Gold price eases after recovery stalled at key barrier; US CPI eyed for fresh signals

GOLD

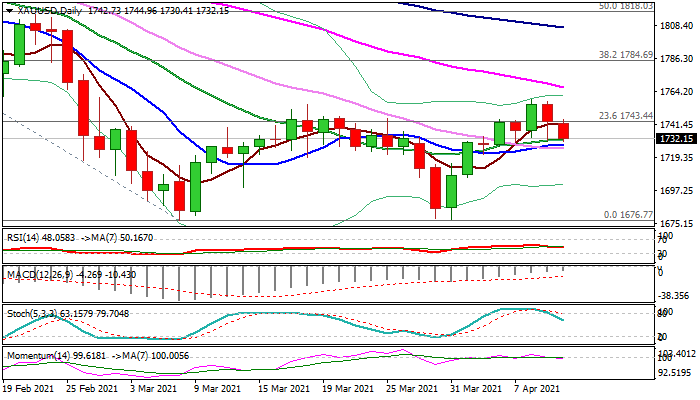

Spot gold holds in red for the second straight day and extends lower after bulls failed to register a clear break above key barrier at $1755 (Mar 18 high) and generate initial signal of double-bottom formation.

Elevated US Treasury yields after US producer prices registered the largest annual gain in 9 ½ years dent metal’s appeal, as recent upbeat US economic data point to accelerating economic recovery, but investors are still cautious.

Key events this week are US inflation on Tuesday and retail sales data on Thursday.

Fed Chair Powell expressed optimism that inflation will accelerate in coming months that would boost the metal, but higher inflation not necessarily means higher gold price (the metal is used a hedge against inflation) as higher yields, on growing expectations of fast economic recovery, would increase the cost of holding metal.

Daily chart indicators point lower (momentum broke into negative territory and stochastic reversed from overbought zone) and support bearish scenario, however, bears need to break pivotal supports at $1731/27 (20DMA / Fibo 38.2% of $1677/$1758 recovery / converged 10/30DMA’s) to signal further weakness at top at $1758.

Res: 1744; 1758; 1766; 1775

Sup: 1727; 1718; 1708; 1700

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.