Gold Price Forecast: XAU/USD could aim for $2,043 on weak US Nonfarm Payrolls report

- Gold price is looking to stabilize amid Good Friday-led thin market conditions.

- US Dollar holds rebound with US Treasury bond yields ahead of United States Nonfarm Payrolls data.

- Gold price action remains at the mercy of the key US jobs data amid favorable technicals

Gold price is trading around a flat line in early Good Friday’s trading, as bulls are defending the $2,000 mark ahead of the all-important United States Nonfarm Payrolls report. The United States Dollar (USD) is clinging to recovery gains amid a minor rebound in the US Treasury bond yields, as the market mood remains slightly optimistic heading into Easter celebrations.

Gold price and US Federal Reserve rate expectations

The recent series of downbeat United States economic data has bolstered expectations that the US Federal Reserve (Fed) will likely pause its tightening cycle in May, with markets now pricing odds for a no rate hike next month at 48%. The latest employment data from the US point to loosening labor market conditions while risks of a recession are mounting. In light of this, traders bet that Fed could adopt a wait-and-see approach at its May meeting.

The US Initial Jobless Claims dropped to 228K for the week ended March 31 vs. 200K expected. Further, annual revisions to the data showed applications were higher this year than initially thought, supporting evidence that the labor market was slowing. On Thursday, the US ADP private sector employment increased by 145,000 jobs in March vs. 200K expected and 261K previous. US ISM Services PMI dropped from 55.1 to 51.2 in March, below the expectation of 54.5. Meanwhile, all of the ISM Services sub-components slowed their pace of expansion.

Despite falling US Treasury bond yields on looming recession risks, the US Dollar is keeping the corrective upside intact as it continues to draw safe-haven flows, limiting the uptrend in the Gold price.

United States Nonfarm Payrolls report holds the key

The next direction in the Gold price remains at the mercy of the United States labor market report, which is the last employment data for the Federal Reserve to assess ahead of the May 2 and 3 monetary policy meeting. Economists are expecting the US economy to add 240K jobs in March, compared with a 311K increase reported in February. The March Unemployment Rate is likely to hold steady at 3.6% while the Average Hourly Earnings are seen easing further to 4.3% in the reported month vs. 4.6% previous.

A miss on the headline Nonfarm Payrolls number combined with softening wage inflation in the United States will build a perfect case for a Fed rate hike pause in May, triggering a fresh sell-off in the US Dollar and the US Treasury bond yields while lifting Gold price back toward the yearly high of $2,032. If Nonfarm Payrolls figure surprises to the upside, 25 basis points (bps) Fed rate hike bets will strengthen further, resuming the Gold price correction below $2,000.

Irrespective of the outcome of the US labor market data, volatility spikes are likely to emerge amid thin liquidity, as major stock markets are closed globally in observance of Good Friday. Additionally, investors could resort to repositioning ahead of next week’s critical United States Consumer Price Index (CPI) data release.

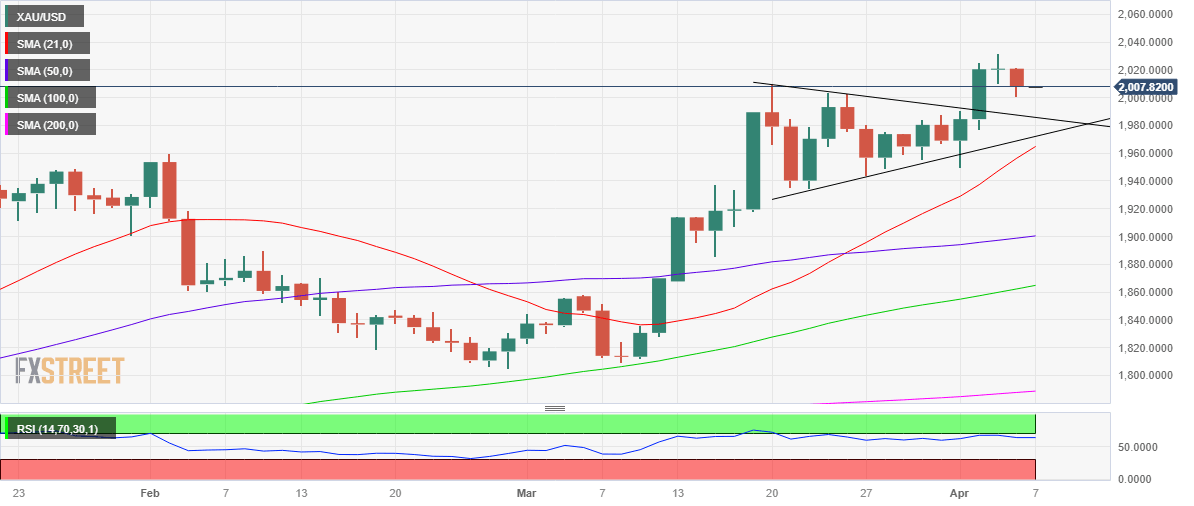

Gold price technical analysis: Daily chart

Nothing seems to have changed technically for the Gold price, with the $2,000 mark still offering strong support. The next cushion is seen at the pennant resistance-turned-support at $1,986, below which the confluence of Tuesday’s low and the pennant support near $1,975 will be tested.

The 14-day Relative Strength Index (RSI) is holding comfortably above the midline, keeping Gold buyers hopeful.

Should Gold bulls fight back control, immediate resistance is seen at $2,020 figure, above which the yearly top at $2,032 will come into the picture.

Weak US Nonfarm Payrolls could trigger a fresh upswing toward the pennant target measured at $2,043 on acceptance above the latter.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.