Gold Price Forecast: XAU/USD down but not yet out as Trump and Fed grab attention

- Gold price licks wounds after Monday’s steep correction from near-record highs.

- Mounting trade war fears could revive the buying interest in Gold price.

- Gold price remains poised for upside amid bullish daily RSI while above 21-day SMA.

Gold price licks its wounds following the sharp pullback from three-month highs just shy of the all-time peak of $2,790. Gold trades take account of the latest tariff talks by US President Donald Trump and his administration as attention turns toward mid-tier US economic data and Federal Reserve (Fed) policy announcements.

Gold price stays hopeful amid Trump-led risk aversion

Despite the unabated haven demand for the US Dollar (USD) amid mounting trade war fears and the extended sell-off on global stocks. The upswing in the US Treasury bond yields on reports of the White House pausing all federal grants add to the bearish undertone in Gold price.

Late Monday, US Treasury Secretary Scott Bessent called for new universal tariffs on US imports, starting at 2.5% and rising gradually, per the Financial Times (FT). Meanwhile, President Trump noted that he plans to impose tariffs on imports of computer chips, pharmaceuticals, steel, aluminum, and copper. He added that he “wants tariffs “much bigger” than 2.5%” as Treasury Secretary Bessent proposed.

The continued tariff threats by the Trump administration continue to dent risk sentiment. Meanwhile, Asian markets are still reeling from the pain of China’s low-cost artificial intelligence (AI) model - DeepSeek-led global AI sell-off, which smashed current AI leader Nvidia by roughly 18% on Tuesday.

Looking ahead, traders look forward to the mid-tier US Durable Goods Orders and Consumer Confidence data for fresh trading impetus. However, US President Donald Trump’s tariff threats and the sentiment on Wall Street will play a key role in driving markets, eventually impacting the value of the USD and the Gold price.

Markets will also remain on a cautious footing as the Fed begins its two-day monetary policy later this Tuesday, with the policy decision and Chairman Jerome Powell’s press conference due on Wednesday.

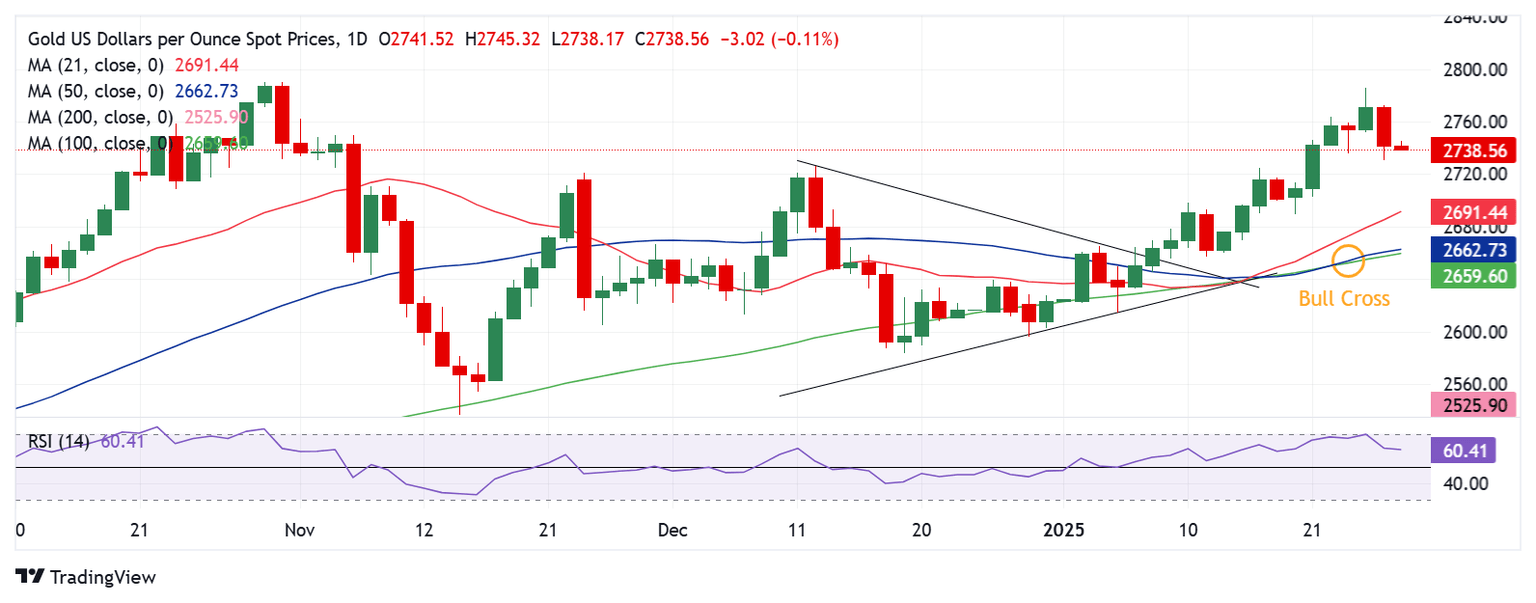

Gold price technical analysis: Daily chart

The daily chart shows that the short-term technical outlook remains constructive for Gold price despite the long-due correction.

Gold price’s failure to seek daily candlestick closing above the symmetrical triangle target of $2,785 warrants caution for buyers.

However, the 14-day Relative Strength Index (RSI) holds comfortably above the midline, currently near 61, keeping Gold buyers hopeful.

Adding credence to the bullish potential, the 50-day SMA closed above the 100-day SMA last Thursday, confirming a Bull Cross.

Gold price must seek a daily closing above the record high of $2,790 to set a new highest level ever above $2,800. Buyers will then aim for the $2,850 psychological level.

On the downside, the immediate support will be seen at the previous day’s low of $2,731.

Sellers will then aim for the $2,700 round level, below which the 21-day SMA at $2,691 will be challenged.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.