Gold Price Forecast: XAU/USD bulls insist on US election day, upside appears limited

- Gold bulls see the last dance on US election day amid caution trading.

- US dollar eases as stocks advance on upbeat US and Chinese PMIs.

- Falling US inflation expectations to limit the upside in XAU/USD.

Gold (XAU/USD) extended its rebound into a third straight session on Monday, although remained below the $1900 mark. Gold held firm as surging coronavirus cases globally and caution ahead of the US election boosted gold’s safe-haven appeal. Further, a retreat in the US dollar from five-week highs amid a rally in Wall Street also backed the strength in the yellow metal. The US stocks advanced following upbeat Chinese and US ISM Manufacturing PMI reports. However, the bulls failed to take out the $1900 barrier, undermined by falling US inflation expectations over the past two weeks, in absence of a new fiscal stimulus aid.

Looking ahead, gold’s fate hinges on the outcome of the 2020 Presidential election. The presidential race narrows in six swing states, as Joe Biden continues to hold a narrow lead over Donald Trump in the final stretch on Tuesday. In the meantime, a jittery market mood combined with rising coronavirus concerns could likely keep the precious metal in a familiar trading range.

Gold: Short-tern technical outlook

Hourly chart

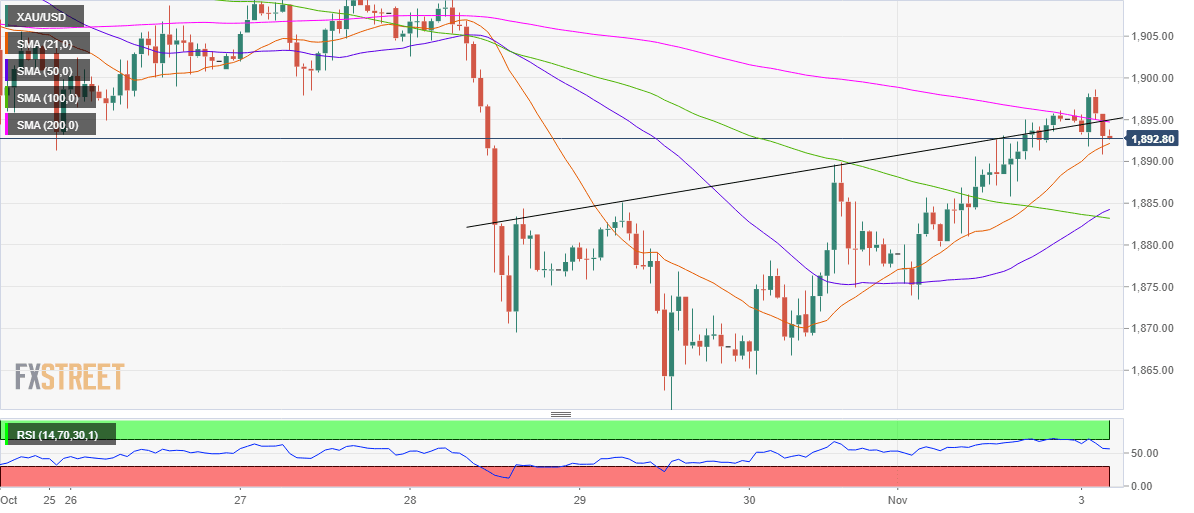

The hourly chart shows that gold fails to find acceptance above the downward-sloping 200-hourly moving average (HMA).

The price charted an inverse head-and-shoulders breakout on the given timeframe but the further upside appears to lack follow-through, as sellers continue to lurk at $1900.

Recapturing the latter is critical to unleashing more gains, with a test of the pattern target at $1910 due on the cards.

The 50 and 100-HMA bullish crossover adds credence to the bullish bias. The hourly Relative Strength Index (RSI) holds above the 50 level despite the latest leg down, leaving buyers hopeful.

On the flip side, acceptance below the 21-HMA at $1891 could trigger a sharp drop towards $1884, almost where the upward-sloping 50-HMA coincides with the 100-HMA.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.