Gold Price Forecast: XAU/USD corrects from two-week highs, Fed decision eyed

- Gold price pulls back below $3,400 in the lead-up to the Fed showdown.

- The US Dollar bumps up on optimism over US-China trade talks.

- Gold price appears a ‘buy-the-dips’ trade on the Fed verdict.

Gold price has come under intense selling pressure early Wednesday, correcting sharply from two-week highs of $3,435. Renewed optimism over the upcoming US-China trade talks and profit-taking ahead of the US Federal Reserve (Fed) policy announcements.

Gold price pulls back before the next big move higher

Late Tuesday, the White House announced that US Treasury Secretary Scott Bessent and US Trade Representative (USTR) Jamieson Greer will travel to Geneva, Switzerland, to attend trade talks with Chinese Vice Premier He Lifeng. The trade talks will be held from May 9 to 12 in an effort to de-escalate a trade war between the world's two biggest economies.

Asian traders hit their desks on Wednesday and reacted positively to this overnight news, reducing the safe-haven flows and the demand for the traditional store of value, the Gold price. The US Dollar (USD) firms up with US-China trade optimism easing concerns over economic growth.

Meanwhile, traders resort to taking profits off the table after the latest Gold price rally, repositioning ahead of the critical Fed verdict and Chairman Jerome Powell’s press conference. As a no-rate-change decision is fully priced in, Powell’s tone during the presser will hold the key to altering markets’ expectations of interest rate cuts this year.

Following robust US labor market data and business PMIs, markets have pared bets for a June rate cut, with Goldman Sachs and Barclays moving their rate calls to July from June.

Powell will likely stick to the Fed’s cautious rhetoric, hinting at a wait-and-see approach amid a lack of clarity on the impact of US tariffs. In case he acknowledges resilience in the economy, it could be read as a hawkish shift in the Fed’s policy stance, which could push back against June rate cut bets and fuel a fresh leg up in the Greenback. As a result, Gold price could extend its correction from two-week highs.

On the other hand, Gold price could witness a fresh upswing if the Fed signals a June rate cut, expressing concerns on the economic outlook.

In the meantime, the Gold price downside could remain cushioned by the escalating geopolitical tensions globally. Israel's security Cabinet unanimously approved a plan to widen the military offensive in Gaza. Meanwhile, a Kremlin spokesman said Russia will stick to its plans for a unilaterally-imposed ceasefire between 8 and 11 May. Still, he warned that an appropriate response will be given immediately if Ukraine does not also halt the fire.

Pakistan has vowed to a strong retaliation after the Indian armed forces early Wednesday carried out missile attacks on nine terror targets in Pakistan and Pakistan-Occupied Kashmir (PoK), in response to the terror attack in Pahalgam in Jammu & Kashmir.

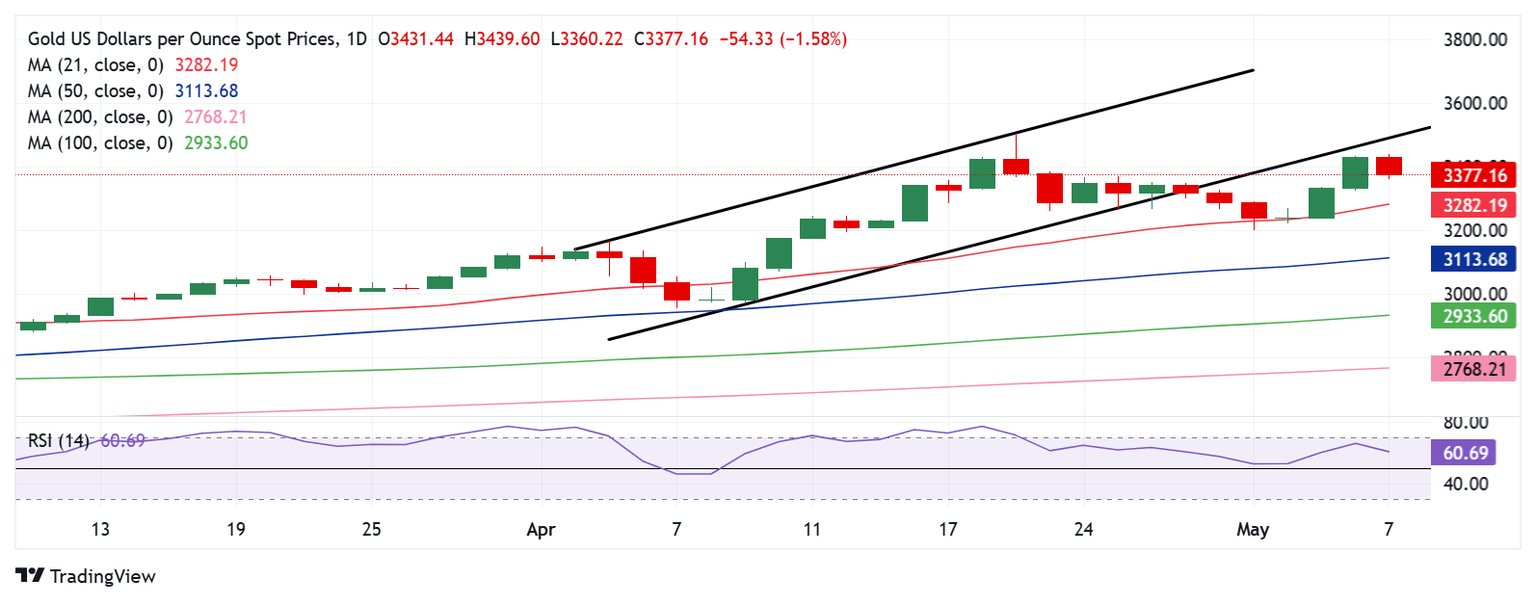

Gold price technical analysis: Daily chart

Gold price faced rejection below the channel support (now resistance), retreating sharply toward the initial support of the $3,350 psychological barrier.

The 21-day Simple Moving Average (SMA) at $3,283 will be the following line of defense for Gold buyers. Deeper declines will challenge the May 2 low of $3,223.

However, the 14-day Relative Strength Index (RSI) holds above the midline near 61.50, suggesting that any dip will likely be bought in.

Gold price must find a firm foothold above the two-week high of $3,435 to take on the upside. The next topside target is at the channel support (now resistance) at $3,494, where the record high will also come into play.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.