Gold Price Forecast: XAU/USD eyes $1840, overbought conditions, NFP could play spoilsports

- Gold holds onto recent advance above $1800, 3-month tops.

- Eyes $1840 after the technical breakout on the 4H chart.

- Overbought RSI conditions caution bulls ahead of the key NFP data.

Gold (XAU/USD) put up a solid show and outperformed on Thursday, rising over 1% to hit the highest levels in three months at $1818. The price of gold finally raced past the $1800 psychological level, thanks to the persistent weakness in the US dollar and the Treasury yields on dovish Fed expectations. Despite rising inflation expectations, the Fed is likely to remain committed to its accommodative policy stance until a ‘substantial progress’ is witnessed in the labor market. The recent Fedspeak also pushed back tapering bets, lifting stocks and gold at the dollar’s expense. Gold bulls ignored upbeat US Initial Jobless and signs of strengthening economic recovery, as prospects of higher inflation continue to underpin the inflation-hedge, gold.

The price of gold is extending the recent upsurge, sitting at a new 11-month top at $1822, as the bulls take a breather, in anticipation of the all-important US NFP report. The US economy is seen adding 978K jobs in April vs. 916K reported previously. A big NFP blowout is needed to revive the Fed’s tapering talks, which could likely trigger a sharp correction in gold. However, disappointing figures would back the central bank’s dovish approach, fuelling further upside in gold. In the meantime, the broader market sentiment and the greenback’s price action will be closely followed.

Gold Price Chart - Technical outlook

Gold: Four-hourly chart

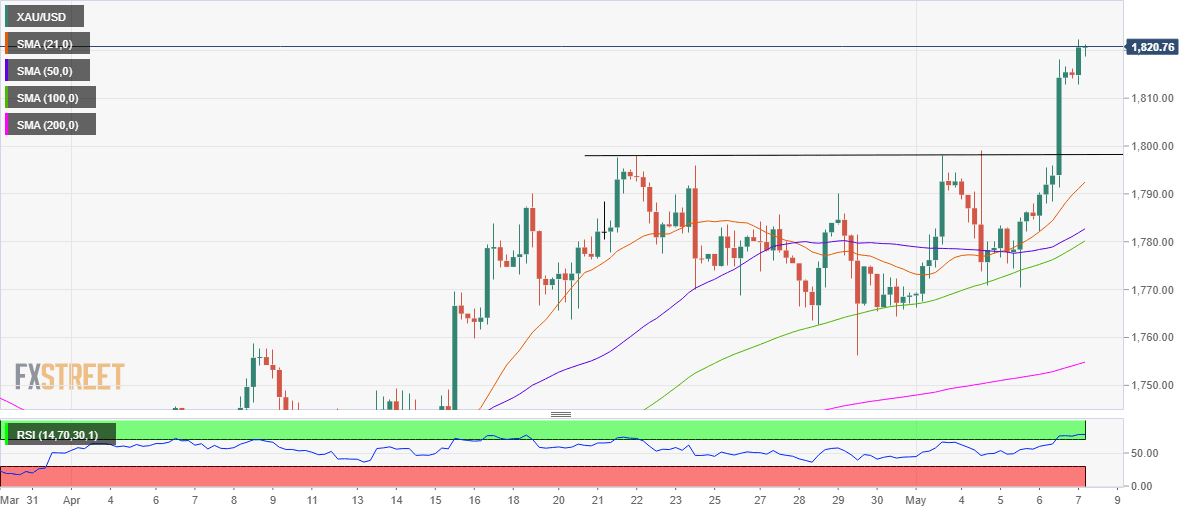

Gold’s four-hourly chart shows that the price extended the upside break from the rounding bottom formation.

The next barrier awaits at the $1830 round figure, above which the pattern target measured at $1840 could be tested.

However, with the Relative Strength Index (RSI) holding in the overbought region, a pullback towards Thursday’s close of $1815 cannot be ruled.

Further south, the $1800 mark could protect the downside. The pattern neckline resistance now support at $1798 will be the level to beat for the gold bears.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.