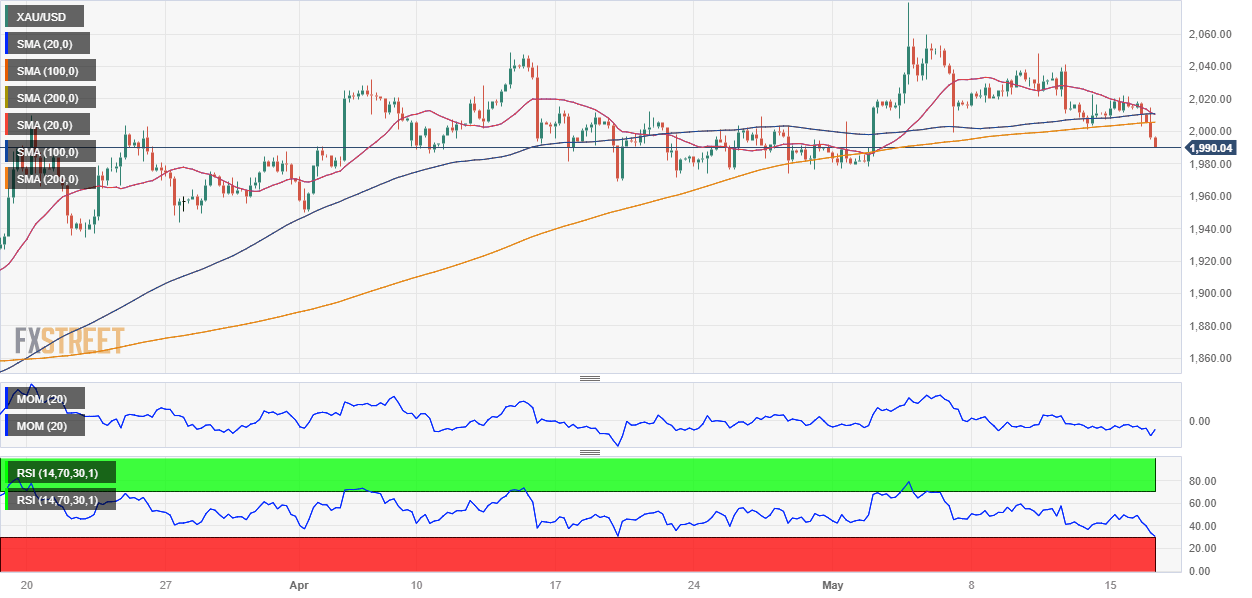

XAU/USD accelerated its slide once below the $2,000 level and currently trades in the $1,991 region, at its lowest in two weeks. The daily chart shows that the bright metal sunk below a directionless 20 Simple Moving Average (SMA), while the longer ones maintain their bullish slopes far below it. At the same time, technical indicators turned lower and are currently piercing their midlines, anticipating additional declines in the upcoming sessions.

The near-term picture is bearish. The 4-hour chart shows that the pair develops well below all its moving averages, with the 20 SMA gaining downward traction above the longer ones. Meanwhile, technical indicators head firmly south within negative levels, with the Relative Strength Index (RSI) indicator entering oversold territory without signs of bearish exhaustion.

Support levels: 1,987.45 1,969.20 1,956.70

Resistance levels: 1,989,75 2,008.40 2,029.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.