Gold Price Forecast: Third time a charm for XAU/USD buyers?

- Gold price rebounds from near the $2,970 region again on Wednesday.

- Risk-off flows dominate as traders brace 104% US tariffs on Chinese imports, Fed Minutes.

- Gold price remains stuck between two key daily SMAs; RSI recovers to prod the 50 level.

Gold price is looking to finally end its corrective downside early Wednesday, finding demand once again near the $2,970 region. A sustained upside in Gold price hinges on the market reaction to the reciprocal tariffs and the Minutes of the US Federal Reserve (Fed) March policy meeting.

Gold price focuses tariff updates for fresh directives

Gold price is capitalizing on deteriorating investors’ confidence as US President Donald Trump’s global reciprocal tariffs come into effect. Markets are spooked mainly due to the whopping 104% tariffs on Chinese goods, which took effect, heightening US-China trade tensions.

The White House confirmed late Tuesday that 104% duties on imports from China would take effect after midnight on Wednesday.

Amidst looming tariff uncertainty and the increased odds of a US recession, the US Dollar (USD) sticks to its bearish momentum, allowing Gold price to find its feet. However, if the Fed Minutes indicate prudence due to risks of higher inflation, the Greenback could see a temporary relief rally. USD sellers will likely jump in in no time due to the reciprocal tariffs coming into effect.

All in all, Gold price is likely to emerge as a clear winner even if the Fed Minutes are perceived as cautious, in the wake of the US-China trade war escalation. Late Tuesday, President Trump accused China of manipulating the currency to protect against tariffs, but he remained hopeful that China would make a deal at some point.

Meanwhile, the ongoing recovery in the US Treasury bond yields could threaten the upswing in the non-yielding Gold price. But the impact could be limited amid increased dovish bets surrounding the Fed interest rate cuts.

The jump in the US Treasury bond yields could be linked to investors selling the safe-haven asset to cover losses elsewhere. Therefore, the increased bets for aggressive Fed rate cuts could soon check the yield surge.

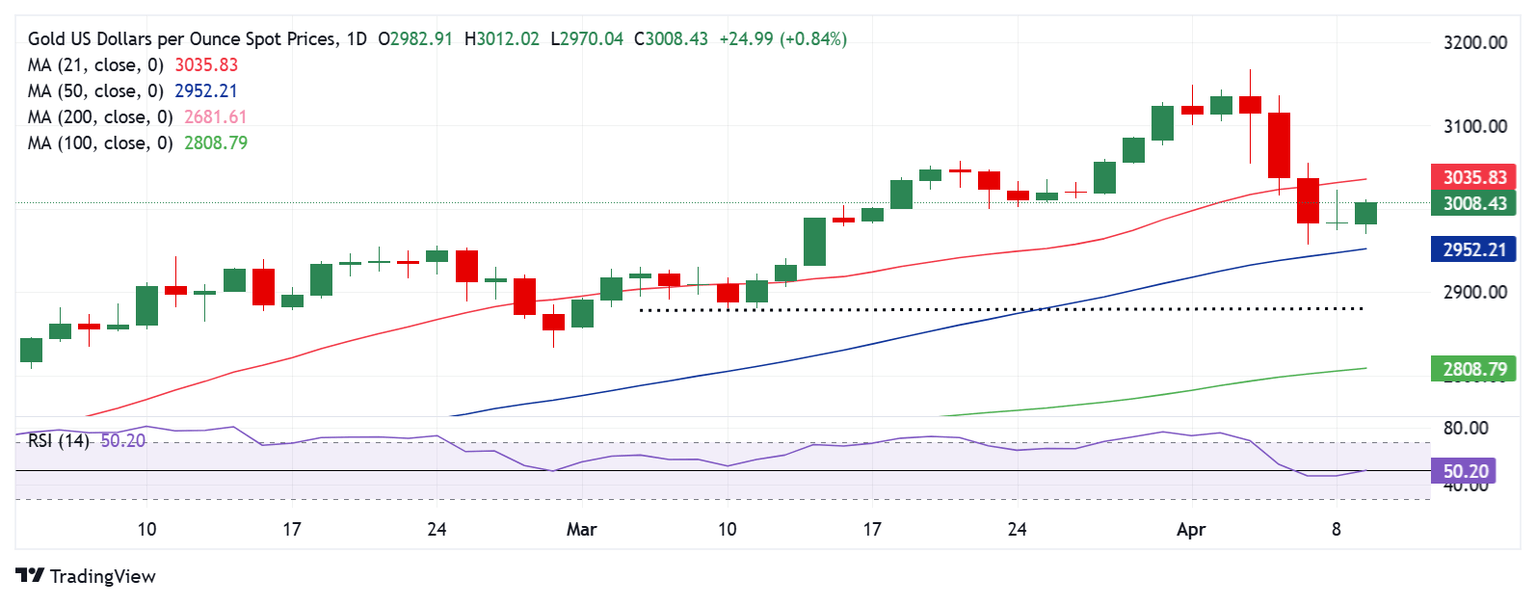

Gold price technical analysis: Daily chart

Gold buyers are fighting back control as the 14-day Relative Strength Index (RSI) pierces the 50 level from below.

Gold price needs acceptance above the 21-day Simple Moving Average (SMA) at $3,036 on a daily closing basis for resuming the record rally.

Buyers will then look to the weekly high of $3,056, above which $3,100 will be tested.

On the flip side, a sustained break below the 50-day SMA at $2,952 will negate the near-term bullish bias, opening the door toward the $2,900 round figure.

The next relevant support levels are seen at the March 10 and 11 lows, at $2,880, and the 100-day SMA, at $2,809.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.