Gold Price Forecast: 200-DMA holds the key for XAU/USD bulls

- Gold shot to one-week tops on Tuesday following the release of softer US CPI report.

- A goodish USD rebound capped further gains for the dollar-denominated commodity.

- Disappointing Chinese macro data acted as a tailwind and helped limit the downside.

Gold witnessed an intraday turnaround from near three-week lows touched earlier on Tuesday and jumped back above the $1,800 mark in reaction to softer US consumer inflation figures. The headline CPI rose 0.3% in August, marking the slowest pace in seven months. The rate of inflation over the past year decelerated for the first time since last October and slipped to 5.3% during the reported month. More importantly, the core CPI moderated to 0.1% MoM and 4% YoY rate, suggesting that the big surge in inflation this year may have peaked. The data eased concerns for an earlier than expected tapering by the Fed and triggered a steep decline in the US Treasury bond yields, which, in turn, benefitted the non-yielding yellow metal.

The combination of factors prompted some intraday US dollar selling, which was seen as another factor that provided an additional boost to the dollar-denominated commodity. Apart from this, a sharp pullback in the US equity markets further underpinned demand for traditional safe-haven assets, including gold, and contributed to the strong move up. The USD, however, managed to recover the post-US CPI losses and kept a lid on any further gains for the precious metal. Nevertheless, the XAU/USD settled near daily tops and held steady through the Asian session on Wednesday. Bulls, so far, have struggled to make it through the very important 200-day SMA amid a modest USD strength and rebounding US bond yields.

That said, disappointing Chinese macro data acted as a tailwind for the commodity and helped limit any meaningful slide, at least for the time being. In fact, China's retail sales grew at the slowest pace since August 2020, while industrial output also rose at a weaker pace in August. The data further fueled worries about a global economic slowdown amid the recent spread of the highly contagious Delta variant of the coronavirus. Moving ahead, market participants now look forward to the US economic docket, featuring the releases of the Empire State Manufacturing Index, Industrial Production figures and Capacity Utilization Rate. This, along with the US bond yields, might influence the USD and provide some impetus to the XAU/USD.

Short-term technical outlook

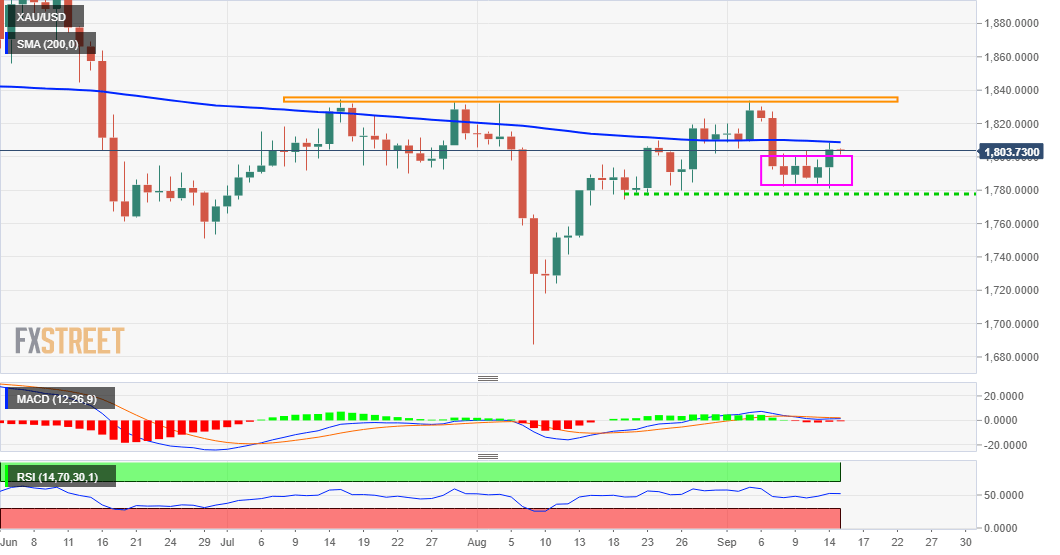

From a technical perspective, the overnight breakout through a near one-week-old trading range and a subsequent strength/acceptance above the $1,800 mark favours bullish traders. Some follow-through buying beyond the $1,808-10 region (200-DMA) will reaffirm the constructive outlook and set the stage for additional gains. The XAU/USD might then accelerate the momentum back towards the $1,832-34 supply zone. The latter marks the multiple-tops barrier, which if cleared decisively should push the metal towards the $1,853 region en-route the $1.868-70 resistance.

On the flip side, the $1,800-$1,795 region now seems to protect the immediate downside ahead of the $1,780 strong horizontal support. A convincing break below will be seen as a fresh trigger for bearish traders and set the stage for a sharp fall towards the $1,750 level. The bearish trend could further get extended and drag the XAU/USD towards the next relevant support near the $1,729-28 region ahead of the $1,700 round figure.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.