Gold Price Forecast: Will US advance Q1 GDP data revive the XAU/USD uptrend?

- Gold price extends its consolidative mode into a fifth straight trading day early Wednesday.

- The US Dollar holds a modest uptick amid a cautiously optimistic market mood.

- Gold price clings to the rising channel support; buyers refuse to give in ahead of the US GDP release.

Gold price holds lower ground in Asian trading on Wednesday, but remains within a familiar range. Gold traders eagerly await the release of the US first-quarter Gross Domestic Product (GDP) data for a fresh directional impetus.

Gold price looks to high-impact US data flow

The first look of the US annualised GDP is expected to show a 0.4% growth in Q1 2025, down from a robust 2.4% expansion in the final quarter of 2024. Goldman Sachs economists expect a negative 0.2% growth.

The expected significant slowdown in the US growth could be attributed to a likely import surge as US firms stocked up on inventory to get ahead of the US tariffs.

If the world’s largest economy shows an unexpected contraction, it would refuel recession fears and bring back bets for aggressive Fed rate cuts to the table, reviving the US Dollar (USD) downtrend. This, in turn, would lift the Gold price back toward record highs.

However, a smaller-than-expected cooldown in the US economy growth could provide a brief relief to broader markets and the US Dollar (USD), allowing Gold sellers to build on their corrective downside.

However, traders will remain cautious and refrain from creating fresh directional positions in the Gold price heading toward Friday’s US Nonfarm Payrolls (NFP) data, limiting any reaction in Gold price.

The US NFP data will help markets assess if there has been any material impact of US tariffs on the labor market.

Markets will also scrutinize the quarterly core Personal Consumption Expenditures (PCE) Price Index data that will be released alongside the GDP figures.

In the meantime, the Greenback defends gains as markets take stock of the recent tariffs headlines. US President Donald Trump signed an executive order on Tuesday to ease the impact of his auto tariffs. Meanwhile, Trump has adjusted the 25% tariffs on auto parts, which were set to take effect on May 3.

Markets also find some consolation from chatter surrounding progress on trade deals between the US and some of its Asian trading partners.

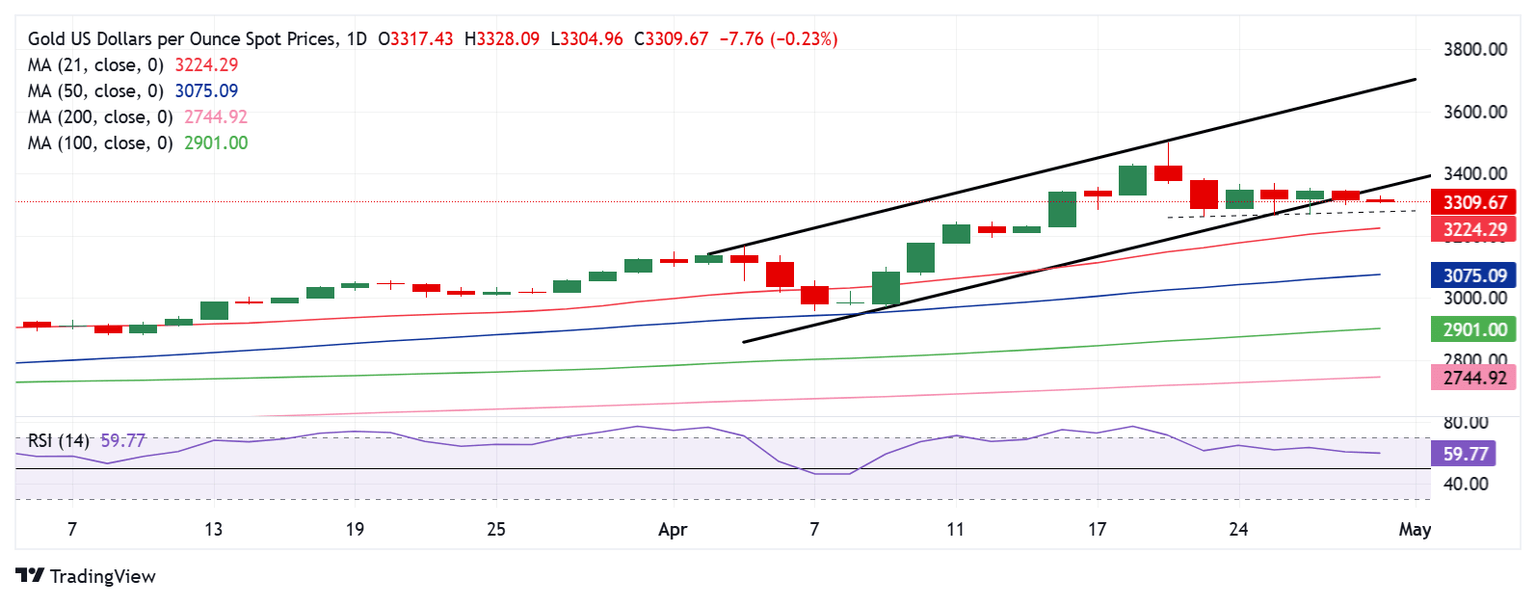

Gold price technical analysis: Daily chart

Gold price has defended the three-week-long rising channel support so far this week, currently testing the water underneath.

The 14-day Relative Strength Index (RSI) still holds above the midline, cushioning any downside in Gold price.

To confirm a downside break of the rising channel pattern, Gold price must find acceptance below the rising trendline support, now at $3,351, on a daily closing basis.

The next support aligns at the $3,300 round level, below which the $3,260 demand area will be tested.

A sustained break below the latter will put the 21-day Simple Moving Average (SMA) at $3,224 to the test, followed by the 50-day SMA at $3,075.

Conversely, Gold buyers must find a firm foothold above the channel support-turned-resistance at $3,351 to revive the uptrend toward the $3,370 static resistance.

A sustained recovery will target the $3,400 and the record high of $3,500 thereafter.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.