Gold Price Forecast: XAU/USD consolidates gains near fresh all-time highs

XAU/USD Current price: $2,582.67

- Investors await the Federal Reserve announcement and the first rate cut in four years.

- Treasury bond yields fell towards fresh yearly lows, weighing on the US Dollar.

- XAU/USD retreated modestly from record highs, retains its bullish potential.

Gold price reached a fresh record high of $2,589.50 a troy ounce on Monday, retreating just modestly from the level and now trading at around $2,582.00 in the American session. XAU/USD surged during Asian trading hours, helped by a resurgent Japanese Yen (JPY), which put pressure on the US Dollar against all major rivals.

The USD/JPY pair fell to its lowest in over a year as investors keep an eye on the interest rate difference between the United States (US) and Japan, as both central banks are meant to announce their monetary policies this week. The Federal Reserve (Fed) is widely anticipated to cut the benchmark interest rate by 25 basis points (bps) on Wednesday, while the Bank of Japan (BoJ) will likely move in the opposite direction on Friday. The US Dollar also fell in anticipation of the Fed’s announcement, as there is a chance the central bank will go for a larger rate cut.

Meanwhile, US Treasury yields trade near fresh multi-month lows. The 10-year note currently offers 3.63%, while the 2-year note yields 3.55%, its lowest in two years.

XAU/USD short-term technical outlook

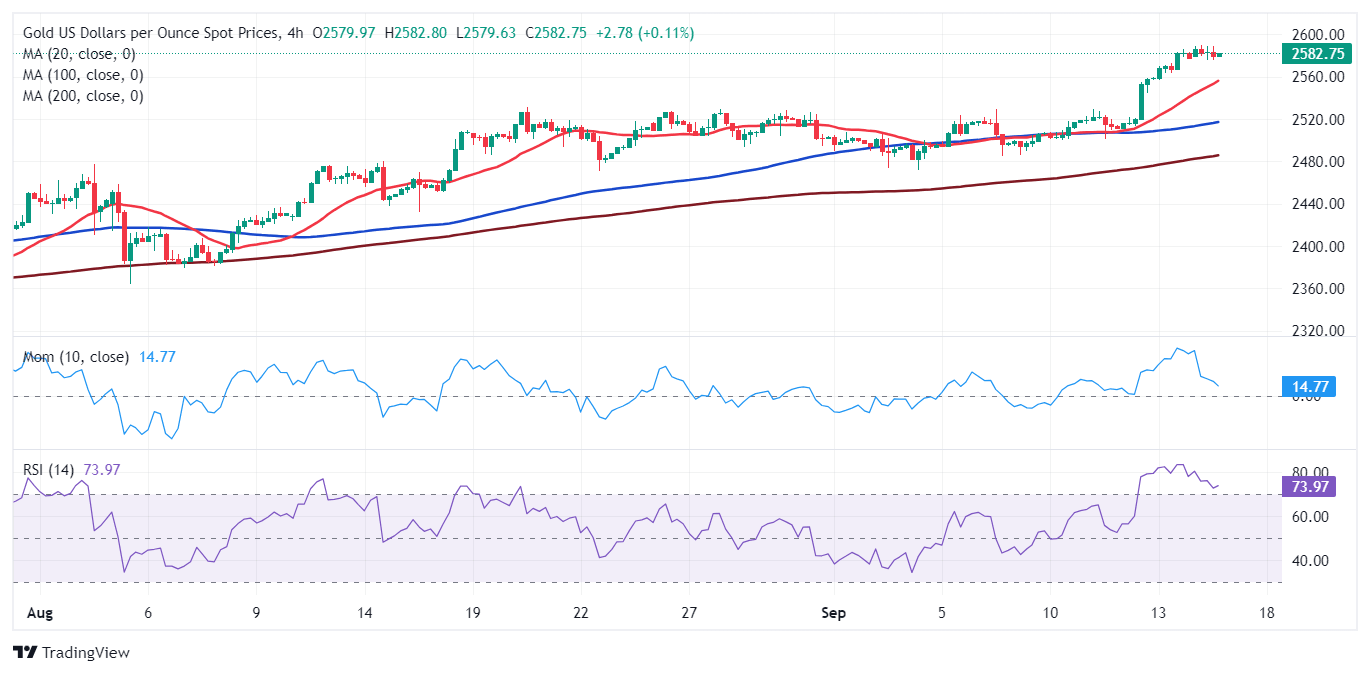

The XAU/USD pair holds on to modest intraday gains, and technical readings in the daily chart show the risk skews to the upside, although the momentum receded. The pair finally detached from a bullish 20 Simple Moving Average (SMA), currently at around $2,517. The 100 and 100 SMAs gain upward traction far below the shorter one, reflecting persistent buying interest. Finally, technical indicators have turned flat, although they hold well into positive territory.

In the near term, and according to the 4-hour chart, XAU/USD seems poised to correct overbought conditions. Technical indicators are retreating from extreme levels with modest downward slopes, not enough to anticipate a steeper decline. Meanwhile, a firmly bullish 20 SMA heads firmly higher in the $2,550 region, far above the longer ones, which also advance.

Support levels: 2,575.20 2,563.60 2,550.00

Resistance levels: 2,590.00 2,605.00 2,620.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.