Gold Price Forecast: XAU/USD clings to critical support as US Nonfarm Payrolls data looms

- Gold price is set to book its third weekly loss on Friday, consolidating near two-week lows.

- The US Dollar pauses its recovery mode ahead of the key US Nonfarm Payrolls test.

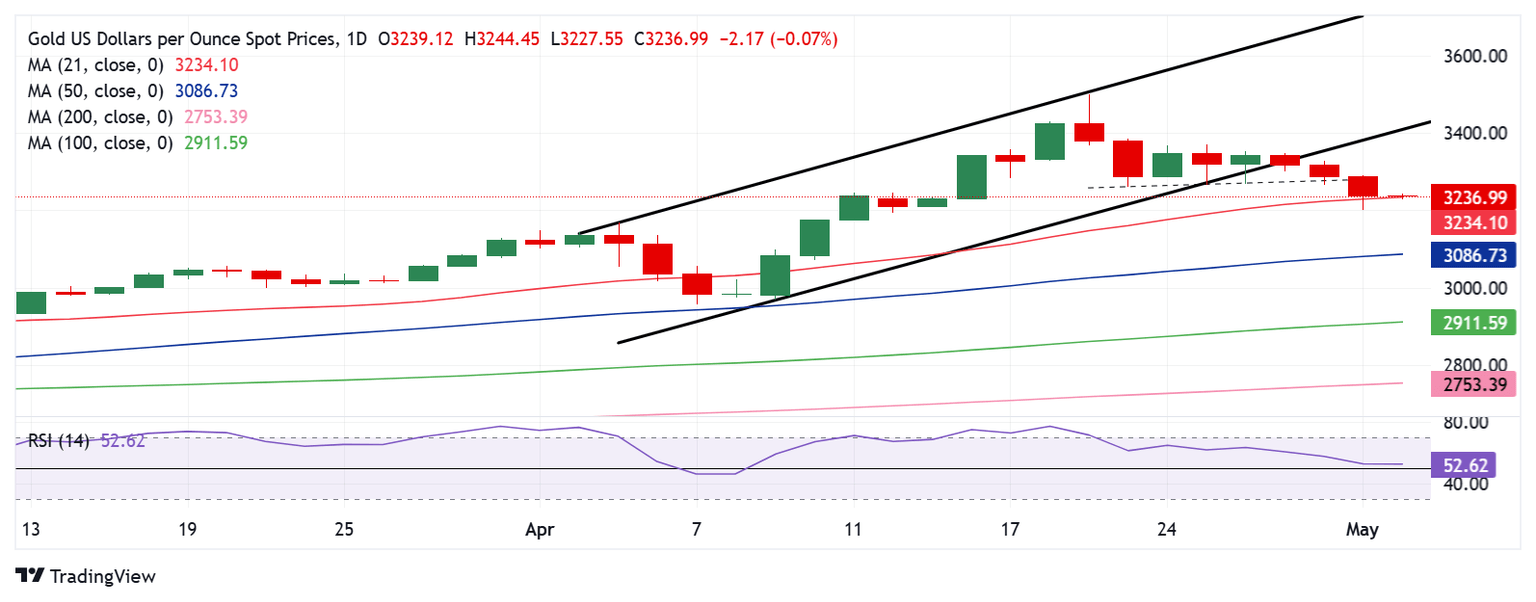

- Technically, the 21-day SMA guards the downside amid bullish daily RSI after the rising channel breakdown.

Gold price is nursing weekly losses early Friday, and it is on track to book its worst week in over two months. Gold buyers refuse to give up, anticipating the high-impact US Nonfarm Payrolls (NFP) data due later this Friday for a fresh directional impetus.

Gold price eyes the US NFP report for some reprieve

Gold price is off the two-week lows of $3,202 set on Thursday, licking its wounds as traders refrain from placing any fresh directional bets heading into the key event risk for Friday – the US labor market report.

The US Dollar (USD) has been on a roll higher this week, thanks to easing trade tensions globally, with the US optimistic about reaching trade deals with its major Asian trading partners, including China.

Risk sentiment received a fresh lift earlier on after the local media reported the Chinese Commerce Ministry as saying that “the US has recently sent messages to China through relevant parties, hoping to start talks with China,”

“China is currently evaluating this,” the Ministry added.

Further, easing US economic growth concerns also underpinned the sentiment around the Greenback, rendering it negative for the USD-denominated Gold price. Data showed on Thursday that the ISM manufacturing PMI fell to 48.7 in April from 49.0 in March, against expectations for a bigger fall to 48.

Early Friday,markets seem to have resorted to their position adjustments in the US Dollar, leading to a pause in its recent uptrend, while the bright metal also draws some support from the Russia-Ukraine geopolitical stand-off.

Attention now turns toward the US NFP data release for the next big action in the Gold price and the King Dollar.

Markets expect the US NFP to show a 130,000 job gain in April, down from a stellar 228,000 job creations reported in March. The Unemployment Rate is set to remain steady at 4.2% in the same period.

If the headline NFP prints a reading below the 100,000 level, it could refuel concerns over the impact of tariffs on ŪS labor market. This narrative could double down on the US Federal Reserve’s (Fed) easing prospects, triggering a fresh US Dollar downside while rescuing the Gold price.

On the other hand, a positive surprise above the 200,000 figure could add extra legs to the Gold price correction, pushing back against expectations of a June interest rate cut and boosting the USD further.

Gold price technical analysis: Daily chart

Gold price clings to the critical 21-day Simple Moving Average (SMA) support, now at $3,234, pausing the correction accentuated by the downside break of a three-week-long rising channel on Wednesday.

The 14-day Relative Strength Index (RSI) sits just above the midline near 52.50, having ended its descent.

Therefore, a rebound toward the immediate static support-turned-resistance at $3,260 could be seen if the 21-day SMA holds on a weak US NFP report.

Acceptance above that level will prompt Gold buyers to flex their muscles toward the channel support (now resistance) at $3,405.

Ahead of that, the $3,350 could be a tough nut to crack.

If the US jobs data exceeds expectations by a wide margin, Gold sellers crack the 21-day SMA at $3,234 on a sustained basis, opening doors toward the $3,150 psychological level.

The 50-day SMA at $3,087 will be next on their radars.

(This story was corrected on May 2 at 06:12 GMT to say that "Gold price is set to book its third weekly loss on Friday," not gain.)

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri May 02, 2025 12:30

Frequency: Monthly

Consensus: 130K

Previous: 228K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.