Gold Price Forecast: XAU/USD correction on the cards ahead of the US NFP?

- Technical charts suggest upside could be limited, risks correction.

- Overall bias remains bullish, as the dip-buying theme will continue.

- US stimulus hopes, a weaker dollar and US-China tensions underpin.

- Focus shifts to the critical US NFP after disappointing ADP report.

The meteoric rise propelled Gold (XAU/USD) to fresh all-time highs of $2055 on Wednesday, as investors continued to find value in the bullion amid the US dollar meltdown and record low real Treasury yields. Disappointing US private sector ADP jobs report added to the concerns of a downbeat Non-Farm Payrolls (NFP) report due this Friday and exacerbated the pain in the buck. Meanwhile, expectations of US stimulus deadlock likely to be overcome soon also boosted the yellow metal. The haven demand for the metal was buoyed by the continued surge in the coronavirus cases globally, with over an 18.66 million tally reported a day. The virus fears continue to temper the economic rebound expectations.

Looking ahead, the yellow metal will remain at the mercy of the US dollar dynamics and fiscal stimulus negotiations. Investors await the Bank of England (BOE) monetary policy decision, with any hints on further stimulus, by way of QE expansion or negative interest rates, will likely benefit the non-yielding gold. Also, the US Jobless Claims could have a significant impact on the gold trades, as all eyes remain on the US NFP.

Short-term technical perspective

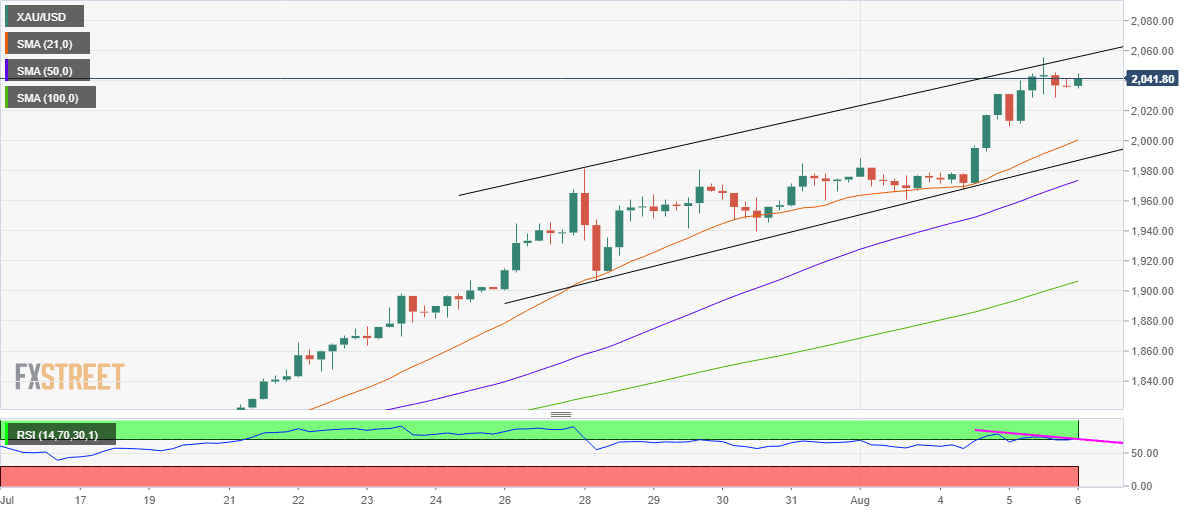

Gold: 4-hour chart

As observed in the four-hour (4H) chart, XAU/USD faced rejection on a few occasions at the two-week-long rising channel resistance near $2056 region. Therefore, a correction looks likely on the cards, as also suggested by the bearish price-Relative Strength Index (RSI) divergence.

In addition, the daily RSI is highly overbought and thus, backing the case for pullbacks. However, the overall bias remains bullish and therefore, every dip in the bright metal is likely to be bought in and spot could retest the record highs. The bullish bias remains intact as long as the spot holds above the 21-4H Simple Moving Average (SMA) at $2001.

Gold: Additional levels to consider

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.