Gold Price Forecast: XAU/USD corrects from record high as focus shifts to US NFP data

- Gold price pulls back from fresh record highs near $3,170 early Thursday.

- Trump’s ‘reciprocal tariffs’ escalate global trade war tensions, bolstering odds of a US recession.

- The daily RSI stays heavily overbought as Gold price awaits Friday’s US Nonfarm Payrolls for further directives.

Gold price is correcting sharply from a new record high of $3,168 reached in the early Asian session on Thursday. Despite the pullback, Gold price preserves a significant part of the recent record run, courtesy of escalating risks of a global trade war and a US recession.

Gold price pulls back before the next push higher

Risk aversion remains at full steam in Asia this Thursday as demand for safe havens such as the Gold price extends from the last US session. The US equity futures, a risk barometer, are down approximately 2.50% so far, as investors worry about potential retaliation from the United States' (US) major trading partners, including China and the European Union (EU), which could ultimately escalate into a severe global trade war.

“US President Donald Trump unveiled a 10% baseline tariff on most goods imported to the US, with much higher duties on products from dozens of countries. Chinese imports will be hit with a 34% tariff, on top of the 20% Trump previously imposed, bringing the total new levy to 54%,” per Reuters. The EU faces a 20% tariff, and Japan, which is targeted for a 24% rate.

Intensifying trade tensions and their implications for inflation and the economic growth outlook in the US continue to undermine the US Dollar (USD) and US Treasury bond yields. Therefore, investors seek safety in the bright metal, the traditional store of value and an ultimate hedge against inflation.

However, Gold price is seeing a fresh profit-taking slide as traders opt to cash in ahead of the all-important US Nonfarm Payrolls data release, which would help provide a sense of clarity on the US Federal Reserve (Fed) interest rate outlook, given the increased recession risks.

Gold buyers have shrugged off the stronger-than-expected China’s Caixin Services PMI data, as repositioning seems to have taken over at the time of writing.

In the meantime, Gold traders will take cues from the weekly US Jobless Claims and ISM Services PMI data for further impetus. Data released by US Automatic Data Processing (ADP) on Wednesday showed that the American private sector added 155,000 jobs in March, a sharp increase from the upwardly revised 84,000 in February and better than the forecast for 105,000.

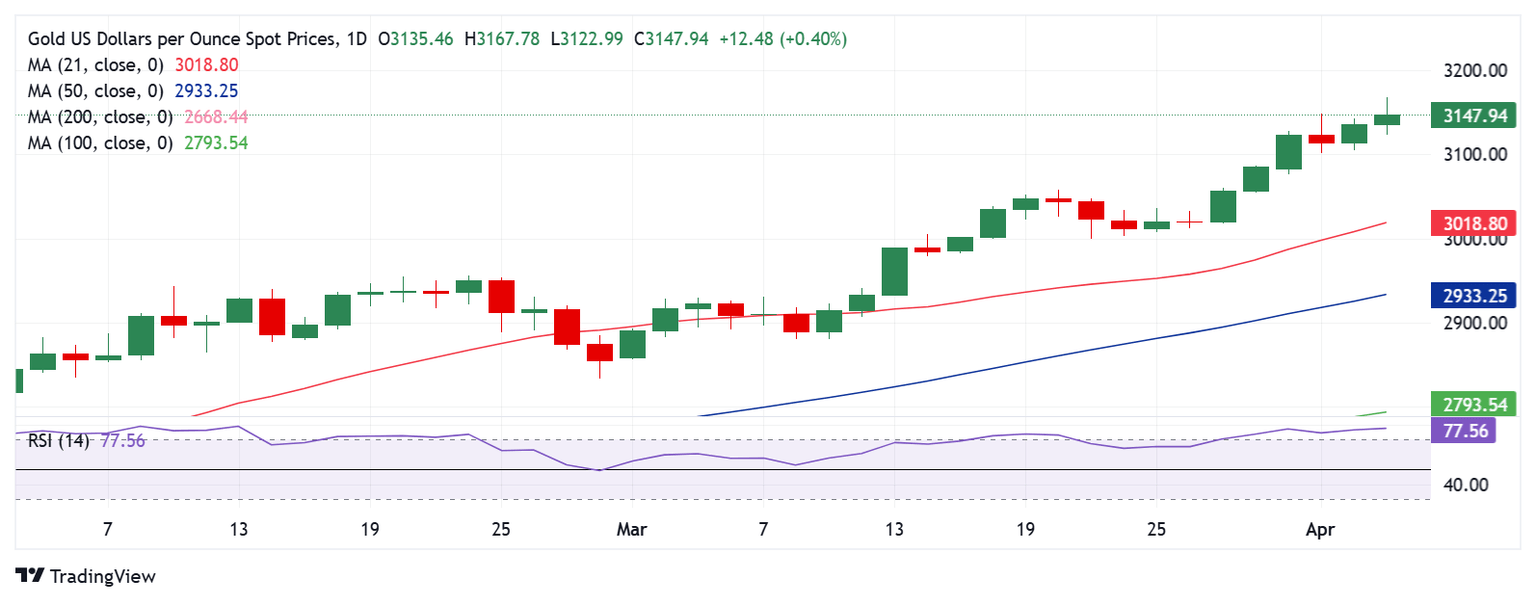

Gold price technical analysis: Daily chart

The short-term technical outlook for Gold price remains more or less the same, with the heavily overbought 14-day Relative Strength Index (RSI) justifying the latest retracement.

If the correction gathers strength, the Gold price could challenge the $3,100 round level, below which this week’s low of $3,077 will be tested.

The $3,050 psychological barrier will be next on sellers’ radars.

Conversely, on a buying resurgence, Gold price will need to retest the record highs of $3,168. Acceptance above that level will initiate a fresh uptrend to test the $3,200 threshold.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.