Gold Price Forecast: Wednesday’s close above $1950 keeps bulls alive ahead of Powell

- Gold cheers cautious market mood, consolidates recent rally.

- Dollar remains on the back foot amid dovish Fed expectations.

- All eyes on US GDP data and Fed Chair Powell’s speech.

Gold (XAU/USD) closed above $1950 on Wednesday, having staged a solid comeback from just above the $1900 mark. The yellow metal fell sharply to fresh weekly lows of $1903 after the US Durable Goods data surprised to the upside. The spot gained 1.27% on the day, as the US dollar eventually slipped across the board in tandem the Treasury yields amid dovish expectations from the Federal Reserve (Fed) Chair Jerome Powell’s speech (due at 1310 GMT) at the Jackson Hole Symposium. Powell is expected to deliver a dovish tweak to its monetary policy by hinting at adopting average inflation targeting (AIT) next month. The new framework is mainly aimed to push up inflation, which could exert additional downside pressure on the greenback. The US stocks hit another record high, which hurt the haven demand for the dollar and boosted gold prices.

So far this Thursday, Gold has slipped below $1950, as we write, consolidating the previous rally. The pullback, however, appears short-lived ahead of the US Q2 Preliminary GDP release and the key event risk for today – Powell’s Jackson Hole Symposium address. The technical set up favors the bulls, backing the case for the upside.

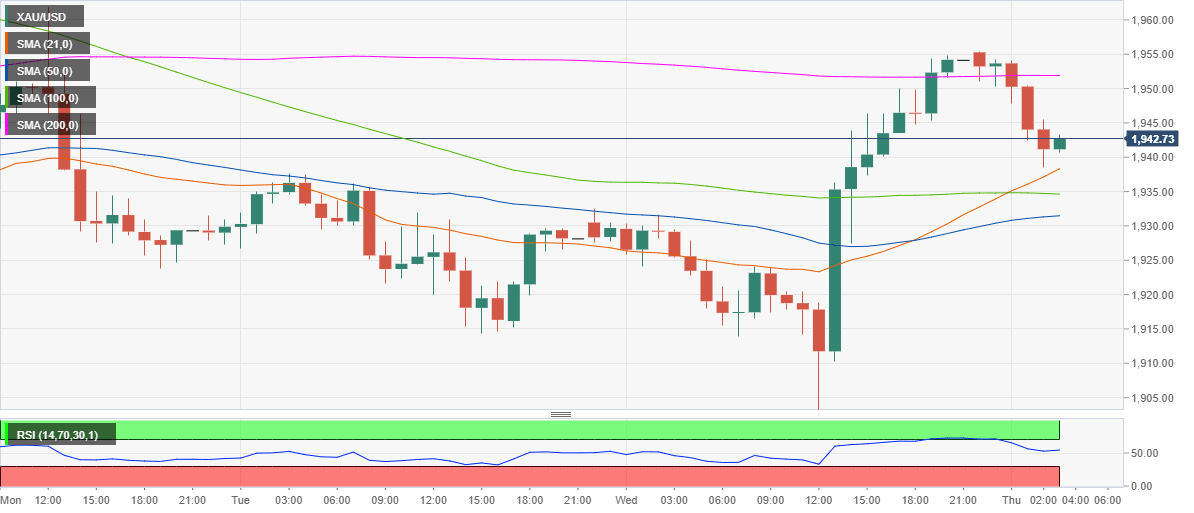

Gold: Hourly chart

Short-term technical perspective

As it is all about the Powell speech on Thursday, the powerful 21-hourly Simple Moving Average (HMA), currently at $1938, is seen offering immediate support to the Gold bulls.

A break below which the horizontal 100-HMA at $1934 will be tested. Should the bulls fail to defend the latter, the next cushion awaits at the 50-HMA of $1931.

Selling pressure will accelerate on a breach of the last, with Wednesday’s low of $1903 back on the sellers’ radar. If Powell turns out to be less dovish, the metal could extend its decline towards the August 12 low of $1863.

To the upside, recapturing of the horizontal 200-HMA at $1952 is critical to re-enforce the bullish momentum. Note that the prices closed above the 200-HMA on Wednesday, having formed a bullish engulfing candle on the daily chart – a bullish reversal indication.

Further north, August 24 highs at $1961 will be tested. Acceptance above the latter will open doors towards the $2000 mark.

The hourly Relative Strength Index (RSI) has turned upwards while above the midline, suggesting more room to the upside.

Gold: Additional levels to consider

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.