Gold Price Forecast: Weak US ADP jobs data could drive XAU/USD above $1,950

- Gold price flirts with three-week highs near $1,940 ahead of key US ADP jobs data.

- US Dollar and US Treasury bond yields lick their wounds due to poor US JOLTS Job Openings.

- Gold price reclaims key 50-Daily Moving Average, what’s next?

Gold price is challenging three-week highs near $1,940 in Wednesday’s trading so far but the further upside depends on the upcoming top-tier US ADP employment data, especially after the JOLTS Job Openings data disappointed by a wide margin on Tuesday.

Will US ADP jobs data confirm renewed dovish Fed bets?

Asian traders are cheering the surge in Wall Street overnight amid renewed expectations of an extended US Federal Reserve (Fed) rate hike pause this year while news that Chinese state-owned lenders will reduce rates on the majority of the nation’s outstanding mortgages and on deposits boosted sentiment further. In the wake of risk-on trading early Wednesday, the US Dollar is struggling with the rebound alongside the US Treasury bond yields, allowing Gold buyers to hold the fort near multi-week highs.

Also, traders refrain from placing any decisive bets on the US Dollar or Gold price heading into the top-tier US Automatic Data Processing (ADP) Employment Change data due later in the day, which is expected to show that the US private sector added 195K jobs in August, down from the 324K job addtiions in July.

A bigger-than-expected US ADP jobs figure will squash hopes for one more Fed rate hike this year, fuelling a fresh US Dollar sell-off, as the US Treasury bond yields would also tumble. In such a case, Gold price will challenge the $1,950 psychological level. If the US jobs data surprise markets to the upside, then the US Dollar could resume its uptrend at the expense of the Gold price.

Apart from the US employment data, Gold traders will also pay attention to the second estimate of the Q2 Gross Domestic Product (GDP) and the Pending Home Sales report for fresh trading cues. At the moment, markets are pricing in an 87% chance of the Fed standing pat at its meeting next month, the CME FedWatch tool showed, and are now pricing in a 53% probability of another pause at the November meeting compared with 38% odds a day ago.

The expectations for a Fed pause have risen after a set of disappointing US statistics released on Tuesday. US JOLTS Job Openings dropped to the lowest level in over two years to 8.827M in July, compared with an increase of 9.165M reported in June. Meanwhile, US Consumer Confidence fell sharply to 106.1 in August after two straight monthly increases amid renewed concerns about inflation, a Conference Board survey showed on Tuesday.

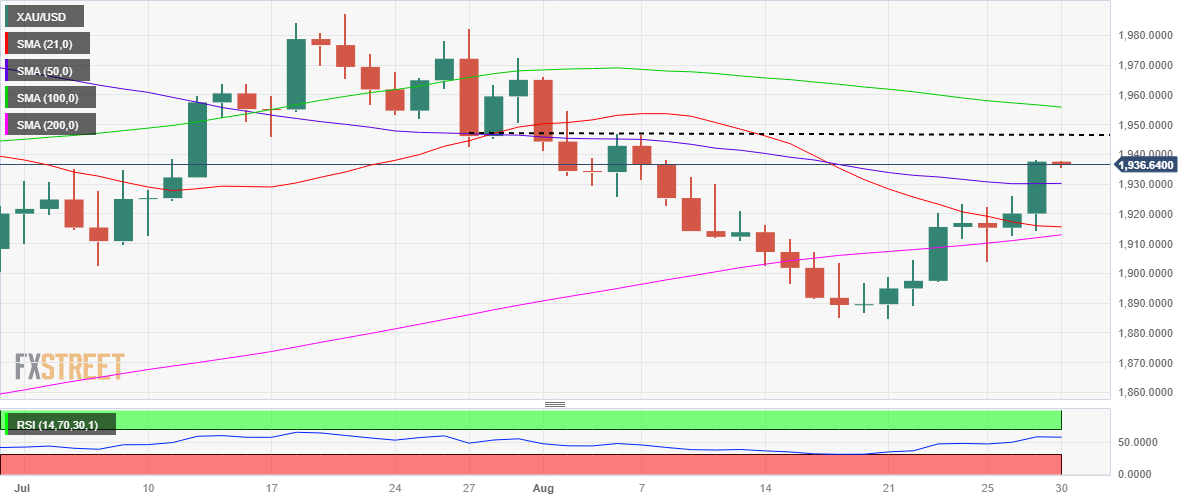

Gold price technical analysis: Daily chart

Gold price has taken out all major Daily Moving Averages (DMA) to reach three-week highs, justifying the bullish turn in the 14-day Relative Strength Index (RSI) indicator on the daily chart.

Daily closing above the critical 50 DMA at $1,930 on Tuesday has reopened doors toward the August 7 high of $1,947, above which the $1,950 psychological level will be tested.

Acceptance above the latter is crucial to unleashing the additional upside toward the downward-sloping 100 DMA at $1,956.

On the downside, the immediate cushion aligns at the 50 DMA resistance-turned-support of $1,930, a break below which Gold sellers will target the powerful support around the $1,913 level. That level is the confluence of the 21 and 200 DMAs.

This week’s low of $1,904 will be next on Gold sellers’ radars should the downside momentum gather steam.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.