Gold Price Forecast: A test of $1800 or $1750 on the FOMC decision?

- Gold remains pressured below $1800 ahead of FOMC outcome.

- XAU/USD trapped between two key averages on the 1D chart.

- Fed’s decision to trigger a fresh direction in gold, Biden’s speech also eyed.

Gold (XAU/USD) dropped on Tuesday but held within its recent trading range between $1800-$1765, as the US Treasury yields surged and pushed the US dollar higher alongside. Better-than-expected US CB Consumer Confidence data and expectations of President Joe Biden’s fiscal stimulus fuelled a fresh rally in the returns on the US debt. Meanwhile, mixed performance on the US stocks amid pre-Fed caution and earnings reports lifted the US dollar’s safe-haven appeal, which added to gold’s decline.

This Wednesday, nothing seems to have changed for the yellow metal, as the US dollar trades firmer while the yields hold onto the recent advance ahead of the FOMC monetary policy decision. Although the Fed is unlikely to alter its policy stance, investors will pay close attention to any hints on a likely tapering of the bond-buying program, given the optimism over improving economic outlook. The focus will also remain on fresh updates on the fiscal stimulus, as Biden is set to address Congress later on Wednesday.

Gold Price Chart - Technical outlook

Gold: Daily chart

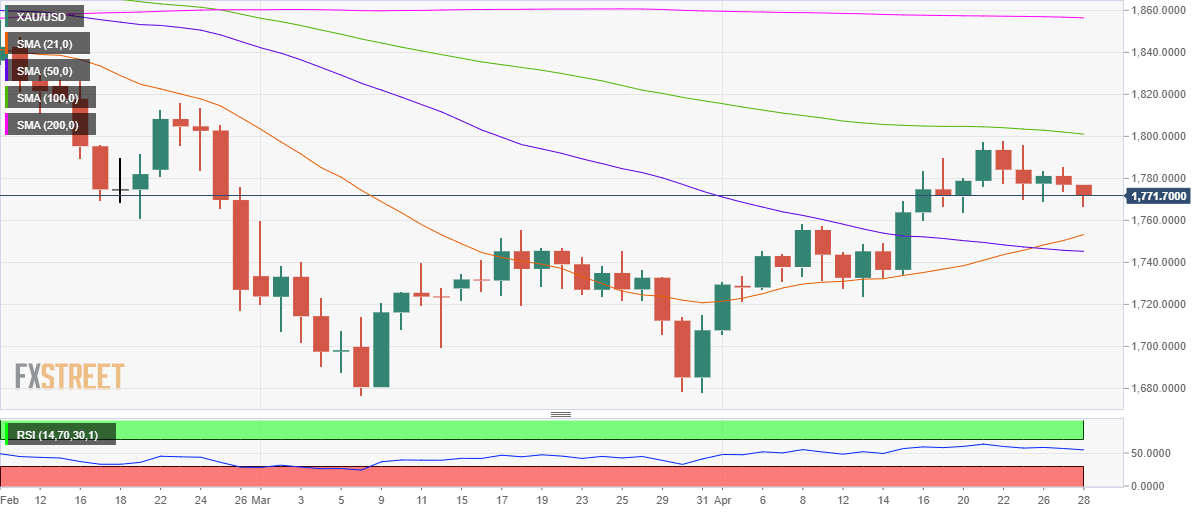

As observed on the daily chart, gold is holding up in a $50 range since mid-April, with the horizontal 100-daily moving average (DMA) continuing to limit the upside.

Meanwhile, buyers continue to lurk on every dip towards the 21-DMA. The 100-DMA and 21-DMA lie at $1801 and $1753 respectively.

The all-important FOMC decision is likely to determine the next direction for the metal, with chances of an upside break seen higher, as the 14-day Relative Strength Index (RSI) keeps its range above 50.00.

To conclude, gold’s fate hinges on the Fed’s announcements while acceptance on a break of either of the two barriers could trigger sharp moves.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.