Gold outlook: Price rises on geopolitics/fresh purchases from China

Gold

Gold price edged higher in early Monday trading following a $10 gap-higher opening, lifted by heated geopolitical situation and fresh demand.

Traders shifted into safer mode after Syrian rebels seized capital Damascus and took control over the country, with growing uncertainty about the near future, supporting gold price.

Another key driver of the yellow metal this morning was fresh demand from China, as PBOC resumed purchasing gold after a pause of six months.

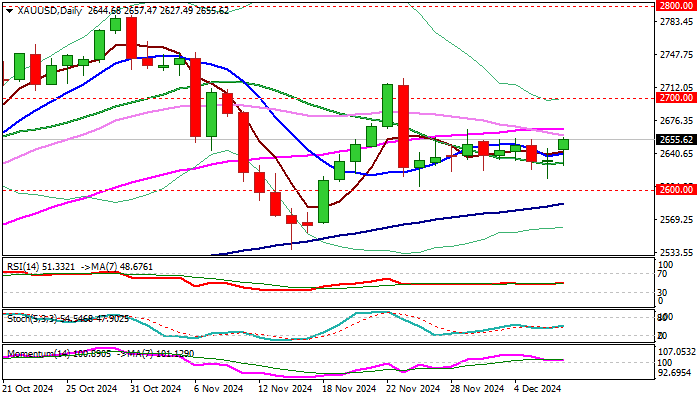

Technical picture on daily chart improved (although still lacking clearer direction signal) as the price rose towards the top of near-term range ($2666, also 50% retracement of $2721/$2605 bear-leg, reinforced by 55DMA).

Persisting bullish momentum and rise above 10/20DMA’s develop initial positive signal, which will look for confirmation on sustained break through range ceiling, to open way for extension towards targets at $2677/93 (Fibo 61.8% & 76.4% respectively) and $2700 (psychological).

Holding and close above broken 10DMA ($2640) to keep fresh near term bulls intact, with larger bullish bias seen above daily cloud base ($2630).

Res: 2666; 2677; 2693; 2700.

Sup: 2640; 2630; 2613; 2605.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.