Gold Price Forecast: XAU/USD attacks 100-day SMA, with a Bear Cross in play

- Gold is at its lowest in three weeks, approaching $3,300 early Wednesday.

- US Dollar stays firm amid less aggressive Fed’s easing expectations, ahead of Fed Minutes.

- Gold needs a daily closing below the 100-day SMA at $3,311 amid a Bear Cross and a bearish RSI.

Gold is flirting with three-week lows near $3,300 in Wednesday’s Asian trading as the US Dollar (USD) clings to the previous upswing, bracing for the Federal Reserve (Fed) Minutes later in the day and Friday’s speech by Chair Jerome Powell at the Jackson Hole Economic Symposium.

Gold looks to Fed Minutes for continuation of the USD upswing

The renewed strength around the USD could be mainly attributed to increased expectations that Fed Chair Powell would push back against bets of aggressive interest rate cuts during his Jackson Hole speech on Friday.

Powell has maintained a cautious stance on policy, in the face of the potential impact of US President Donald Trump’s tariffs on inflation.

However, weak US labor data and consumer inflation data prompted markets to price in two rate cuts by the Fed this year, with the first one expected in September.

The odds of a September Fed rate cut now stand at 85%, down from 91% seen a week ago, the CME Group’s FedWatch Tool shows.

Further, strong US housing data released on Tuesday also added to the USD upswing as traders took account of the geopolitical developments surrounding the Ukraine peace deal.

Despite successful talks between the US, Ukraine and European Union (EU) leaders earlier this week, confirming securities guarantees to Ukraine, “US President Donald Trump ruled out deploying ground troops to Ukraine on Tuesday but suggested air support could be part of a deal to end Russia's war in the region,” per Reuters.

According to CNN News, White House Press Secretary Karoline Leavitt noted that plans for a bilateral meeting between Russian President Vladimir Putin and Ukrainian President Volodymyr Zelenskiy are now under consideration.

The immediate focus is now on Minutes from the Fed’s July meeting. However, it is unexpected to provide the latest insights on the Fed’s path forward on interest rates as the policy meeting was before the July jobs and Consumer Price Index (CPI) data publication.

Therefore, all eyes now remain on Powell’s speech at the annual Kansas City Fed’s Jackson Hole Economic Policy Symposium, which will take place August 21-23.

Fed Chair Jerome Powell is due to speak on Friday on the economic outlook and the central bank's policy framework at the event.

His words will be closely scrutinized for confirmation whether the Fed will stick to its recent dovish tilt, in the face of emerging risks to the economy and the labor market.

In the meantime, the moves in Gold could be technically driven, while the broader market sentiment and repositioning could also play a pivotal role.

Gold price technical analysis: Daily chart

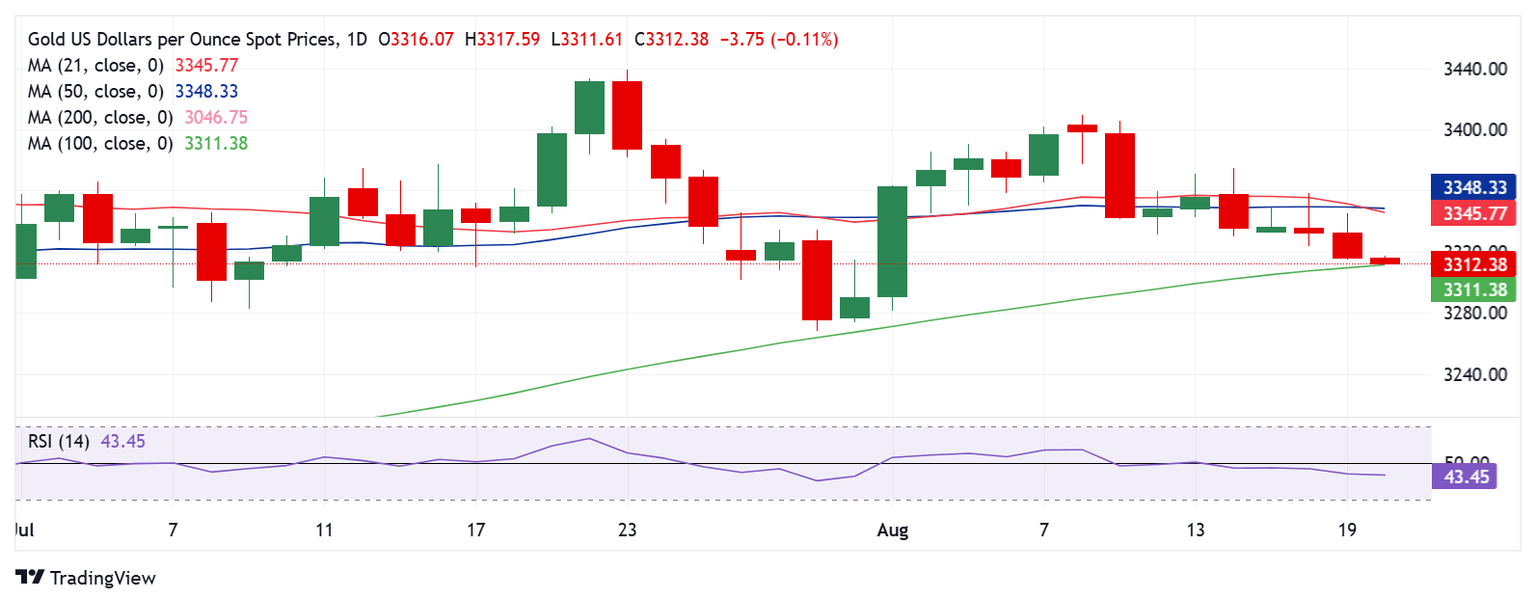

The daily chart shows that the 21-day Simple Moving Average (SMA) closed below the 50-day SMA on Tuesday, confirming a Bear Cross.

Meanwhile, the 14-day Relative Strength Index (RSI) points lower below the midline, currently near 43.50, suggesting that more downside remains in the offing.

Sellers need to find a strong foothold below the 100-day SMA at $3,311 for a sustained downtrend.

Further south, the July 31 low of $3,274, below which the July 30 low of $3,268 will be tested en route to the $3,250 psychological barrier.

Alternatively, strong resistance aligns near $3,346, the confluence area of the 21-day SMA and the 50-day SMA.

The next bullish targets are seen at the previous week’s high of $3,375 and the $3,400 round level.

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Next release: Wed Aug 20, 2025 18:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.